What's the point?

What's the point?

I already can't get people to pay attention to projects this week. We ended last wek on a high note but it was the same high note (S&P 4,708) that we hit on November 5th and Friday was the 22nd so 11 trading days with no net progress and, suddenly, we're closing out Novemer already. The last day that SPY had 100M contracts traded was Ocober 6th and there has only been 2 days above 69M since Ocober 15th. So volume is dying and we're making no progress.

As I've mentioned before, low-volume rallies are caused by the default buy-ins of "Dumb Money", which is a combination of IRA, 401K, Fed and other Central Banks and individual investors who put thier money into index funds, which buy the bad stocks along with the good – at full market prices. That's what causes the usual end-of-day surges but the Fed is withdrawing some of their Monetary Easing and now Pension Funds are seeing their cash allocations dropping to 7-year lows.

According to the WSJ: "Bigger private-market bets, inflation fears and a surge of retirees are putting public retirement funds at risk of a cash crunch that would force them to sell assets at losses to pay pension checks. Public pension funds have hundreds of billions of dollars less on hand than the amount they will need to cover promised benefits after two decades of underfunding, unrealistic demands from public-employee unions, and losses during the 2007-2009 financial crisis." Keep in mind it is the WSJ so curse those Unions for forcing employers to keep the promises they made to their workers, right?

According to the WSJ: "Bigger private-market bets, inflation fears and a surge of retirees are putting public retirement funds at risk of a cash crunch that would force them to sell assets at losses to pay pension checks. Public pension funds have hundreds of billions of dollars less on hand than the amount they will need to cover promised benefits after two decades of underfunding, unrealistic demands from public-employee unions, and losses during the 2007-2009 financial crisis." Keep in mind it is the WSJ so curse those Unions for forcing employers to keep the promises they made to their workers, right?

Public pension funds have historically been able to access cash when equity markets faltered by selling bonds. But over the past two decades, fixed income portfolios shrank to 24% of assets from 33%, according to the Boston College data, as falling rates turned bonds into a drag on returns. Now inflation threatens to further erode the value of fixed-income investments.

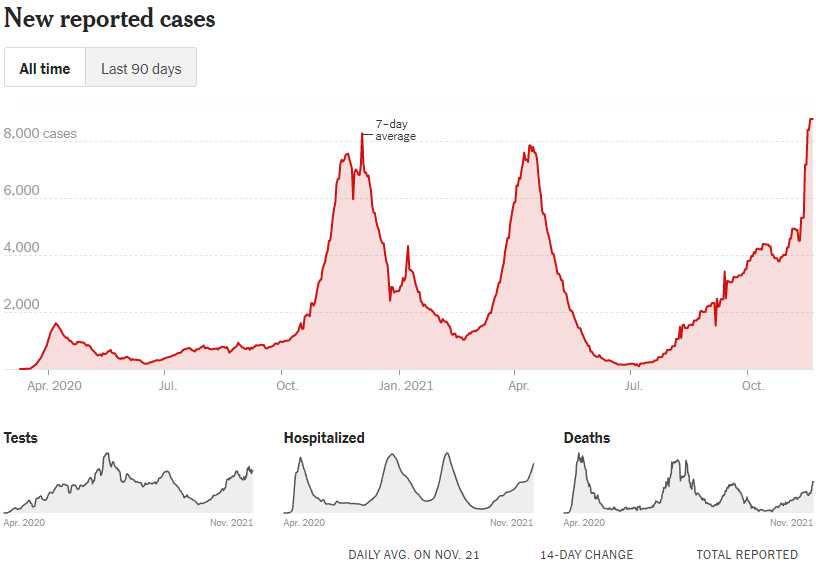

Meanwhile, with Thanksgiving just days away, Federal medical teams have been dispatched to Minnesota to help with Covid-19 cases at overwhelmed hospitals. Michigan is enduring its worst case surge yet, with daily caseloads doubling since the start of November. Even New England, where vaccination rates are high, is struggling, with Vermont, Maine and New Hampshire trying to contain major outbreaks. Here's what Michigan looks like:

I know, no one is talking about this stuff, right? That's because people are "sick of it" and aren't interested in Corona Virus news anymore – nor are the interested in "safety" or "prevention" measures. It's a 2 year-old topic and the parents are now seeing if ignoring it will work. Michigan has 10M people and 1.4M of them have already been diagnosed with the virus and 49,219 tests yesterday discovered 8,780 newly infected people and 3,525 people were hospitalized YESTERDAY and 76 people died.

State reporting is inconsistent but recent reports collectively show that there have been more than 1.89 million cases and at least 72,000 hospitalizations and 20,000 deaths among fully vaccinated people in the U.S. this year. State and federal data broadly show unvaccinated people are primarily driving pandemic numbers. Breakthrough infections, however, are making up a growing portion because of rising numbers of vaccinated people and waning immunity among people who got their shots early on.

770,800 people in the US have now died from Covid – as many people this year as last year and this year isn't over. The spread of the highly contagious Delta variant and low vaccination rates in some communities were important factors, infectious-disease experts said.

770,800 people in the US have now died from Covid – as many people this year as last year and this year isn't over. The spread of the highly contagious Delta variant and low vaccination rates in some communities were important factors, infectious-disease experts said.

Covid has proven to be an enduring threat even in some of the most vaccinated places, many of which are confronting outbreaks again now, as the world prepares to live with and manage the disease for the long term. In Europe, parts of Austria, Germany and now the Netherlands have imposed new restrictions in recent days after Covid-19 cases rose and hospitals came under strain.

The 2021 U.S. death toll caught some doctors by surprise. They had expected vaccinations and precautionary measures like social distancing and scaled-down public events to curb the spread of infections and minimize severe cases. But lower-than-expected immunization rates as well as fatigue with precautionary measures like masks allowed the highly contagious Delta variant to spread, largely among the unvaccinated. “Heading into this year, we knew what we needed to do, but it was a failure of getting it done,” said Abraar Karan, an infectious-diseases doctor at Stanford University.

According to updated data from the CDC (now that they are allowed to work on Covid again), only 59% of the U.S. population is fully vaccinated and only 17% have received booster shots due to a loss of interest on the part of the population. Talking about Covid is not good for ratings – half of you are rolling your eyes right now – so the media has stopped takling about it and it's not good for political polling – so our leaders don't want to "go there" anymore either.

So we pursue plan B – ignore the problem – and that is going about the way you would expect.

An August study in the journal Health Affairs that argued that nearly 140,000 U.S. Covid-19 deaths between the beginning of 2021 and the end of May could have been prevented by vaccinating a larger portion of the population (1/2 of the year's total deaths). Vermont has the lowest Covid-19 death rate per 100,000 people since the pandemic began, although the state is in a continuing surge. Vermont also has the most fully vaccinated population among the states, at 72%. Mississippi, closer to the bottom of the list with about 47% fully vaccinated, has the nation’s highest death rate since the pandemic began. BORING!!! Please, let's not talk about Covid anymore….

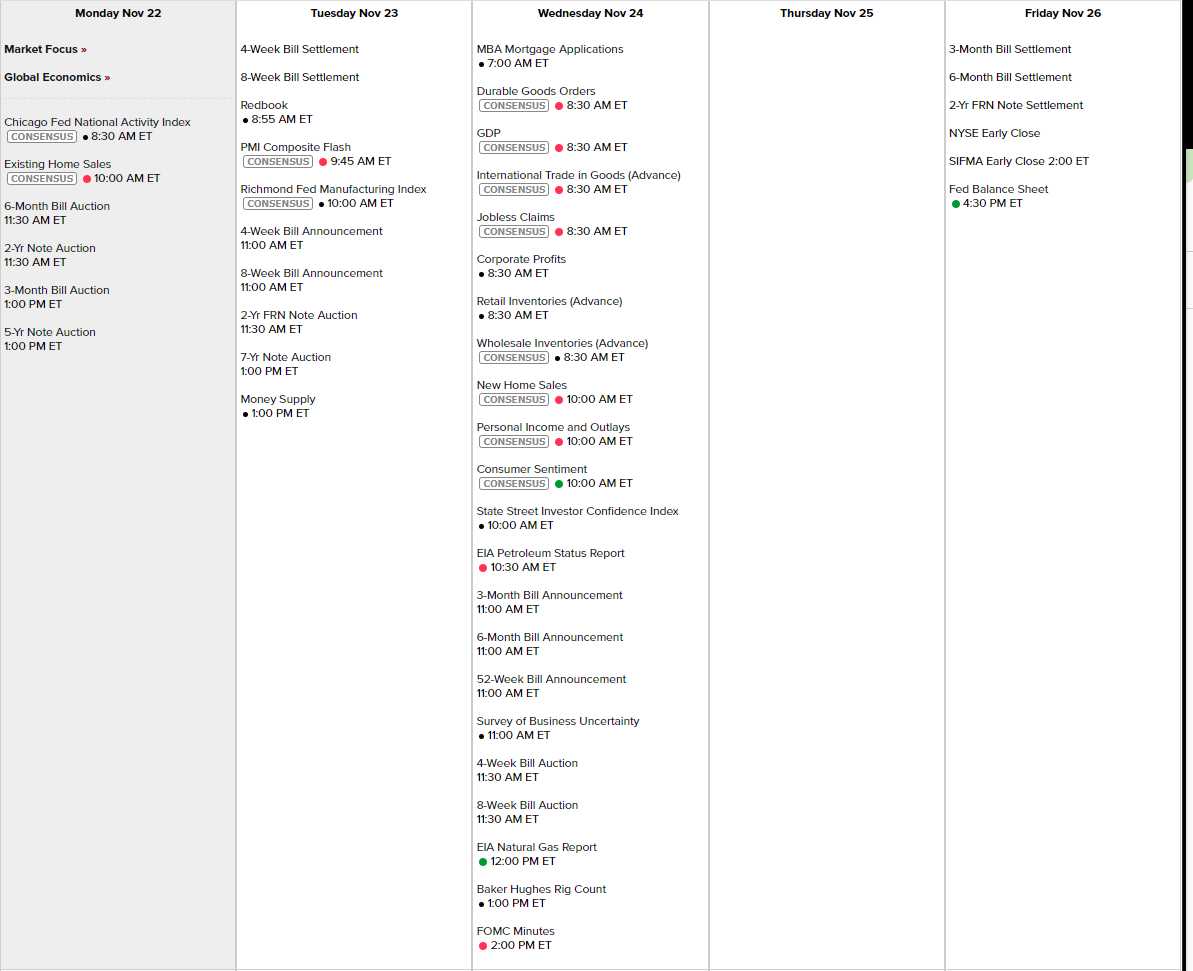

Moving on then…. So not much is going on this week, data-wise, and it's all happening on Wednesday, including GDP, Durable Goods, Home Sales, Personal Income and Investor Confidence. Then we're off Thursday and good luck finding anyone who's working on Friday in the US.

It's also a great week to try to slip bad earnings reports under the radar:

Can't even get those on Friday….