How bad is this version of Covid?

How bad is this version of Covid?

We don't really know yet but it seems to be more contagious but milder and that's actually a good thing in a VACCINATED population, as it promotes herd immunity (for those that don't die). The Spanish Flu Pandemic of 1918 ravaged the planet yet today Influenza is what keeps us out of work for a few days and yes, some people still die but in 1933, scientists isolated the Influenza virus and began testing shots on soldiers and college students and they rolled out the vaccine in 1936 and by 1945 it was required to attend school (friggin' Democrats, right?).

We have learned to live with influenza and we'll have to learn to live with Covid too but, hopefully, we aren't going to take 37 years to immunize the population. They had an excuse back then – they had to invent it! Disposable syringes weren't even invented until the 50s so our parents in this picture are sharing their needles…

Anyway, 5 generations later the flu that killed 50M people (3% of the World's population at the time) now kills "just" 0.02%, 1/100th as many. The question for investors, however is what will happen to this generation of humans as we become exposed to the new variant? Yes, it's milder, but that doesn't mean we should run out and get it. There's not enough data to make a firm decision but it doesn't seem like it's going to be a market-killer – we'll simply have the same weakened economy for a little bit longer.

We can play these things strategically, of course. I mentioned MRNA on Friday and they are up another 10% this morning as the company announced they are working on a vaccine booster for Omicron. This is why we like them, they have proven their technology works, why did people dump them just because one flu had possibly run its course? There's always another one and this is already case in point.

BioNTech (who co-developed the PFE vaccine) is a similar company to MRNA and it's also popping, Yodi had the idea back on Nov 2nd and we turned it into a trade in our Live Member chat Room:

BNTX/Yodi – Hard to say whether or not they are a one-trick pony but one trick is all they need as we'll be getting Covid vaccines every year, it looks like. They are not wasting this opportunity and are developing 20 more vaccines with potential to launch over the next 5 years. They are also working on cancer therapies – obviously huge money IF they can get a winner. Overall, BNTX is as likely as MRNA to succeed over the long haul and MRNA has a $136Bn valuation on $20Bn in sales with $12Bn in profit while BNTX gets less respect with a $66Bn valuation, $16Bn in sales and $9Bn in profits. Since their burn rate in 2019 was only $279M, their cash ($8.5Bn) with another $18Bn coming means they will be able to work on whatever they want for quite a long time.

So I think Yodi has found a worthwhile investment but, unfortunately, it's a pricey stock so it only fits in our LTP at $283.50. In the LTP, let's:

- Sell 5 BNTX 2024 $200 puts for $35 ($17,500)

- Buy 10 BNTX 2024 $300 calls at $80 ($80,000)

- Sell 10 BNTX 2024 $400 calls at $54 ($54,000)

That's net $8,500 on the $100,000 spread so you have to love the upside potential of $91,500 (1,076%) but we're not in the money – it's a speculative bet that they do find something else to sell over the next 12 months, otherwise our investing premise is dead. So let's remember to keep an eye on these and hopefully Pharm will have some color commentary on the subject when he checks in.

I'm pointing this out because, despite the move up, it's still good for a new trade as the net on the spread is still only $14,250 out of a potential $100,000 so there's still $85,750 (600%) more to gain, even if you missed the first $5,750 worth of gains our Members are already enjoying in their first month.

Also, I don't know if you noticed it but people have been flying all year without any major incidents yet you can buy Delta Airlines (DAL) for $24Bn at $37.50 and Delta made almost $5Bn in 2019. They lost $12.4Bn in 2020 and they are losing $3Bn this year but next year should be back to profits and, long-term, we're not going to stop flying – even if we all have to wear space suits on the plane.

Let's take a poke at DAL in our Future is Now Portfolio:

- Sell 5 DAL 2024 $40 puts for $10 ($5,000)

- Buy 20 DAL 2024 $40 calls for $8.40 ($16,800)

- Sell 20 DAL 2024 $55 calls for $5 ($10,000)

I'm being aggressive with the short puts because this trade will either begin working by Q1 or we're out anyway. It's a $30,000 spread at net $1,800 so there's a $28,200 (1,566%) upside potential at $55. Worst case is we're forced to own 500 shares of DAL at net $43.60 but we'll pull the plug long before that happens.

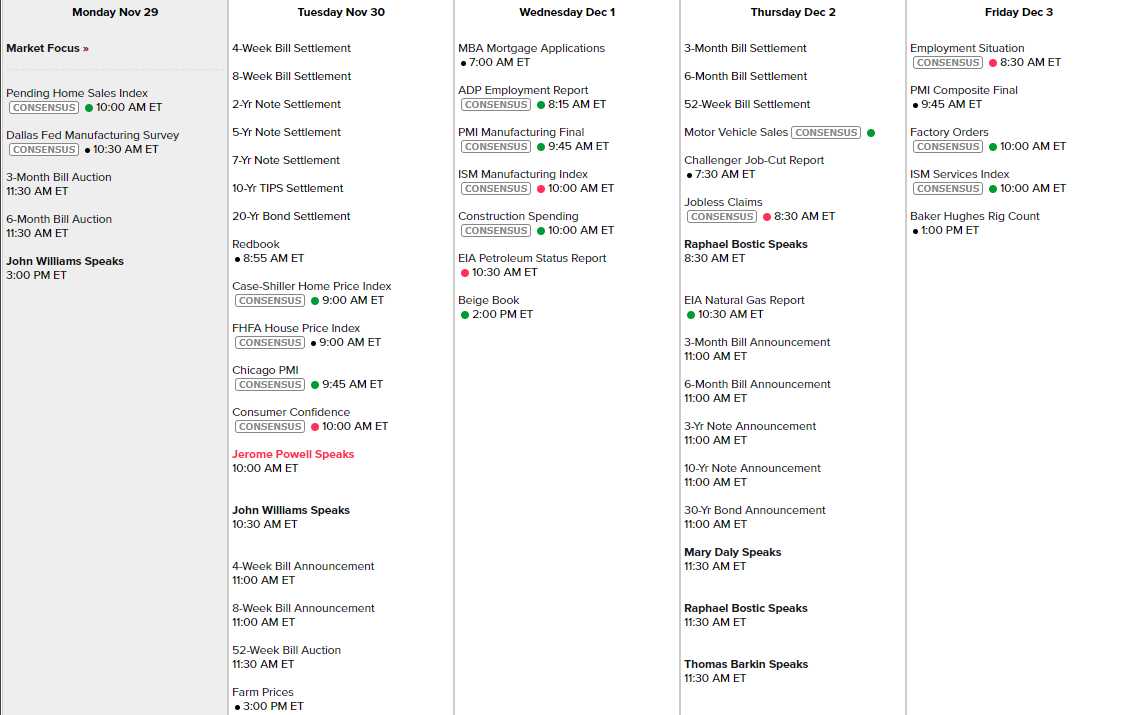

Powell is speaking tomorrow morning and I'm sure he'll tell us the Fed will do whatever it takes to make sure rich people don't suffer from Omicron. We'll see the Beige Book on Wednesday and the Non-Farm Payroll Report is out Friday morning, along with Factory Orders, PMI and ISM Services so lot's of info all week long:

And there are still plenty of companies reporting earnings, which should keep the Russell pretty volatile, though there are some large caps trickling in as well:

Omicron ‘Pretty Mild’ So Far, South African Health Expert Says

Dutch Cluster Suggests Omicron Has a Foothold in Europe

More Countries Find Omicron Cases as Israel Shuts Borders

Markets Face Weeks of Uncertainty in Wait for Omicron Answers.

Black Friday store traffic down 28% from pre-Covid levels as Americans stay home

Virus Variant Sends Mideast Stocks Into Nosedive After Oil Slump

Europe’s Energy Crisis Is About to Get Worse as Winter Arrives

OPEC+ Likely to Be Cautious on Oil Demand at Meeting, Vitol Says

Yuan Surge Shows Traders’ Faith in Hands-Off Central Bank

El-Erian Says Fed Should Recognize Inflation Isn’t Transitory

Massive inflation will likely push Fed to hike rates six times before 2024: Federated Hermes

Charting Global Economy: Latin America at Top of Inflation Wave.

Christmas Tree Shortage Develops As Consumers May Pay Record Prices

Eurozone Inflation Likely Hit Record High in November

Traders Unwind Rate-Hike Bets as New Covid Fears Spread

Black Friday Rout Shows Dangers of Margin Borrowing

Iran, EU, China and Russia Meet in Vienna Ahead of Nuclear Talks

Airlines Avoid Thanksgiving Pitfalls as Daily Passengers Top Two Million

Best Buy stores in Minnesota looted, all get away.

California Apple store hit in latest smash-and-grab in broad daylight

Security guard killed protecting bystanders from looters as smash-and-grab crimes rage nationwide.