That's the milestone we hit today, less than two years into the Covid crisis. If it never ends, 50 years from now it could be 20M dead – will the number matter then? Well, that won't happen – it's slowing down, right? No. That is not right. Since August 1st, call it 4.5 (21%) months out of 21 – we've had 186,000 (23%) deaths – this thing is really not slowing down at all.

Now, it's not a Global catastrophe. The US is unique in the number of infections and deaths in all of the World. Our lack of public health care and our disdain for facts and science combine to keep us dying in droves and our hospitals are filling up fast again. 1/3 of our population still isn't vaccinated – that's 100M Americans just walking around as if nothing at all is wrong – and these are not the kind of people who wear masks, wash their hands or maintain social distancing protocols either.

These anti-vaxxers are a powerful voting block being courted by the Conservatives and they have been going to court to prevent vaccine mandates, mask mandates and other measures meant to discourage the spread of Covid – it's the Right to Infect they are protecting and it's making America the most dangerous country on Earth to live in. 1,260 people a day (average) are dying of Covid in Amercia in December – up from 223 average in July – we are very much going the wrong way – again.

We've had a small pullback in the markets but nothing that indicates any real fear of what is obviously a strong resurgence in Covid cases. Readings out of China indicate a significant slowdown in November as restrictions came back on and Europe did the same so we can expect the same results when they announce their economic data for November. The US might be different because, unlike other countries, we don't mind a little extra death and disease into the holidays.

Another "cost" of not containing Covid is not containing inflation, which has been running out of control. Why? Well, less people working causes fewer goods to be produced but we give the workers (and idle businesses) money so they can spend it without producing and that causes the same or more money to chase after fewer available goods and services which, in turn, causes the prices of the goods and services to rise. This is exacerbated by the fact that the Top 10% can afford to pay much, much more for the marginal goods and services so inflation runs up a very steep curve, which puts the price off goods and services out of reach for those on the bottom.

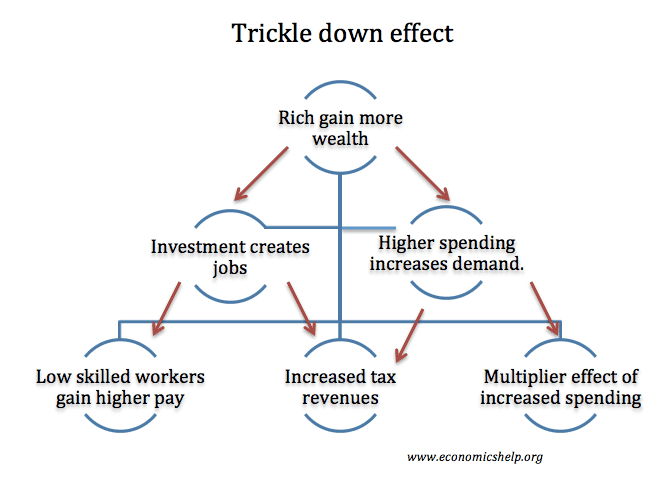

Since the problem was adding money into the system, putting even more money into the system to help the poor only makes things worse – especialy since Americans don't believe in helping the poor, so we give money to the rich so they can "trickle down" their wealth on the bottom end of the population.

Since the problem was adding money into the system, putting even more money into the system to help the poor only makes things worse – especialy since Americans don't believe in helping the poor, so we give money to the rich so they can "trickle down" their wealth on the bottom end of the population.

At the last Fed meeting, Chairman Powell finally admitted that inflation was becoming somewhat of a problem but it may be too late to fix it. The Fed will make a policy announcement at 2pm and we will discuss it live, during our Trading Webinar, at 1pm, EST.

We will see what they actually plan to do about it but probably not much since we're in the middle of another rising wave of Covid and "not much" is a market booster since the Fed is showering the Investor Class with far more money than they could ever spend – or trickle.