Feeling Anxious?

Feeling Anxious?

Clearly not a great place to be on this chart as the next phase is Denial, as in: "I'm sure the markets will bounce" or "I'm sure the Fed will save us" but the Fed just told us they are not going to save us at all with more free money. In fact, there will be no more free money by April and, on top of that, they are going to start raising interest rates.

Are they doing this because we have a healthy econmy with full employment and strong GDP growth? No. They are doing this because we have miscalculated the economy, miscalculated the pandemic and now all the misallocated money that has poured out of the Fed is causing rampant inflation that they don't know how to contain – so they are going to do the same thing that worked in the 1980s and hope nothing has changed in 40 years – because they don't actually have any new ideas.

And it's not just our Central Bank that has concerns. Early this morning the Bank of Japan said it would wind down its holdings of commercial paper and corporate bonds, but kept monetary policy ultraloose overall. The benchmark Nikkei 225 index fell 1.8%. Other Asian indexes were mostly lower, with Hong Kong’s Hang Seng down 1.2% and the Shanghai Composite Index 1.2% lower. On Thursday, the Bank of England raised interest rates, taking investors and analysts by surprise. The European Central Bank said it would phase out an emergency bond-buying program, while ramping up other stimulus measures.

Omicron has prompted restrictions all around Europe ahead of the holidays and, while it may be too late to cancel Christmas, sick relatives that can't get into overwhelmed hospitals are putting a damper on the holiday spirits. On Wednesday, the UK reported the highest number of new Covid cases since the pandemic began (78,600 vs 68,053 in Jan – the previous record). Omicron infections are doubling in the UK every 1.9 days – a very dangerous number! Denmark, Norway and France have shut down nightclubs and Germany is now considering making vaccines mandatory.

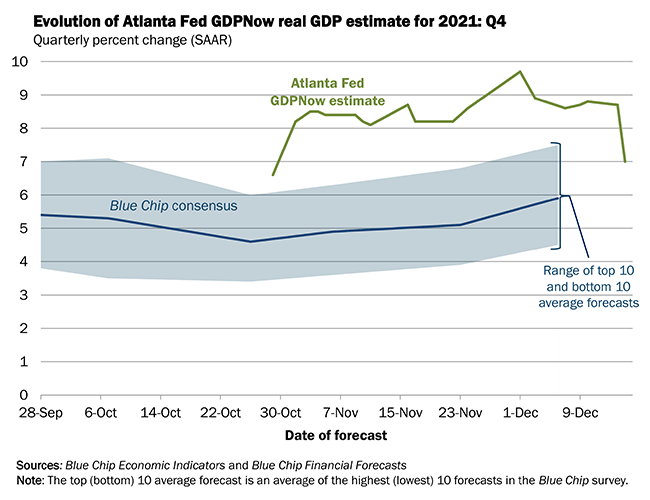

Epectations are indeed very high for Q4 our inflation-fueled GDP is expected to be over 6% for Q4, coming back from Q3s very disappointing 2.1%. Remember, it's easy to grow 6% when we had a quarter last year (Q2) in which the economy fell 31.2%. Q1 was -5.1% so, if we started with 100, Q1 took us down to 94.9 and then Q2 leaves us at 65.3. The stimulus in Q3 last year added back 33.8%, so (65.3 x 1.338) = 87.37 and Q4 was 4.5% (91.30), Q121 was 6.3% (97.05), Q2 was 6.7% (103.6) and the 2.1% we just had leaves us at 105.8.

So, after all that, 2 years after the virus began, we are running a qarterly GDP that is 5.8% greater than before. That's pretty much 2.5% annual growth (as it compounds). That's fine if we can sustain it but the problem is the markets haven't done that math and they are up 50% since 2019. The Nasdaq is up 100% since 2019, in fact.

So, after all that, 2 years after the virus began, we are running a qarterly GDP that is 5.8% greater than before. That's pretty much 2.5% annual growth (as it compounds). That's fine if we can sustain it but the problem is the markets haven't done that math and they are up 50% since 2019. The Nasdaq is up 100% since 2019, in fact.

Can we justify it? Not really. A lot of it is because there are a lot of tech companies that benefitted from a stay at home population. Moving about 1/3 of the workforce of 165M people to remote office set-ups caused a massive buying spree, fueled by Government stimulus money so it was artificial demand enabled by artificial funds and it's neither likely or possible for that pace to continue so investors that are paying 40x earnings (the Nasdaq average) for stocks are in for a rude awakening when earnings stop growing or even reverse when workers go back to the office and now longer need two of everything to get their jobs done.

WITH Trillions of Dollars in stimulus, the economy has grown 5.8% in two years – and that's assuming we can sustain this level going forward, now that the stimulus is over. But soon, student loans will no longer have their payments suspended and the banks are able to foreclose and landlords are able to evict and unemployment benefits now run out – a lot of that extra money that's been pumping around the economy is about to be drained out – at the same time as the Fed is putting the brakes on adding more.

The Fed HAS to put on the brakes because, IF the economy does pick back up, inflation can quickly get out of control. All that QE has driven the money supply up 25% since the pandemic began but the velocity of that money has dropped 25% – so they've been just trying to keep up but it's very tricky if it goes the other way because the money supply is hard to put back in the bottle and if $15Tn moving at 1.4x gave us a $21Tn GDP so does $19Tn moving at 1.1x but $19Tn moving at 1.3x is $24.7Tn – and that is where we get inflation because the GDP isn't growing because we are producting more goods and services – it's just more money chasing the same amount of stuff – and that is very unhealthy.

The Fed HAS to put on the brakes because, IF the economy does pick back up, inflation can quickly get out of control. All that QE has driven the money supply up 25% since the pandemic began but the velocity of that money has dropped 25% – so they've been just trying to keep up but it's very tricky if it goes the other way because the money supply is hard to put back in the bottle and if $15Tn moving at 1.4x gave us a $21Tn GDP so does $19Tn moving at 1.1x but $19Tn moving at 1.3x is $24.7Tn – and that is where we get inflation because the GDP isn't growing because we are producting more goods and services – it's just more money chasing the same amount of stuff – and that is very unhealthy.

It COULD, however, be good for stocks. Not because our companies are actually earning the money but because they get paid more for the same amount of goods and services and the value of the Dollar vs the stocks we buy with those Dollars decreases and so, owning stocks is a nice inflation hedge – as long as the economy doesn't collapse.

As I've said this week, we have plenty of long positions but we're also well-hedged – because things could go either way. In the grand scheme of things, the S&P 500 looks very strong but it looked very strong in the winter of 2019, when we also ignored a rapidly-spreading virus that was shutting down Asia and Europe while our Government and our Corporate Media assured us there was nothing to worry about. The S&P 500 made spikey little candle tops two months in a row then as well – right before the 35% correction.

Have a great weekend,

– Phil