Courtesy of Pam Martens

By Pam Martens and Russ Martens

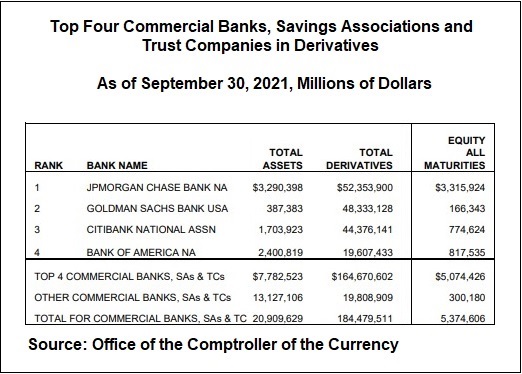

The Office of the Comptroller of the Currency (OCC), the regulator of national banks that operate across state lines, released a report on Monday that details the quantity and variety of derivatives held by commercial banks, savings associations and trust companies as of September 30. (According to the Federal Deposit Insurance Corporation, there were 4,914 commercial banks, savings associations and trust companies operating in the U.S. with FDIC insurance as of September 30.)

The striking detail in the OCC report is that one taxpayer-backstopped, federally-insured bank, JPMorgan Chase Bank N.A., is for some unfathomable reason sitting on 62 percent of all stock (equity) derivatives held at all 4,914 federally-insured banks in the United States. The second striking detail is that this federally-insured bank’s holdings of stock derivatives come to a notional amount (face amount) of $3.3 trillion. (Yes, trillion with a “t.” See above chart.) And the third striking detail is that 74 percent of JPMorgan Chase’s stock derivatives are not centrally-cleared but instead are opaque, over-the-counter (OTC) contracts – highly likely beyond the scrutiny of bank regulators.

Why is any taxpayer-backstopped bank in the United States allowed to own anything near a trillion dollars in stock derivatives, let alone a bank like JPMorgan Chase that has admitted to an unprecedented five criminal felony counts brought by the Justice Department in the past seven years, with three of those felony counts for rigging markets.

The Dodd-Frank financial reform legislation of 2010 promised Americans two things pertaining to derivatives. First, it promised that federally-insured banks would no longer house the derivatives that blew up much of Wall Street and the U.S. economy in 2008. This was known as the “push-out rule” where derivatives were to be pushed out to other parts of the bank holding company which could be wound down in case of insolvency, without impacting the federally-insured bank – or so the theory went. That promise was derailed in December 2014 when Citigroup (the recipient of the largest bailout in U.S. history during the 2008 financial crisis and its aftermath) was able to get its pawns in Congress to repeal the push-out rule by attaching an amendment to a must-pass spending bill to keep the government running. (See our report: Meet the Two Congressmen Who Facilitated Today’s Derivatives Nightmare at Wall Street’s Mega Banks.)

…