This is not good.

This is not good.

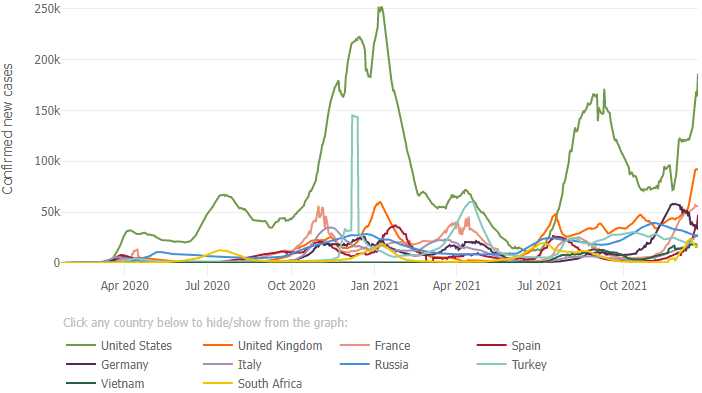

If this were Cryptocurrency or a stock you owned, it would be good but it's not – it's an incredible surge in Covid in the past 30 days as the US and the UK refuse to shut down for the holidays and we're paying the price, with infections surging back to levels we had when our former President was denying the problem even existed. Now, supposedly, we know better – but obviously not.

Keeping the malls open through Christmas is very likely to cost us Q1 (again) as we have to shut down eventually to get this thing under control. It is critical to have hedges in place and, now that we're back to 4,700 on the S&P 500 – I'm tempted to take this opportunity to cash out our portfolios completely and not risk another market melt-down when traders are "surprised" that we are once again overwhelmed by Covid.

Omicron does seem to be milder than the Delta strain that has been dominant this year but it's also far more contageous and it's breaking through vaccines. There were actually 242,794 cases yesterday and 69,413 people were hospitalized. There are only 919,559 hospital beds in the US, at this pace, we will fill them all some time in January.

Omicron does seem to be milder than the Delta strain that has been dominant this year but it's also far more contageous and it's breaking through vaccines. There were actually 242,794 cases yesterday and 69,413 people were hospitalized. There are only 919,559 hospital beds in the US, at this pace, we will fill them all some time in January.

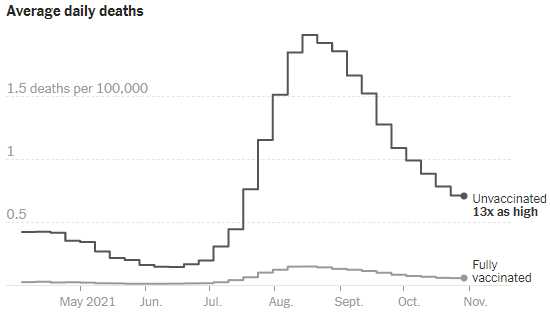

I know you are reading in the Corporate Media that Omicron is milder but it's infecting more people and still, in America, a supposedly advanced country, only 62% of the population is fully vaccinated with 27% still having not had a single shot and, as it turns out, unvaccinated people are 13 TIMES more likely to die of Covid than vaccinated people and 5 times more likely to become infected with Omicron and, the way it is spreading, that means it's pretty much a certainty that 100M people will be catching Omicron and over 500,000 of them will die – happy holidays – I hope that time at the mall was well-spent!

To be fair to the Corporate Media, Corporate Advertisers don't like you scaring the customers away from shopping – so they don't. Disney owns ABC, ESPN so they clearly have an interest in keeping the show running with their theme parks, hotels, movies and cruise lines. DIS lost $2.8Bn in 2020 and, in the legal game, that's called Motive, Means and Opportunity…

Of course we're not picking on Disney as Comcast (CMCSA) owns NBC, MSNBC, CNBC, Unviersal Studios – so they are just as motivated at DIS to play down Covid and keep the citizens shopping. VIAC and T (Time/Warner) are more of a pure-play on media (and phone companies too) and then there's Fox, who clearly don't want us to even get vaccinated and encourages protests of lockdowns (including court battles against them). And that's it – that's everyone who controls see and hear all day long in the media (From Visually):

What "THEY" have all decided to tell us, so far, is that Omicon is no big deal and, amazingly – despite clear scientific and stastistical evidence to the contrary – people are believing it – even though this same group of people just lied to us the exact same way about Covid 2 years ago (it's Covid (20)19, remember?).

So PLEASE, make sure you are well-hedged – just in case it turns out they are lying to us again.

And have yourselves a merry little Christmas!

– Phil