Winning!

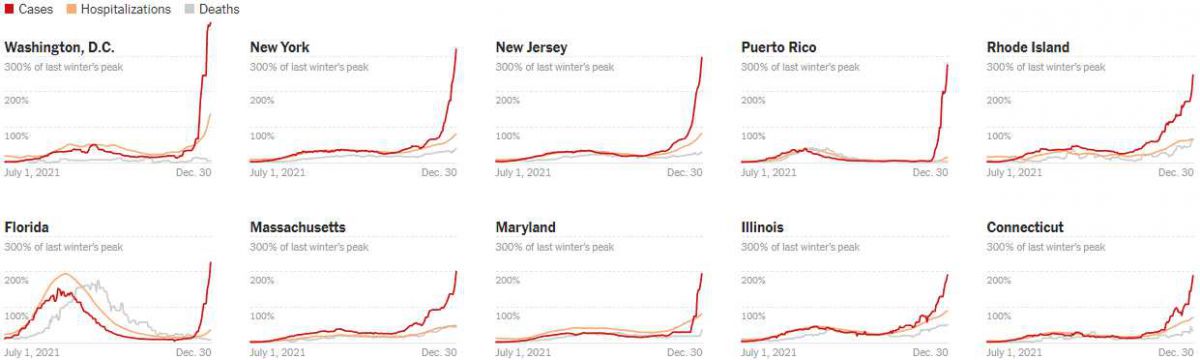

If Charlie Sheen has taught us nothing else, it's that saying you are winning – over and over again – can actually make people think you are winning… Even when things are actually spiraling out of control. Yesterday, the US set a new record with 582,044 cases of Covid reported in 24 hours, just as we head into the one day a year when it can be guaranteed that people will be gathering in large crowds this evening. Winning!

We are winning with our S&P 500 (/ES) Futures shorts, those are up over $4,700 already but this time (unlike Thanksgiving), we are keeping our hedge on into the holiday weekend. Speaking of holiday weekends – for some reason, the stock markets are open today but I'm declaring a half day – unless something crazy is happening by lunch.

We are winning with our S&P 500 (/ES) Futures shorts, those are up over $4,700 already but this time (unlike Thanksgiving), we are keeping our hedge on into the holiday weekend. Speaking of holiday weekends – for some reason, the stock markets are open today but I'm declaring a half day – unless something crazy is happening by lunch.

Nothing happening in the markets during this low-volume week actually matters but, when we cross 1M new cases of Covid per day in January – that might start to matter. So far, thankfully, the death rates and hospitalization rates are not so bad but the total number of deaths in the US is about to hit 850,000 (1.5%) out of 54.3M Americans who have been infected so far.

In the past month, 5.4M people have been infected – that's 10% of the people who were infected over the prior two years and 37,114 people died – that's 4.3% of the people who died in total and that's only 0.67% of the people recently infected so WINNING as half as many people are dying even though twice as many people are being infected – winning!

On a positive note, 9,138,204,546 doses of vaccine have been administered globally but, unfortunately, 2.5Bn of us in the US, Europe, China and Japan have gotten 7.5Bn doses and the other 5.5Bn people have had to share the remainng 1.5Bn does. Winning! Being vaccinated does seem to help but America has 100M unvaccinated citizens and Omicron is spreading through that population like a conspiracy theory at a Trump rally. Winning.

On a positive note, 9,138,204,546 doses of vaccine have been administered globally but, unfortunately, 2.5Bn of us in the US, Europe, China and Japan have gotten 7.5Bn doses and the other 5.5Bn people have had to share the remainng 1.5Bn does. Winning! Being vaccinated does seem to help but America has 100M unvaccinated citizens and Omicron is spreading through that population like a conspiracy theory at a Trump rally. Winning.

We are indeed fortunate (winning) that the Omicron strain of covid seems to have evolved to be less deadly than the Delta variant is is rapidly replacing. That has not been true for mutations of Bird Flu, Hepatitis C or HIV – all of which became worse as they progressed. Covid is closely related to bird flu so winning – so far…

Most importantly, the S&P 500 is wrapping up a WINNING! year at 4,766 this morning after starting the year at 3,750 so 1,000 points is 26.666% – winning! 4,800 completes a 50% gain from 3,200 which is where we were in December of 2019 and we pulled back to 2,400 in March of 2020, which was a 50% retracement of the run from 1,600 that began in 2013. That means a weak retrace of the current run would be 320 points – back to 4,480 (which you can see has been tested twice in December), while a strong retrace of 640 points (which would be a weak retrace of the run from 1,600) will take us back to 4,160 – those are the lines we'll be watching (out) for in Q1.

Here's wishing you and your family a happy, healthy and prosperoous 2022,

– Phil