Happy 2022!

Happy 2022!

It's happy 4,785 on the S&P 500 this morning, so I guess we didn't need those hedges but forgive me if I don't dump them just yet – as the year is young. The dangers are still out there. In fact, Evergrande is still a thing as trading had to be halted in Hong Kong this morning as the property developer was ordered to demolish 39 buildings in the next 10 days because the building permits were "illegally obtained."

With $197Bn worth of bonds coming due in January for the Property Industry, this is not a good time to shake investor confidence though it is possible the Government did Evergrande a "favor" by giving them an excuse to cancel a project they can no longer afford, building yet another speculative, empty city to rot on the Chinese landscape.

Real Estate is 29% of China's GDP and Evergrande alone has $300Bn in debt that appears to be in real danger of defaulting and no wonder, since there are now 65M vacant properties in China. There are only 110M homes in the entire United States! In China, with 1.3Bn people, it's "only" 20% of the housing market but imagine what the US would look like with 20% vacant homes (it's more than double our rate)?

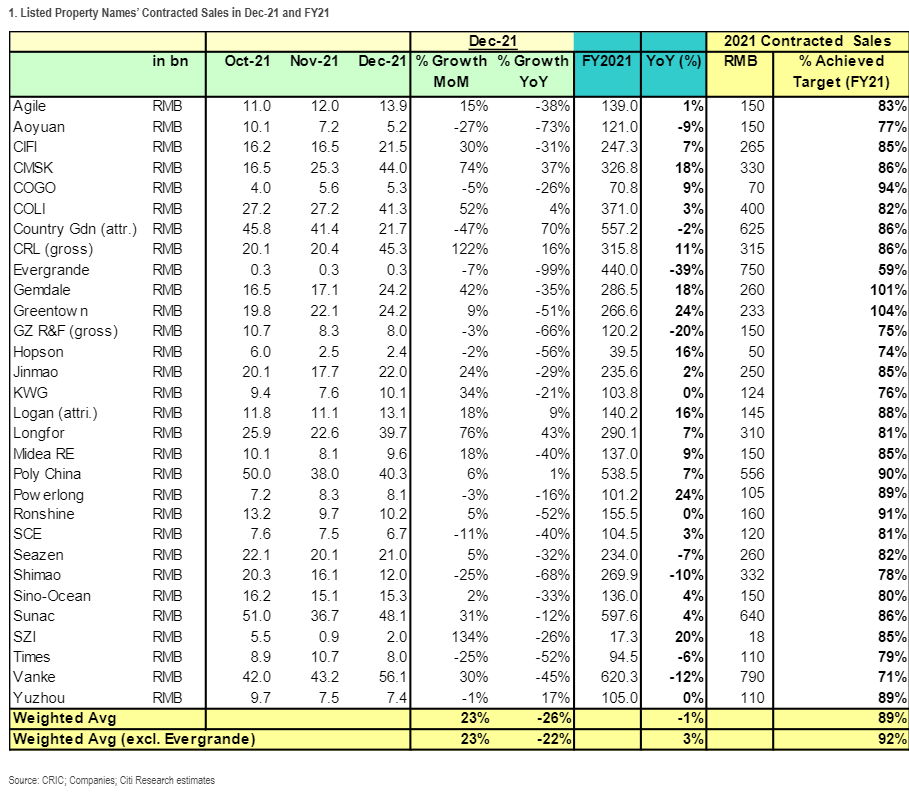

Contracted sales for Chinese property developers fell 26% in December and Evergrande's are down 99% from last year – would you buy a pre-construction home from them? This does not bode well for the bondholders, does it?

These companies need to raise $197Bn this month to avoid defalts on Trillions of Dollars worth of debts and they can't do it at 10%+ rollover rates (due to the increased risk of default) so expect them to float equity and dilute – which will create an upcoming sell-off in the sector. And the pressure is really on because Chinese New Year is February 1st and that's a week off for the markets so they have very little time to come up with a plan to raise capital of face a major crisis to start off the year.

We began 2021 shorting the China ETF (using FXP) due to property concerns and those paid off early with FXI now down at $36.50, from a high of $53.74 in February, so down about 1/3 for the year. In China, the Communist Government accumulates sales revenues worth billions of dollars from land sales and the earnings of the property market, and the reason behind this real estate-driven economy lies in the country’s constitution. According to the Chinese constitution, all the land in China is owned by the state, so when developers want to build on a piece of land, they have to lease it from the government, often by participating in local land auctions.

We began 2021 shorting the China ETF (using FXP) due to property concerns and those paid off early with FXI now down at $36.50, from a high of $53.74 in February, so down about 1/3 for the year. In China, the Communist Government accumulates sales revenues worth billions of dollars from land sales and the earnings of the property market, and the reason behind this real estate-driven economy lies in the country’s constitution. According to the Chinese constitution, all the land in China is owned by the state, so when developers want to build on a piece of land, they have to lease it from the government, often by participating in local land auctions.

Evergrande’s model worked as long as it could keep building and selling at an inexorable rate. The company would borrow to buy land, get homeowners to buy off the plans, and then borrow again to start another project. Behind the rapid growth, a big interest bill was mounting. By July 2020, the company's liabilities had reached 86 percent of all of its assets and the group turned increasingly to short-term lending with high interest rates.

Now it's like that old joke: "If you owe the bank, $300,000 and can't pay it, you are screwed but if you owe the bank $300Bn and can't pay it – the bank is screwed" or, in this case, the Chinese economy.

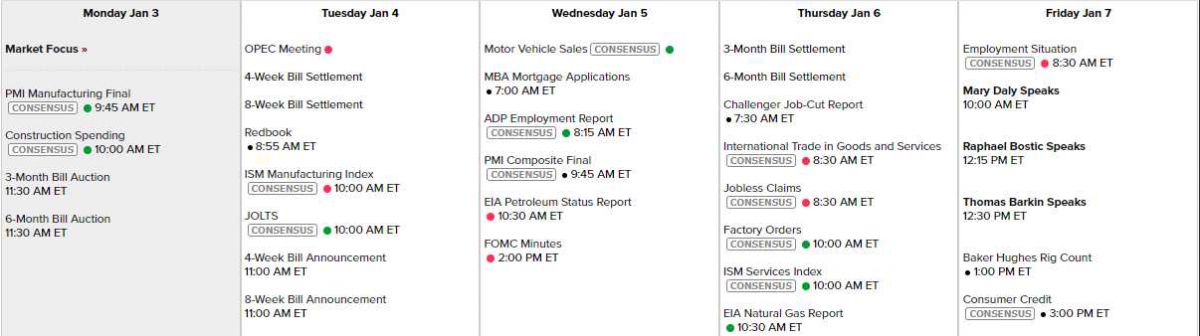

In the US this week, we'll have Non-Farm Payrolls on Friday and plenty of data all week, kicking off with PMI and Construction Spending this morning, ISM tomorrow, PMI (again) and Motor Vehicle Sales on Wednesday along with the Fed Minutes. Thursday is ISM Services and Factory Orders and Friday, in addition to NFP, we have 3 Fed speakers – which makes me think the NFP report is going to be disappointing and they are lined up to spin it.

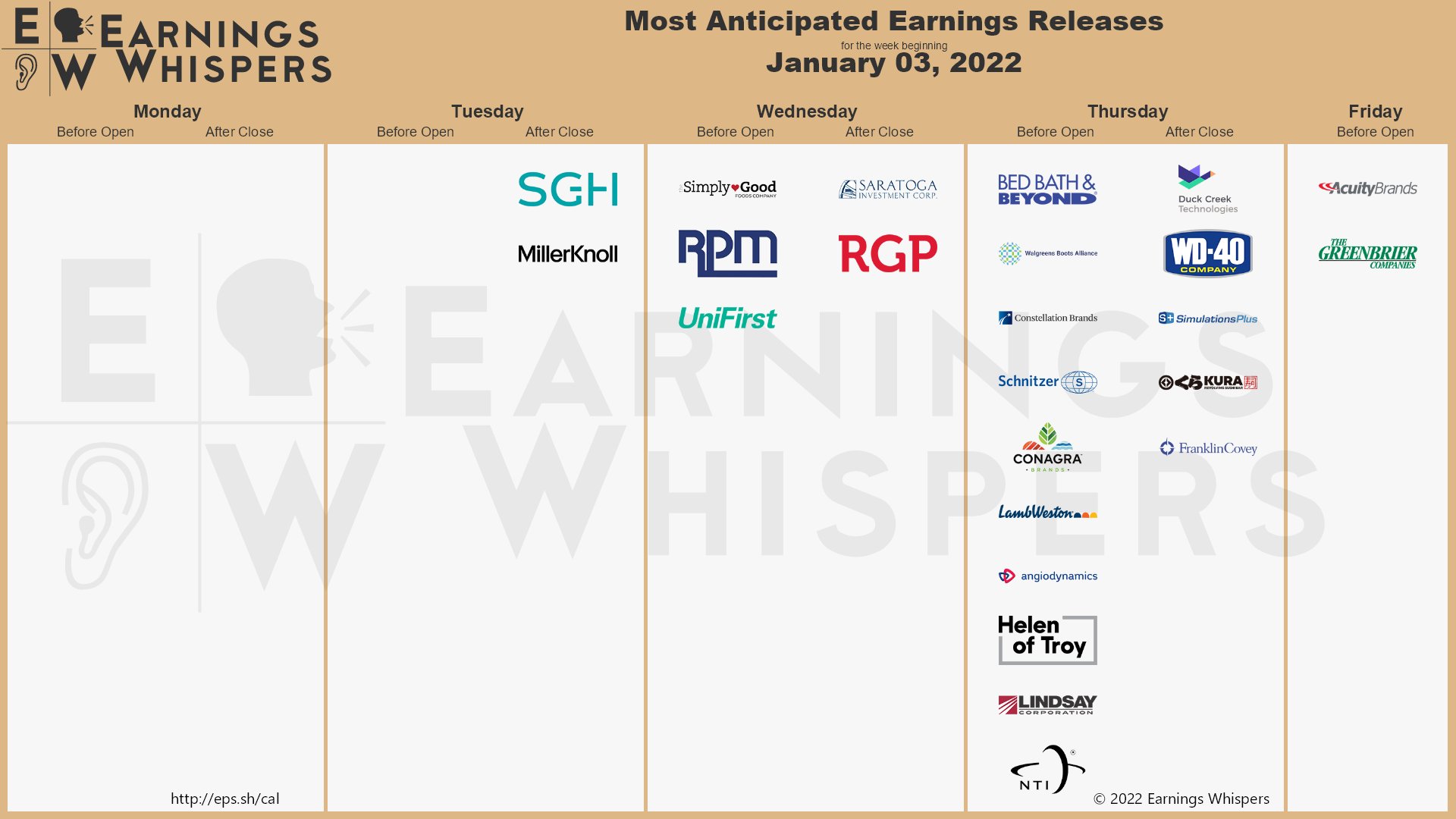

And, guess what? It's that time of year again: