By Jacob Wolinsky. Originally published at ValueWalk.

Hidden Value Stocks issue for the fourth quarter ended December 31, 2021, featuring ValueWorks’ Charles Lemonides sharing his top small-cap stocks, Tidewater Inc. (NYSE:TDW) and United Natural Foods Inc (NYSE:UNFI), and Bonhoeffer Fund’s Keith Smith finds a hidden value opportunity in Asia Standard International Group Ltd. (HKG:0129).

Q3 2021 hedge fund letters, conferences and more

- See Part II here.

- See Part III here.

Introduction

Welcome to the December 2021 (Q4) issue of Hidden Value Stocks.

In this issue, we have our usual two interviews, an update from Charles Lemonides, CIO and founder of ValueWorks LLC, and extracts from letters of funds previously profiled.

The first interview is with Jim and Abigail Zimmerman of Lowell Capital. Between its founding in 2003 and 2015, Lowell Capital turned an investment of $10k into $38,779. After the launch of the Lowell Capital Value Partners fund in 2017, that investment has since grown to $58,883.

The second interview features Lyrical Partners. The firm describes itself as a deep value investor that has always been “hunting in the cheapest part of the market.” Since its inception at the beginning of 2019, the Lyrical International fund has returned 17.6% per annum after fees.

We hope you enjoy this issue of Hidden Value Stocks, and if you have any questions or comments, please feel free to contact us at support@hiddenvaluestocks.com.

Sincerely,

Rupert Hargreaves & Jacob Wolinsky.

Charles Lemonides: ValueWorks LLC

In the Q3 2020 issue of Hidden Value Stocks, Charles Lemonides, the founder of ValueWorks LLC picked out Tidewater and United Natural Foods as his top small-cap stocks. We recently caught up with Charles to see if he’s still bullish on these two firms.

Tidewater

The offshore oil and gas business seems to be getting close to an inflection point. If so, Tidewater Inc. (NYSE:TDW) should prove extremely leveraged to such an inflection and the share price could be revalued meaningfully higher in a matter of quarters.

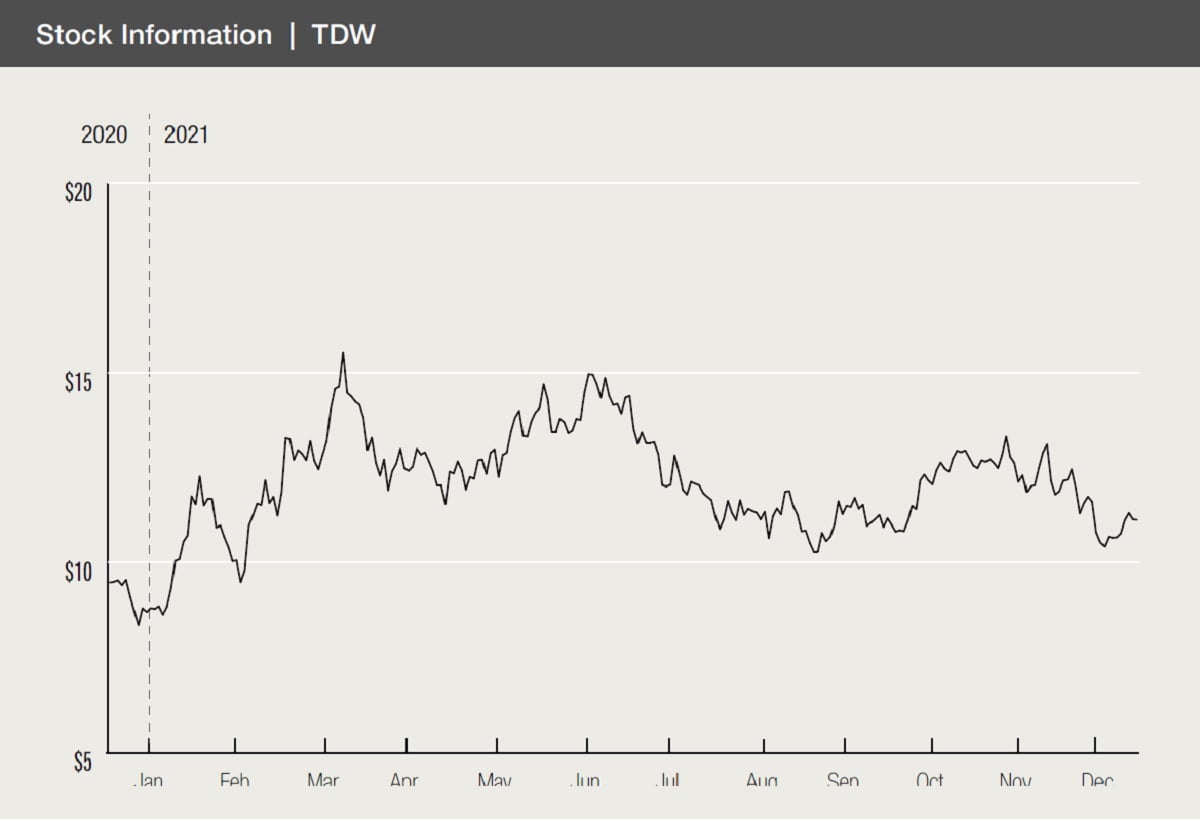

The shares have had a solid return over the past twelve months, touching a low of under $6 per share in November of 2020, and are now trading at roughly $12 per share. But we view this as a sharp bounce off an unsustainable low, and expect a more meaningful advance over the next several years. We believe there is a high likelihood the shares trade in the mid-twenties in 2022 and then double from there as we reach a cyclical market top in the second half of the decade.

Day rates for offshore support vessels have been trending higher as oil prices have remained above $50 per share for an extended period. There has been a steady but gradual uptick in almost all areas of offshore energy activity for a number of quarters. Current oil prices support that uptick. As the excess supply of actively marketed support vessels has been gradually absorbed, day rates have advanced to profitable levels. Further increases in activity will have the amplified effect of increasing the number of vessels operating and increasing the average price, resulting in much higher operating earnings and free cash flow.

With 41 million shares outstanding and minimal net debt, Tidewater’s enterprise value today is roughly $500 million. For the quarter ending September 30, revenue grew 6% sequentially to $92 million, generating EBITDA of $8.7 million. A mid case would be a sustained 6% sequential revenue growth rate, slower expense growth and $22 million quarterly EBITDA reported 8 months from now, for an EBTIDA run rate of $88 million. Critically, that would not represent a cyclical top but would be a base level from which cash flow would accelerate.

United Natural Foods

United Natural Foods Inc (NYSE:UNFI) has also advanced sharply since our last update. We see this stock being a bit further along in its recovery, with an advance from under $5 per share in 2020 to $50 today.

Our expectation is that the shares will reach $100 over the next several years.

We are several quarters into an earnings acceleration, yet the shares remain quite reasonably priced. The company has demonstrated a sustainable quarterly earnings run rate of better than $1.00 per share. Our base case is for 15% earnings growth based on 5% top line growth, modest margin expansion, debt reduction and lower interest spreads as credit quality improves. There is material upside from there should food/grocery inflation exceed management’s forecast 1%.

Much of the investment story has been de-risked over the past 12 months. The integration of the 2018 acquisition of SuperValu has been completed and cross-selling opportunities and the benefits of scale are being realized. The company’s contract with WholeFoods/Amazon has been renewed. Management transition seems to have been executed smoothly and debt reduction has meaningfully reduced liquidity risk.

As investors come to understand that the transition to e-commerce represents not a threat, but an opportunity for this at-scale national distributor to gain share, the equity should command a premium rather than a discounted multiple, providing further upside to our $100 per share midcase price target.

Keith Smith: Bonhoeffer Fund

Bonhoeffer Fund portfolio manager Keith Smith, who featured in the Q3 2018 issue of Hidden Value Stocks, profiled his newest hidden value opportunity, Asia Standard International Group Ltd. (HKG:0129) in his latest letter to investors:

Asia Standard (HKG:01299) holds a large number of Chinese real estate developer bonds, including those of Evergrande and Kaisa. The Evergrande bonds have declined to about 20% of face value as of September 30 (they were at 40% of face value on July 31, 2021, the last market-to-market valuation date for Asia Standard’s bond portfolio) while the Kaisa bonds have declined to 85% of face value. I ran a stress test assuming a 25% decline in the bond portfolio from July 31, 2021. This is 2x the 13% decline in the portfolio from Evergrande and Kaisa bond prices between July 31, 2021, to September 30, 2021. The resulting NAV/share is $8.09 versus the $10.09 NAV as of July 31, 2021. The September 30 stock price of $0.85 is at a 91% discount to the stressed NAV and 92% to the July 31, 2021, NAV.

Updated on

Sign up for ValueWalk’s free newsletter here.