Negative Manipulation

Courtesy of Michael Batnick

The stock market is manipulated. Multiples are being driven endlessly higher by low interest rates and government spending and buybacks and flows into index funds.

There’s more than a little truth here, but mostly it’s a lie. Real GDP is at an all-time high, as are earnings for the companies that ya know, make up the stock market.

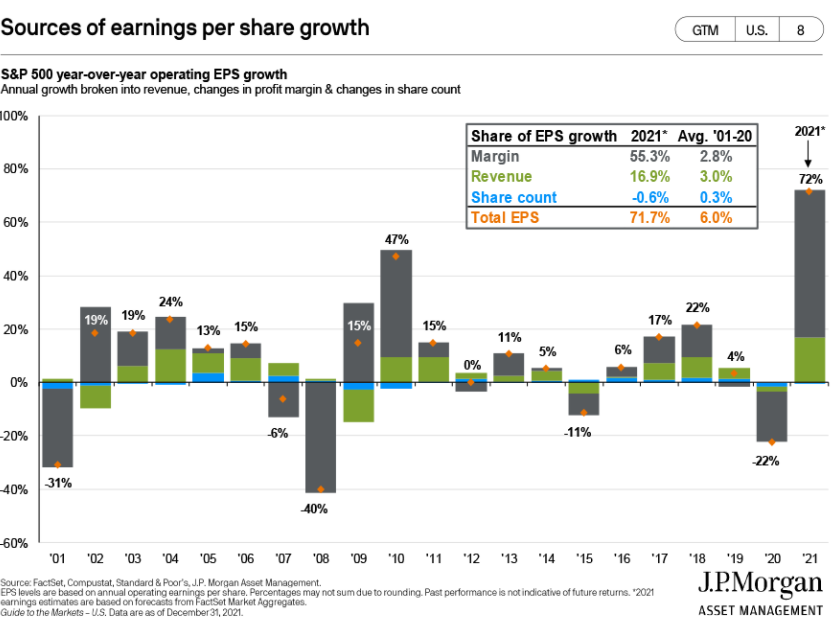

The 27% return for the SP 500 in 2021 was driven by earnings growth. Plain and simple. In fact, multiples compress and if they hadn’t, returns would have been even higher. This chart from JP Morgan’s most recent Guide to the Markets is chef’s kiss.

This one’s the coup de grâce. It breaks down EPS growth by margin expansion (contraction), revenue, and share count. Over the last 20 years, buybacks were responsible for 0.3% of the 6% annual EPS growth. In 2021, share issuance diluted earnings per share. This idea that buybacks are manipulating the market is nonsense on stilts. They’re mostly done to offset share issuance, which is another topic for another day.

One more thing that stands out in the chart above is margin expansion. Bottom lines were hit last year as the shutdown put the squeeze on businesses. But as the economy reopened, companies found ways to improve their earnings. And that, my friends, is what ultimately drives the market.

Josh and I are going to cover this, growth stocks getting rekt, and much more on tonight’s What Are Your Thoughts?

Source: