Seems a little high, doesn't it?

Seems a little high, doesn't it?

We're so close to 5,000, we might as well get there as, clearly, the numbers are meaningless. We've discussed how trading the S&P 500 at 40 x earnings is ridiculous but it's still happening so get used to the "new normal", I guess. Of course it all comes down to risk vs. reward and there's just as much RISK in a 10-year bond that pays you 1.666% as there is in a stock that pays a 3% dividend so of course buy the stock.

See the multiples don't matter when the underlying returns don't match up. Usually you can get 4-5% on bonds and they are considered very safe but, in a rising rate environment, the interest paid on the bonds may not keep up with inflation and you end up losing money – in steady Dollar terms. Stocks, on the other hand, usually inflate with everything else so you keep up on the investment side and, if they are paying more dividends than a bond does interest – well then it's a pretty easy choice.

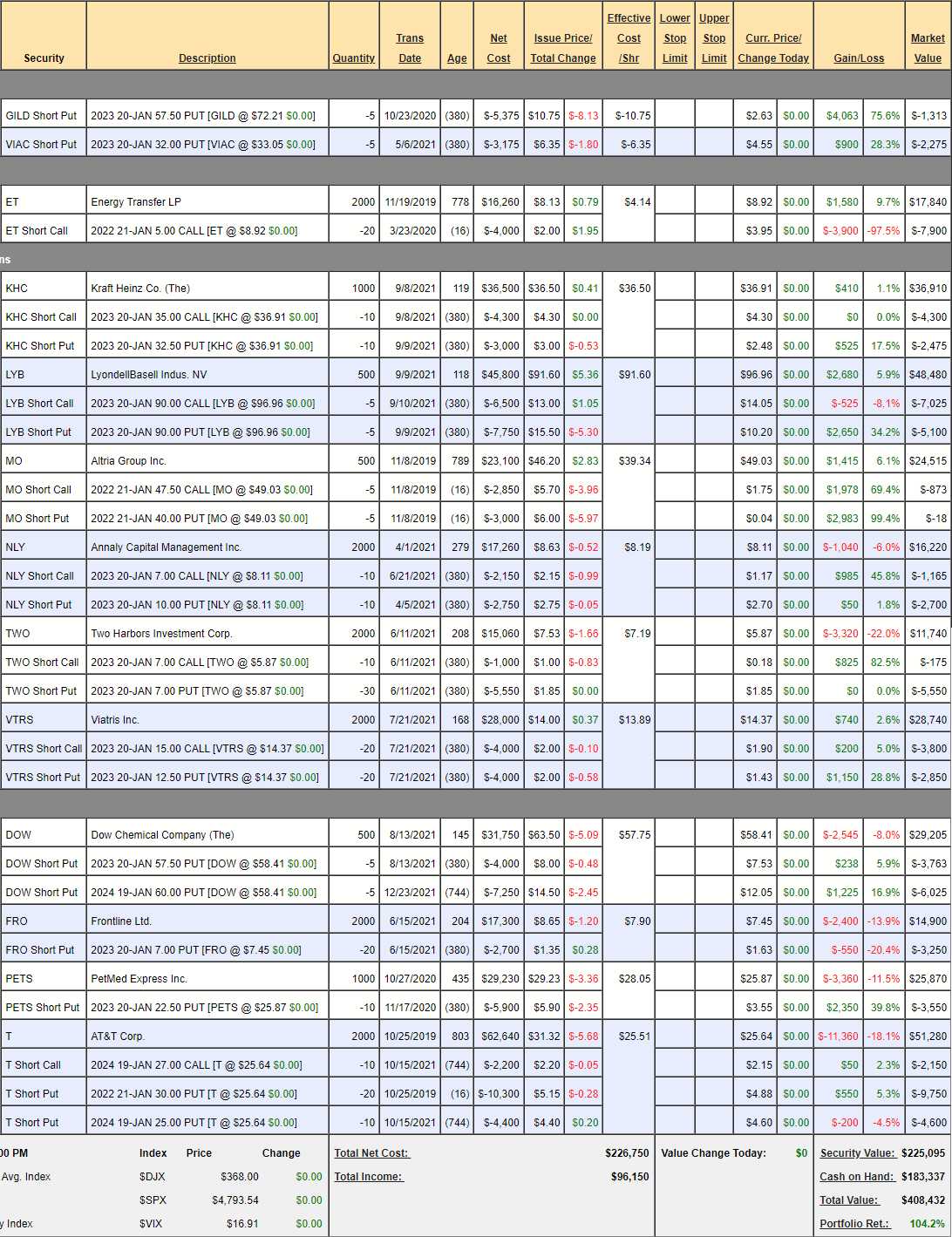

At PSW, we have a Dividend Portfolio which we reviewed for our Members on December 23rd and we only made 2 adjustments (closing out PFE and gettting more aggressive on DOW), as it's a very low-touch portfolio and, if we're doing it right, it shouldn't need to be touched as it's a very conservative portfolio. Generally we aim to make 30-40% a year and we started this one on 10/25/19 with $200,000 and we're up to $408,432 (up 104.2%) so far – a bit ahead of schedule.

Let's look at what we expect out of this portfolio, which is still conservatively 45% in CASH!!

- GLD – We expect the puts to expire worthless and we'll collect $1,313.

- VIAC – We expect the short puts to expire worthless and we'll collect $2,275.

- ET – We will get called away at $5 and collect net $10,000. The stock pays an 0.61 dividend so instead we can double down on the stock, spending $17,840 for 2,000 more shares and we'll sell 20 2024 $7 puts for $1.35 ($2,700) and we'll roll the 20 short Jan $5 calls at $3.95 ($7,900) to 40 short 2024 $7 calls at $2.60 ($10,400) so we're spending net $12,640 and now we get called away in 2024 at $28,000 instead of $10,000 now and, while we wait, we collect $2,440/yr in dividends. Our total expected profits are ($28,000 + $4,880) – $22,640 = $10,420 (46%) over 2 years.

- KHC – On track for the full $35,000 and currently net $30,135 and we will collect $3,200 in dividends (2 years) and sell more puts and calls when these expire (1 year) but let's conservatively call it $8,065 (26.7%) expected.

- LYB – Over target already so we expect the full $45,000 and currently net $36,355 so $8,645 + $4,520 in dividends is $13,165 (36.2%) plus more from new puts and calls we sell.

Keep in mind, by the way, that these expections are from maturing trades – our cost basis is actually quite a bit lower, we're including profits to date in the current price so, of course they seem a little tame. The main point is we started with $200,000 2 years ago and these are our current forward expectations. This kind of planning works well for retirement portfolios.

- MO – Was a Trade of the Year runnner-up last month so we know we like them. A bit over our target with the short puts and calls expiring with nice profits is perfect for us. In this case we can see we haven't touched this trade at all in two years and we started with net $17,250 and we collected $3,600 (20.8%) and, if we let ourselves get called away at $47.50 ($23,750), we'd close out with a net profit of $10,100 (58.5%) but instead we're going to take the Jan $47.50 calls at $1.75 ($875) and roll them to the 2024 $50 calls at $4.50 ($2,250) and we'll sell 5 of the 2024 $45 puts for $6 ($3,000) so we're lowered our basis to $12,000 and we'll collect another $3,600 (30%) in dividends and get called away at $25,000 for a $15,600 (130%) total profit from our actual start.

- As noted above, we count the current net of $23,624, then we sell the puts and calls for net (because of the roll) $4,377 and we'll still collect $3,600 in dividends so the basis will be net $15,647 with $15,600 (99.7%) expected.

- NLY – Another one we'll want to keep but essentially on track at net $12,355 with a whopping $3,520 (28.5% over 2 years) in dividends to be collected while we wait to be called away for $14,000 so $5,165 (41.8% upside potential). Again, keep in mind we will roll the calls, hopefully to a higher strike and sell more puts so it gets better next January but we're keeping it simple and only counting what's on the table now.

- TWO – Another fun REIT. This one is underperforming at net $6,015 but what do we care as long as they keep paying their 0.17 ($340) quarterly dividend? That's 5% PER QUARTER while we wait! We're aggressive here with 30 short puts and only a 1/2 cover – waiting for a recovery. Let's assume we're all called away at $7 and that's $14,000 + $2,720 in dividends into 2024 for an upside potential of $10,705 (177%). Eventually we'll cover the remaining 1,000 shares and roll the short puts – which will bring in even more money!

- VTRS – Right on track for $30,000 and currently net $22,090 and $1,760 in dividends is $9,670 (43.7%) in upside potential.

- DOW – Just got more aggressive with them, buying back the short calls. Too soon to cover them so have to speculate here that we WILL sell the 2024 $65 calls, which are now $6.50 with an 0.42 Delta, for $8 ($4,000) which brings our "current" net down to $15,417 on the $32,500 spread plus $2,800 in rock-solid dividends gives us $19,883 (129%) of upside potential.

- FRO – Coming back a bit and we're aggressive on these. Contracts only go out a year so let's say we sell the 2023 $7 calls (now $1.65) for $2.50 ($5,000). That would knock our net down to $6,650 so called away at $14,000 has a $7,350 upside potential and they currently don't pay dividends – but I think they will restart, which is why they are here. People don't understand that, if they don't pay the dividend – they'll start piling up cash and look even more attractive.

- PETS – Also aggressive at net $22,320 and I'd like to sell 2024 $35 calls, now $3.30 with an 0.38 Delta for about $6 ($6,000) at $32.50 and that would drop our net to $16,320 called away at $35,000 + $2,400 in dividends is $21,080 (129%) upside potential.

- T – I was so tempted to buy more at $22 but we already had $50,000 worth. Sad now. Current net is $34,780 and called away at $27 would be $54,000 plus $4,160 of the most reliable dividends on the planet oops, and we're only half covered so hopefully we'll collect another $2,000 selling the 2024 $30s (now $1.40) and that would be $25,380 (73%) upside potential at $30.

So we have a total of $150,071 of upside potential and plenty of CASH!!! in hand to add new trades so we're right where we want to be starting the new year. See how 13 very boring, low-risk trades can add up to fantastic returns – without all that stressful, constant trading…

This is supposed to be fun, not a job!