By Jacob Wolinsky. Originally published at ValueWalk.

Symmetry Invest A/S commentary for the second half ended December 31, 2021.

Q3 2021 hedge fund letters, conferences and more

In this newsletter, we will be looking more into the subject of an “emerging manager” and how I have used a performance coach to improve everyday life.

H2 2021

As always, returns and portfolio updates are sent to shareholders on a monthly basis through the website.

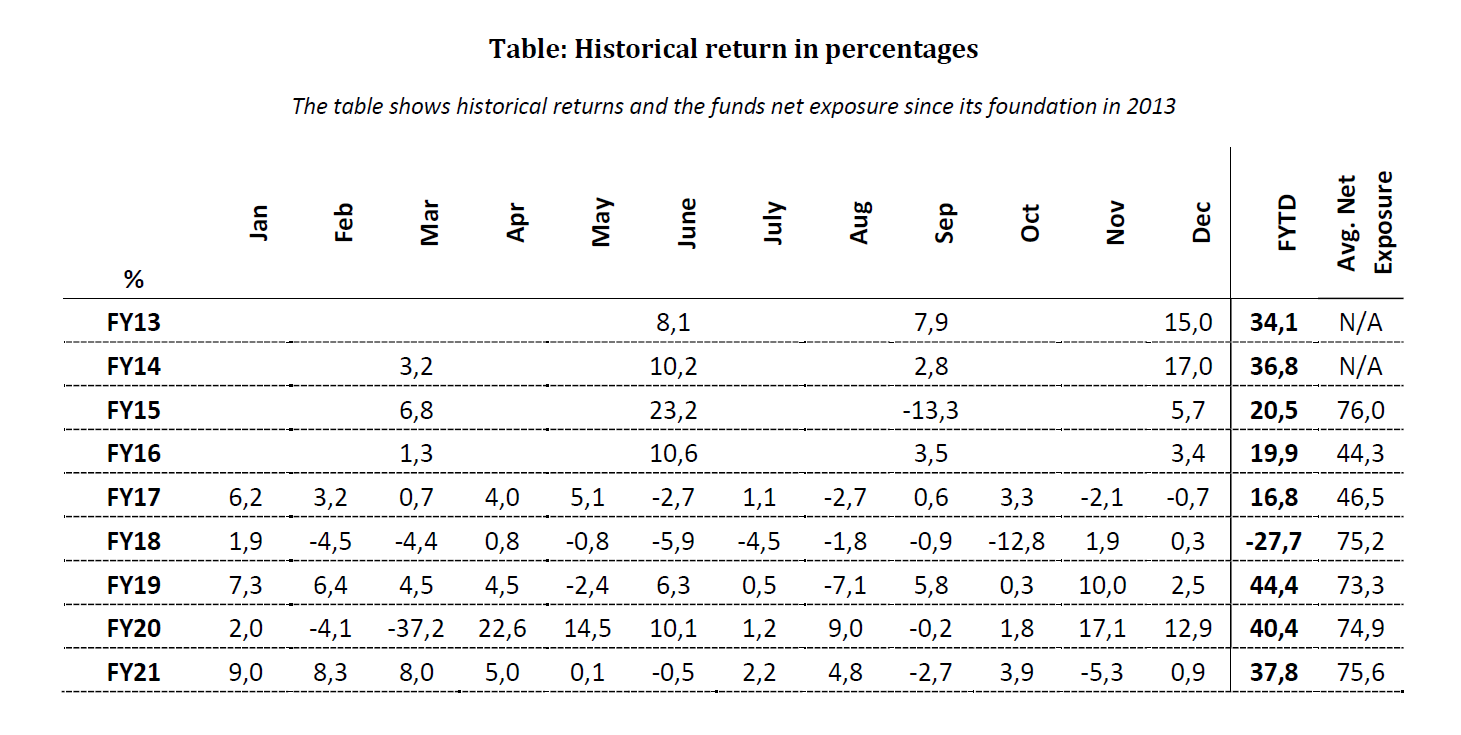

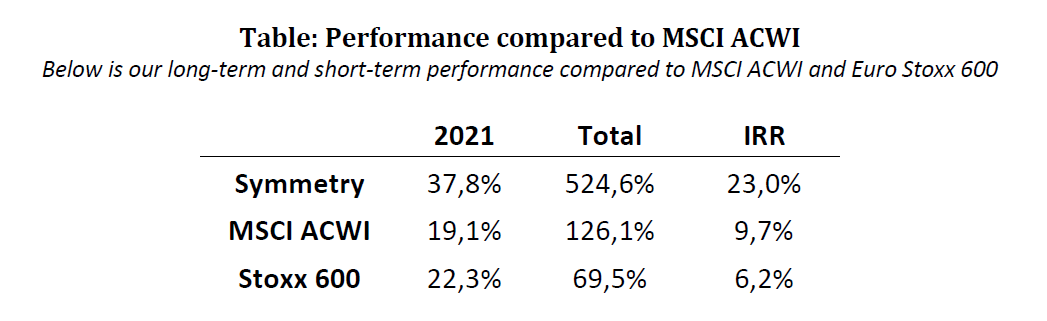

Overall, Symmetry had a really good 2021 where we, once again, beat the market and created good risk-adjusted returns. It was a year that felt easy in the sense that we had many no-brainers in our portfolio, while Q4, on the other hand, was very volatile and hard to navigate in various sectors. Many of our industry colleagues had their returns completely eroded in November/December, and several of them ended the year in the red. We also experienced our fair share of problems in parts of the portfolio, but on the whole we did well. In our Q2 2020 Newsletter I reviewed the concept of our ”all-weather portfolio”. In 2020 Symmetry benefited from our exposure to e-commerce, technology and gambling stocks, which rose significantly and aided our performance greatly. This year, however, these stocks have been negative contributors while insurance (Protector) and real estate (Catella) have acted as positive contributors. This is fully in line with our long-term strategy. We will never be the fund that produces the highest returns in any given year, but rather we strive to have a diversified portfolio across different sectors, factors and geographies. As we are both long and short, we have the ability to perform under most market conditions.

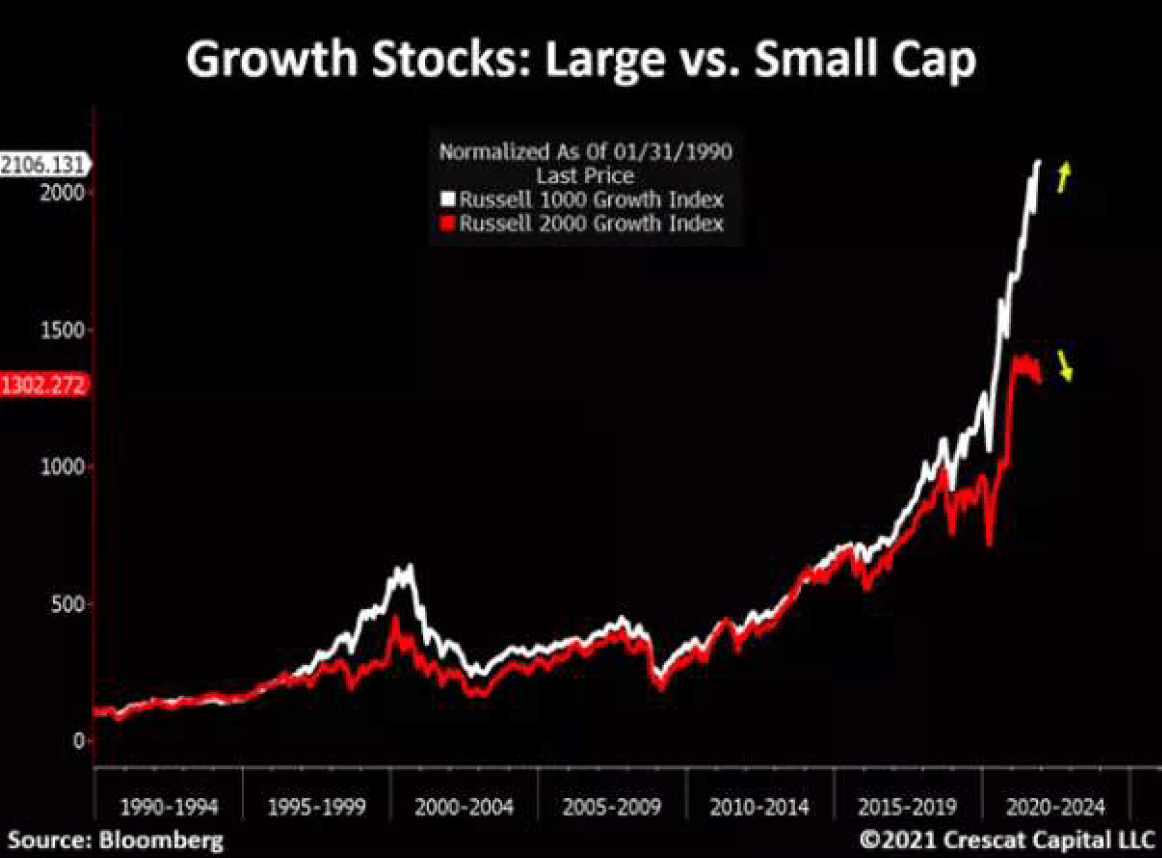

However, one of the factors we can’t protect ourselves from is the large cap vs small cap fluctuations. Symmetry is a small and mid cap fund with the ability to have a maximum of 20% of our capital in large cap firms. Historically, our small and mid cap exposure has been more to the tune of 80-95%. One of the trends we have seen over the last 6 months is the outperformance of large cap vs. small cap.

We have observed this trend in most markets where we have exposure, with large rotations out of small and into large shares. These large shares are also what are driving the direction of the major indices around the world.

The US small cap index Russel 2000 is “only” up 13% YTD in 2021, and as can be seen in the above graph, all of which was achieved in January and February, while the rest of the year was flat.

This applies to most stock markets. The majority of the returns made in the large indices this year are driven by a handful of companies where Symmetry, given our investment mandate, has no allocation.

Fortunately, we view this as a temporary trend. The largest mega cap shares now have a valuation that is completely unreasonable, relative to the small and midcap market that we focus on.

We believe 2022 will provide many opportunities for active stock picking.

Why Is It Favorable To Be An Emerging Manager?

One of the concepts that have come to annoy me lately is “emerging manager”. The concept is often used to describe a young up-and-coming fund manager. The concept of emerging is therefore not wrong in and of itself, but the problem is how it’s being used. In my opinion, all managers that are not emerging are in “liquidation”. The investment industry isn’t one where you can acquire a set of skills and then rely on them forever. If you are not constantly evolving, others will overtake you. In these semi-annual letters I will try to explain how we at Symmetry constantly are working on bettering ourselves so that, hopefully, others can utilize some of our experiences.

Why Should One Be Unique?

One of the most common questions I get from potential investors in the fund is “what makes you unique”? Early on, as a young manager, I often tried to explain how we operate in a small, uncrowded niche and that we have a longer time horizon etc. But over time, I have come to accept that you do not have to be unique. You do not have to have some special niche, the best data, the right segment, etc. It is not like in medicine, technology or industrials where you can invent a unique product and live well from this for many years to come. Investing is about constantly getting a little better. One of the best investor letters I have read in a long time was “Worm Capital Q3 2021” which reviewed how “aggregation of marginal gains” provides a lasting advantage. How to do this in practice? You read Warren Buffet, Charlie Munger, Joel Greenblatt etc., and while you should not strive to become the next Warren Buffet, make sure to learn from the best and find your own way. Make sure to constantly optimize your “pattern recognition skills”, learn to manage your emotions and work with your analytical skills. Today, when my investors ask me what makes us unique, I answer that we go to work every day with the goal of becoming a little better than we were yesterday. But the fact is that one does not have to be unique or be the best. The investment industry is not a zero-sum game. If you are just among the top 10% of all investors, you will do unbelievably well.

Using A Performance Coach

As mentioned in the previous newsletters, one of the things I spend time on is making sure to constantly be the best version of myself. As mentioned in H1 2020, it can be about getting optimal sleep or, as mentioned in H1 2021, optimizing one’s work habits. Another thing I have done over the past six months is increase the use of a performance coach (I owe Brad Hathaway of Far View Capital a big thank you for the idea). A performance coach helps one to be the best version of oneself, both as an investor and fund manager but also as a parent, spouse and human being in general. When you mention the word performance coach, there are probably many who picture something like this.

The reality is a bit different!

As mentioned in previous newsletters, the investment world is one of the most fantastic industries to work in. Every day you learn something new and you get to meet many interesting people. But it is also an industry that is emotionally and mentally demanding if not handled properly. Symmetry has expanded rapidly in recent years, going from 1 to 4 employees and from 100 to +500 million DKK in assets. As a fund manager, you are ultimately responsible for other people’s money and our investors show us confidence by investing their money with us. I think most managers would lie if they did not say it can be hard from time to time. When you perform poorly you are afraid of he reaction of your investors and when you perform well you are afraid that they will get too high expectations. The feeling and fear of disappointment are constantly present. When you have to be a husband and father of 3 children at the same time, it is important to be able to control this. A performance coach can help you control and understand your emotions, making sure that you are always balanced and well-considered, that you know when you are in the throes of your emotions and need to take a step back as well as make sure that you can separate things and be the best version of yourself, whether you are on work or are at home.

I highly recommend this to other fund managers. For those interested, I suggest the book “Trillion Dollar Coach” which deals with how Bill Campbell as a performance coach helped the CEO’s of Apple, Google, etc., to be become better leaders.

News From The Portfolio

As always, we will provide a longer review of our portfolio in our annual investor letter, which will be published at the end of March. We will therefore make our comments in this newsletter more sporadic.

A good acquaintance of mine runs an investment fund in the U.S. with great success. One of the things he is super good at is multiple arbitrage. He has an amazing ability to find stocks that trade at P/E 12 but should trade at P/E 16. The underlying intrinsic value of the stocks might increase by 10% annually, but because he has often been able to achieve this multiple arbitrage within 6-12 months, he has managed to deliver +20% annual return. He can buy a stock at P/E 12 and when it rises 30% to P/E 16 he is out again and into a new stock.

Symmetry’s strategy has many similarities, but we operate with a longer time horizon. Instead of finding stocks that can deliver 30% in 6-12 months, we look for those who can deliver 3-5x in 3-5 years. Our stocks often increase in intrinsic value by 20-30% annually, and on top of that we try to achieve multiple expansion during our holding period.

The downside of our strategy compared to my US counterpart is that it is far harder for us to find stocks for our portfolio than it is for him. There are just far more stocks in his universe and therefore he can make a lot of money by having a high turnover in his portfolio. The advantage of our strategy, on the other hand, is that once we find the right shares, we have a multi-year time horizon where we can benefit from high returns from the shares.

This leads us on to our 3 best investments in 2021: Franklin Covey (104%), JDC Group (171%) and Protector Insurance (90%). Franklin Covey and Protector were 2 of our biggest holdings when we started the year and JDC was acquired in February-April. Of course, it is reasonable to think that the upside is exhausted in the shares because they have performed so well in 2021. We disagree with this. Therefore, the 3 shares are still our 3 largest shares in the portfolio. As mentioned above, we only make a few investments per year. But when we find stocks that perform, it is our job to hold them until the full potential is exhausted. We still believe all 3 stocks have +100% upside going into 2022.

JDC

It makes no sense to look at where JDC Group AG (ETR:JDC) has come from to predict where they are going. 2021 ended up being a transformative year for JDC, which has set the company up for a long-term growth period that the market still does not recognize. When JDC announced a deal with Provinzial in February, the stock rose 40-50%. But the deal itself would more than double revenue and multiply earnings. When JDC later this year announced an even bigger deal with VKB, the share rose 20%. It is understandable that the market is having a hard time grasping the extent of what JDC is facing in the coming years. We’ve done our part to explain it: JDC_2021_09_29. If you look at the valuation in isolation, JDC is trading at around 1.7x revenue and 20x EBITDA on our 2022 estimates. It might therefore not look like a stock with huge potential. But if you dig a bit deeper, you will find that JDC will roll out +200 savings banks throughout the year. All of these will only start to take full effect from 2023-2024. JDC has announced an estimated effect of 100 million in annual income at Provinzial and at least the same at VKB. We peg a +95% probability that they will also win the remaining savings bank which will land an annual turnover in the amount of 300 million EUR from all savings banks. This is to be compared with JDC’s current turnover of around EUR 145 million which currently grows 15- 20% organically without contributions from these savings banks. But it is also worth noting what the EUR 300 million estimate is based on. This includes a penetration of only 10% of the customers in the individual savings banks and approx. 2 contracts per customer. But if you look at their other customers, they have approx. 5 contracts per customer. In addition, you can also judge whether 10% penetration is too low, since customers are offered a free product (they can save money), on which they can get better service and better overview. We think there is a high probability that JDC can achieve a turnover of over EUR 1 billion within 4-5 years which will be close to 10x the current one. Combined with rising margins and an increased multiple, we still see huge potential in JDC.

Franklin Covey

Franklin Covey Co. (NYSE:FC) has had a fantastic year. Their subscription business is really starting to gain traction and the market is starting to understand the strong underlying unit economics FC has, which we wrote about in the spring: FC. Franklin Covey wins because they have a product and content that makes sense. They solve critical challenges and must-win battles at companies. Some of the biggest challenges companies currently are facing are bias, inclusion, diversity and sustainability in the workplace. FC is still at a very early stage after their transformation to become a subscription company. We have seen this play out many times before at other companies. Once the flywheel and unit economics are up and running, there is a long road of returns ahead of us. If you look at FC, the stock is still only trading at an EV/Sales multiple of around 2x. It is absurdly cheap for a cash flow positive company with super unit economics that grows 20-30% with sustained recurring revenues and multi-year contractual relationships to back it up. If you look at an FCF multiple, FC is still only trading at 18-20x FCF on this year’s figures. FC will grow cash flow by 30-50% annually in the coming years, in line with their high flow-through, and is trading at only approx. 10x FCF a few years into the future.

Protector Insurance

For many, Protector Forsikring ASA (FRA:PR4) is a simple company. An insurance company that sells through brokers with low costs and low prices and thus continuously takes market share. If you dig deeper, however, you will understand the magic that takes place. The company’s founder Sverre Bjerkeli resigned this year after 15 years at the helm.

Fortunately, he has left the company in good stead. His 3 young “heirs” Henrik (CEO), Hans (Deputy CEO) and Dag Marius (CIO) all have Protector blood in their veins and understand the company’s culture in depth. If you listen to the analysts, they think the share is worth 130-140 NOK as they believe the company’s growth and investment results will be in line with the industry in the coming years. However, looking at their historical growth of 20% annually and their investment results, it has been significantly above market. Investors trying to fully understand Protector will be much better off underwriting higher growth and return on investment going forward. Even if we use market returns for the future, the stock is trading at a P/E around 8-9x. Adjusting for their high overcapitalization, we are down to around 6-7 in P/E.

I had a chat with another great manager about the stock. He thought it was impossible to underwrite the capability of the CIO and therefore one needed to use market returns in their assumptions going forward. My feedback was if he thought it was impossible to underwrite the CIO of Protector how should the investors have any ability to underwrite him. To me its more about laziness if one are not willing to do it. It’s the same as trying to value a high growth company with a 3-year DCF model without spending any real due diligence on the longevity of the growth. To make a fair assessment of Protector one need to fairly evaluate the CIO. We did an interview him recently: Protector CIO. To us there is 3 main areas to judge:

1) Historical returns 2) How returns are created 3) Long term strategic thinking

The historical returns are significantly ahead of the market both on stocks and bonds. We will look deeper into this in our annual letter. Another great area with Protector is that they disclose their equity book yearly in their annual report. Its then quite easily to see how the returns have been created. In our view they have been made the right way without excess risk taking. The last part is to just the emotional stability and long-term thinking. We can then look at how they in the history took risk off the book in great times and was extremely aggressive during Covid when everyone else was panicking. On the equity book they only had 2 bad years (2018-2019). We can see how they made some mistakes and managed to correct those and adjust the strategy. On the overall level we have a great view of them and think can outperform also in the future. If they even get close to their historical investment return, we are talking 4-5x in P/E. Despite the rise of the shares in 2021, we are still very optimistic about the future. Protector can pass on all inflation directly to customers and will at the same time have the benefits of higher interest rates.

We wish you all a happy 2022.

Updated on

Sign up for ValueWalk’s free newsletter here.