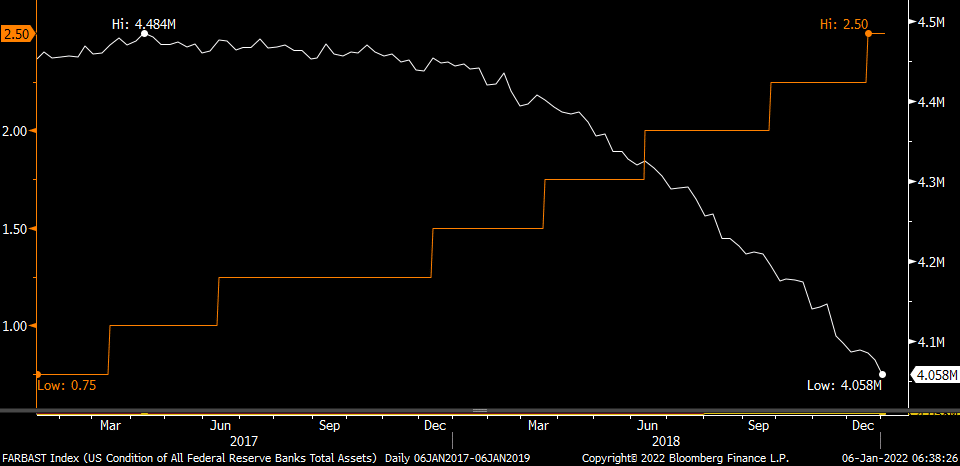

Here’s what happened the last time the Fed attempted to shrink its balance sheet and hike rates simultaneously

Courtesy of Joshua M Brown

Here’s what happened the last time the Fed attempted to shrink its balance and hike rates simultaneously…

Chart via Peter Boockvar, a throwback to 2018:

It was a disaster. That white line you see if the Fed allowing bonds to “run off” or mature without replacing them with more bonds. This is a shrinking of its balance sheet or what has been termed by others as Quantitative Tightening (QT).

Two separate major corrections occurred that year, culminating with a nasty 20% crash into Christmas Eve which finally forced the Fed to say “Okay, just kidding. Not only are we not raising rates anymore, actually, the next few moves will be cuts. Merry Christmas, we’re sorry.” I’m paraphrasing, but that’s literally what happened. The Fed had gotten up to 2.5% Fed Funds (orange line) and both the stock and bond market called “Bullshit!” on them – meaning, the economic growth story was no longer being bought. By Q3 2019 the yield curve had inverted and in 2020 we were maybe on track for a recession, with or without Covid.

You forget how f***ed up and counterproductive the stupid trade war with China was and the real economic damage of all those tariffs. Pre-Covid, Trump was bailing out his beloved farmers and steelworkers left and right because of his own misguided nonsense policies. I bumped into White House Chief Economic Advisor Larry Kudlow in an NBC greenroom that year – even he couldn’t defend this shit off-camera.

Anyway, putting the balance sheet into run-off while concurrently hiking rates at every meeting was a bad idea in that environment. Not only did it not help the Fed achieve its dual mandate of full employment / stable prices, it actually worked against everyone’s interests. Which is why that hiking cycle had to be unraveled just a few months later.

And now, four years later, there are people who want to tell you that the Fed is anxious to repeat this experiment? Lift-off in rates while simultaneously shrinking its balance sheet and tightening financial conditions, upending stocks and bonds while it seeks to normalize policy. With Omicron running circles around the CDC and local governments? Yeah, okay. That’s a dumb f***ing bet. Powell is smart.

If you got spooked by the Fed Minutes this week, where one or two members were sort of maybe discussing the possibility of run off, it’s understandable. A lot of very serious, very (self-) important people were doing TV hits actually taking this scenario seriously. Don’t.

The reality is that these bond buying programs should have been tapered this past summer and fall as home prices and stock prices and retail sales were exploding higher. Many of us had been shouting this from the rooftops. The sooner they stop stimulating the market, the better. But they’re not looking to go so fast as to repeat the mistakes of 2018. Why would they? Where is the gun to their heads?

I’ll give Peter the last word here:

Is it even worth having the discussion now about a shrinkage in the Fed’s balance sheet while they are still growing it into March? No. The minutes said ‘some’ talked about this, not ‘several.’ Is the Fed going to repeat 2018 when they were hiking rates and letting the balance sheet run off at the same time? Doubtful.