By Jacob Wolinsky. Originally published at ValueWalk.

SVN Capital Fund’s letter for the year ended December 31, 2021, discussing their new position in Dino Polska SA (WSE:DNP) and a short attack on Evolution AB (STO:EVO).

Q3 2021 hedge fund letters, conferences and more

Dear Partner,

SVN Capital Fund’s portfolio returned +23.60% gross and +21.09% net of all fees (subject to audit) for the year 2021. Your return will be different depending upon when you invested.

In the following pages, I will walk you through changes to the portfolio (which are not significant), the portfolio composition and description of high-quality businesses, a short attack on Evolution AB, and market musings. Before I get started with the portfolio, please allow me to digress a bit to talk about the power of patience unleashed by the Oracle of Buffalo.

The Oracle of Buffalo

While pursuing my research on a Polish company, I came across a book titled “The Oracle of Buffalo.” I decided to dig in, and I am glad I did. A lot of us have heard of the Oracle of Omaha (Warren Buffett). Who hasn’t? But have you heard of the Oracle of Buffalo? Stephanie Mucha of Buffalo, NY is that oracle. I believe she was just as financially savvy as the one in Omaha.

So, what was her background? Stephanie was born into abject poverty. Born in 1917 to Polish immigrants Antoni Niciszewski and Mary Strenk, she was one of seven children. After dropping out of high school, she worked as a maid and then at Buffalo Veterans Medical Center for 44 years as a nurse until she retired in 1994. She got married to Joseph Mucha, a Polish immigrant who was 26 years older than she. By the time Joseph died in 1985, the frugal couple had managed to amass a net worth of approximately $469,000.

As a practicing nurse at a VA hospital, she happened to come across many interesting products in the medical field. Occasionally, if she thought a particular product was promising, she would do some research, check the periodicals for any reviews, and talk to her friends and get their opinions before buying some shares in the company.

One day in 1961, she came back from work and told her husband that she saw a dead dog come to life. What she had seen was a demonstration of the first implantable cardiac pacemaker by Medtronic (MDT). Joseph and Stephanie Mucha bought 50 shares of Medtronic at $5.11 per share for a total of $255.50. And here is the kicker…In 2007, when she donated a portion of the shares, she had 8,500 shares as a result of stock splits and dividend reinvestments at $66.00/share for a total of $561,000. A small investment of $255.50 had grown at 2,200x over 46 years.

She bought shares of Pfizer, Merck, Abbott, Johnson & Johnson, Bayer, and GlaxoSmithkline and unleashed the magic of patiently compounding her capital resulting in $3.0 million by 2007. By the time she died in 2018 at the age of 101, she had become a successful philanthropist, giving away approximately $6.0 million to some of her favorite causes and institutions.

What was the secret to her success? It was a combination of frugal living and a unique approach to investing—buying stocks of certain businesses whose products she liked and sitting on them…for decades. I too intend to unleash such patience on our portfolio.

Stephanie’s investment style resonated well with me. A patient, long-term approach is one of my core tenets at SVN Capital. I look to buy and hold a select few publicly traded businesses that meet the following four investment criteria—businesses that:

- I understand;

- not only generate a healthy return on incremental capital but also have great reinvestment opportunities;

- are run by honest and competent management teams with “skin in the game;” and

- are trading at a reasonable valuation.

Dino Polska S.A. (“Dino”) – A New Investment

The only new investment I made in the second half of 2021 was Dino Polska SA (WSE:DNP), a grocery chain in Poland. In September 2021, I wrote about Dino, which you can find here.

One of the unique aspects of our fund is the ability to invest in great businesses around the world. While Poland is a former communist country, it has grown at a steady 4.0% or so over the last 30 years to be the sixth largest economy in the EU. And yet, unlike other fast-growing countries, rural areas of Poland are not emptying into the cities. The urbanization rate in Poland is low compared to other developed and fast-growing countries. Almost 60% of the population of ~40 million live in rural areas and small towns with less than 50,000 people. This statistic works wonderfully for Dino, which focuses on rural areas.

In determining the quality of a business, one of the important areas I focus on is its competitive strength. Strong and durable competitive strength is what helps a business defer the common ailment of “reversion-to-the-mean” returns that most businesses face. While there are a number of local and foreign grocery chains in Poland, most of them focus on big towns and cities where they fight ferociously for consumers, while Dino’s sole focus is on small towns and villages catering to a catchment area of 3,000 to 5,000 people per store. With only four stores per 100,000 people across the country, I believe the company can easily double its current store base of 1,700 by 2025.

Such durable growth managed by a competent team with skin in the game, that has decided to reinvest all its free cash flow back into growing its store base, makes Dino a unique investment opportunity. For further details click the link above.

Portfolio

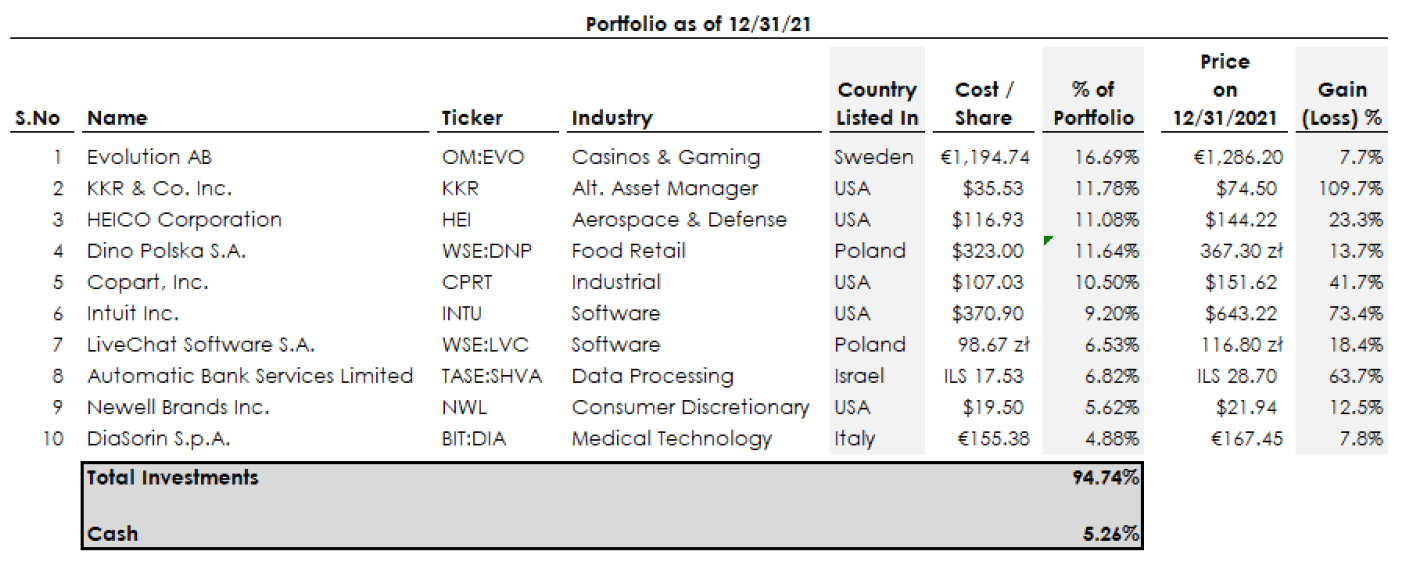

We currently own 10 investments. Cash is approximately 5.3%. A snapshot of the portfolio as of 12/31/21 is in Appendix I.

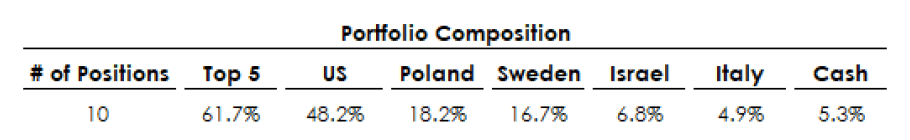

The top five holdings account for approximately 62% of the portfolio. Our portfolio is concentrated and geographically diversified. 48% of our portfolio is listed in the US, while the rest is spread among Poland, Sweden, Israel, and Italy. Here is a look at portfolio composition:

Of course, what matters is not where these companies are listed, but where they generate their revenue and incur costs. In aggregate, our portfolio companies generate approximately 50% of their revenue in North America, while the rest is geographically spread even more widely than the countries listed above.

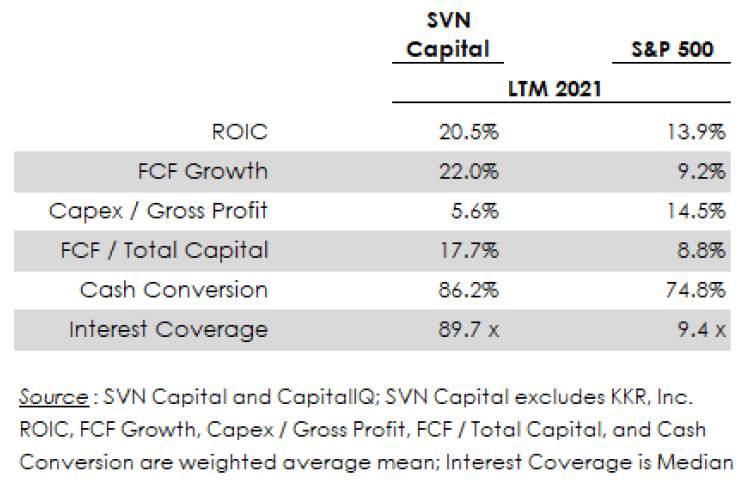

Our portfolio is a collection of high-quality businesses. These businesses are highly profitable and generate healthy free cash flow. I am not interested in money-losing, non-cash-generating businesses that may or may not become profitable in the future. But what exactly do I mean by high quality? While there are qualitative features—including dominant market shares, low-cost providers, and unique cultures—that many of our businesses possess, they also display powerful quantitative features. The following table lists some of the important metrics of our portfolio and the S&P 500 index, which is a good reflection of the overall market. Our portfolio metrics are materially better than the market.

Return on Invested Capital (ROIC) is the primary test of performance in managing a company. Not only do our businesses generate high returns on capital, but they also have terrific opportunities to reinvest in their own businesses. The combined effects of high returns and high reinvestment rate over a long stretch of time leads to significant growth in intrinsic value.

Over a period of time, free cash flow growth will drive market value growth. Healthy free cash flow growth is also a great gauge of corporate health. FCF growth of our portfolio is almost twice that of the S&P 500 index.

High capital intensity raises the operating leverage of a business which amplifies profitability swings, leading to low and volatile returns. As such, low capital intensity (capital expenditure/gross profit) and high capital efficiency (FCF/total capital) are the other hallmarks of high-quality businesses. The capital intensity of our portfolio is just about 1/3rd of the market’s. Also, the capital efficiency of our portfolio is about twice that of market’s.

The cash conversion ratio reveals the ability of a firm to convert its profits into cash. A high cash conversion rate shows the management’s ability to efficiently convert its profits into cash, as well as lend flexibility with respect to its use—reinvest in the business or return it back to shareholders or debtholders. Our businesses not only have high cash conversion rates, but also healthy reinvestment rates. The cash conversion rate of our portfolio is 84% vs. 75% for S&P 500 companies.

Finally, our collection of high-quality businesses carries low financial leverage. Since I look to own these investments for a long time, I prefer to own businesses that carry low financial debt, because the higher the financial leverage, the more volatile will be the returns over time. Debt/Equity of our portfolio is only 23%, while that of S&P 500 companies is much higher. Related to the level of debt is interest coverage, which shows the relationship between profits before interest and the interest charge. A high ratio suggests financial stability and flexibility at the same time. Interest coverage for our portfolio is almost 10 times that of S&P 500 companies.

So the final question is about valuation. The free cash flow yield (next year’s free cash flow/enterprise value), a primary valuation metric I use, of our portfolio is approximately 3.5%. Incidentally, the S&P 500, which is a good reflection of the overall market, is also trading at the same valuation. As I have shown above, our portfolio of businesses is fundamentally far better than the average; it generates more cash, is capital efficient, and carries little in terms of debt, yet it trades at a similar valuation as the market. I strongly believe that our portfolio is attractively priced.

A Short Attack on Evolution AB (EVO)

Thanksgiving week kicked off with fireworks. On November 19, 2021, after the market closed, an attorney in New Jersey, acting on behalf of the author or sponsor, released an anonymous 121-page short report on Evolution AB, one of our portfolio holdings (I first wrote about EVO here). If delivering shock and awe was the primary objective, then it was certainly accomplished. Within a matter of 10 trading days, the stock was down by 40%. Ouch! With EVO being the largest position in the portfolio, it hurt like a thumb on the receiving end of a slamming door—swift and sharp. EVO was also the primary reason for a tough November 2021 and a muted Q4 2021 performance. In this section, I will provide some background, my opinion, and what I did.

Allegations

Even though the anonymity of the report and the outlandishness of many allegations in it reduced the virility of the attack, it still packed a punch. Apparently, the report was sponsored by one of EVO’s US competitors. It had hired a player to covertly pierce the security infrastructure of the company with the sole intent of soiling the company’s reputation. Two allegations in particular, which can be found below, jolted the investors, some of whom took the shoot-first-and-ask-questions-later approach.

- EVO’s games can be accessed not only from jurisdictions that have made such games illegal (e.g., Singapore), but also from unsanctioned terror states that are banned by the US (e.g., Iran and Syria). It also alleged that EVO is aware of such transgressions, yet allows them to continue.

- Gaming regulators in New Jersey had been notified and, because of the seriousness of security lapses, they are likely to cancel EVO’s license to offer its games in New Jersey.

Background

Before I unpack the details, let me provide some context.

Evolution provides the entire infrastructure needed to run an online casino, particularly games with a live dealer. So, for example, when a customer of DraftKings based in one of the five states that currently allow online gambling (CT, MI, NJ, PA, and WV) wants to play blackjack or roulette with a live dealer, Evolution is the company making it happen in the background. Since it is an online game provider, it has online access blockers for preventing access from certain jurisdictions. However, the ultimate responsibility of executing such blocks lies with the operator (e.g., DraftKings).

Also, one of the biggest growth opportunities for the company is North America, particularly the US, where it is a dominant provider. While Nevada sets the regulatory tone for land-based casinos, within the US, New Jersey sets the tone for online casinos. So the possibility of New Jersey regulators punishing EVO and canceling its licenses caught the fancy of many investors and financial press, particularly in Sweden where it made the front pages of local newspapers.

Response….Sort Of

The speed at which false information was spreading reminded me of Mark Twain, who said, “A lie can travel halfway around the world before the truth puts on its shoes.” Beginning Monday, November 22, 2021, the stock promptly started sliding and picked up in ferocity as days progressed…with hardly any response from the company. Even though EVO was the largest position in the portfolio, I saw the weakness as an opportunity to buy more.

On November 24, 2021, the company released a one-page rebuttal of some of the allegations in the report. Apparently, the author of the report, from an undisclosed location, had accessed an internet address in Iran and had tried unsuccessfully to access Evolution’s games. However, at the same time, he accessed an internet address in Germany through which he was able to access Evolution’s games. After accessing the games, he then dropped the German internet address while keeping the Iranian address and recorded his playing activities…just for the sake of preparing this damning report. In fact, the 121-page report was loaded with murky pictures of similarly deceptive screen shots, intended to provide “proof” that Evolution games were being routinely accessed from illegal jurisdictions.

The one-pager also said that they work closely with the regulators to continuously improve its operations. The company had proactively reached out to the regulators in New Jersey and had initiated an internal review. In addition, the one-page rebuttal also said that EVO would hold a conference call.

While the release was helpful in clarifying some of the questions, it left many questions unanswered. So I thought the issues would be addressed during the conference call. To my utter disappointment, it was a 10-minute conversation between Carl Linton (head of IR) and Martin Carlesund (CEO), in which Carl lobbed some softball questions to which Martin responded by reading directly from the one-page press release. Further, the call was NOT open for Q&A which was clearly a mistake. The market saw management’s ambivalence as “where there is smoke, there must be fire,” and sent the stock down another 15% the next day. I bought some more EVO.

My Reaction

While I was disappointed with management’s insufficient one-page rebuttal and for not having opened up the call for Q&A, I agreed with them that the ultimate responsibility of allowing or disallowing a player lies with the operator. For a regulator to punish Evolution in such a situation would be akin to punishing Budweiser for a liquor store that sold beer to a minor who forged his identity.

I remained confident that Evolution was, is, and will be a dominant company in the online gaming industry. It is run by a competent management team, supervised by a board where the two original founders of the company sit. In spite of EVO being the largest position in the portfolio, my reaction was to buy more on the way down.

Mistakes Compound Too

Not having been exposed to the rough-and-tumble US-style capitalism, the management team was like a deer in front of fast-approaching lights—stunned. The management team’s naivete led to some mistakes, which then compounded shortly thereafter. For example, while it is common in the US to use an investment bank and/or PR firm to draft a response in similar situations, the management team naively decided to handle it with internal resources. In most circumstances, this decision may have been fine; but I believe, in this case, this mistake snowballed.

Not only did the decision lead them to not open the call for Q&A, but it manifested in the one-page release, as well. The last sentence in the release read, “An internal review has been initiated to ensure a swift response to any questions from the NJDGE [New Jersey Division of Gaming Enforcement].” To an American investor, the phrase “an internal review has been initiated…” means an acknowledgement of something wrong. What the company meant was, “we will make sure to respond in a timely fashion.” Too late. The damage had been done.

With respect to the relationship with regulators, the management team explained in great detail how the company is in regular contact with regulators around the world and how it complies with all regulator requests. While he didn’t want to speak for the regulators, he didn’t think there was any merit to the allegation that NJDGE is likely to punish the company. Having worked in a bank earlier in my career, I could relate to how the company would work hand in glove with the regulators to avoid any surprises. It would have been nice to hear this from the CEO of the company. Too bad they didn’t open the call for Q&A.

Response…V2

On December 2, 2021, by which time the stock had declined by approximately 40%, the company announced a Eur 200 million share repurchase program. This was the first real confidence booster from the management team. It helped stem the tide a bit.

Later in the week, Martin Carlesund sat down for a virtual fireside chat with the analyst from Morgan Stanley. Martin covered a wide range of topics including the regulatory landscape, unregulated markets, aggregators and operators, payments, and the share repurchase program. He was also excited about 2022, when EVO expects to release more games. I wish he had done this on November 24th when they first attempted to respond to the attack.

So, What Now?

Having realized their follies—not conducting a thorough Q&A session, not taking professional help in drafting a response to the short attack, and using a certain phrase in the press release that raised even more questions—the management team has been busy answering questions behind closed doors, calming fears. Also, the company repurchasing Eur 122 million of shares is another strong signal. The stock has recovered much of its early losses but is still approximately 15% lower than where it was on November 19th, before the short report was released.

While the company’s handling of the matter has left a lot to be desired, my confidence in the business model and the management team’s operating expertise remains high. In fact, having learned more about the regulatory landscape, my confidence has only increased. I am happy to have picked up some more shares of EVO during the height of the panic. Over the years, I am confident that this incident will prove to have been a great buying opportunity, and I expect to make many multiples on our investment in EVO.

As I wrap up this section, I am reminded of a comment by Charlie Munger who said, “…bear markets and drawdowns of 40–50% are the price of admission for being an investor and that everyone goes through it.” It is one of the important reasons why I focus on high-quality businesses; because, over time, they are better able to withstand such hits.

Market Musings

In the mid-year 2021 letter, I said, “Inflation is the current bugaboo as it relates to investing.” It continues to be so. In fact, as I write this letter, the financial media, with its deep commitment to scaring everyone out of the equity market, is pointing to how the Consumer Price Index (CPI) has soared 6.8% from a year earlier. The last time inflationary pressures were this high was in 1982. The question now seems to be not if inflation is here, but is inflation transitory, or is it here to stay.

Yes, the headline reads “inflation is at a 40-year high,” but is it here to stay? I am not so sure. While the stock market has been choppy, the bond market doesn’t seem to care much. For example, interest rates are still languishing around all-time lows, while they were almost at all time highs in 1982. Similarly, the USD is sending a different signal; if stagflation were imminent, the USD would be heading south…in a hurry. Yet, DXY, a fund that tracks the USD, recently hit a 16-month high.

I am convinced that the economy cannot be consistently forecast, nor the markets consistently timed. Therefore, I believe that the only reliable way to capture the full long-term return of equities is to ride out their frequent but temporary declines.

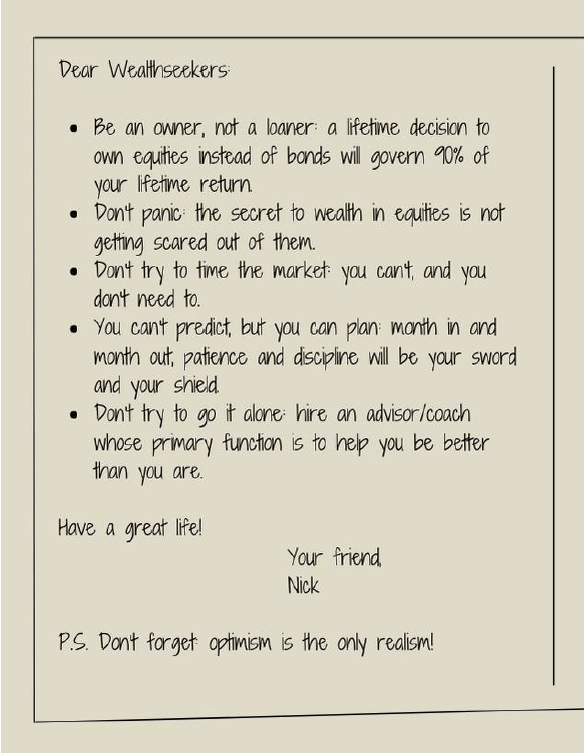

As I look back at 2021, and particularly the volatile last few months due to inflation fears, or the new variant of COVID-19, I am reminded of a wonderful book by Nick Murray, “Simple Wealth, Inevitable Wealth.” In it he captures the essence of the book and his investment philosophy in a postcard, part of which I have reproduced below. It succinctly captures my investment philosophy at SVN Capital, as well, particularly #2, “Don’t panic: the secret to wealth in equities is not getting scared out of them.”

I am optimistic about the future and excited about our portfolio of businesses. I continue to remain patient and invest with a long time horizon.

As I look forward to 2022, I am reminded of G. K. Chesterton, who said, “I would maintain that thanks are the highest form of thought, and that gratitude is happiness doubled by wonder.” It is a privilege to serve you. Thank you.

Sincerely,

Shreekkanth (“Shree”) Viswanathan

Updated on

Sign up for ValueWalk’s free newsletter here.