Bear Markets Suck

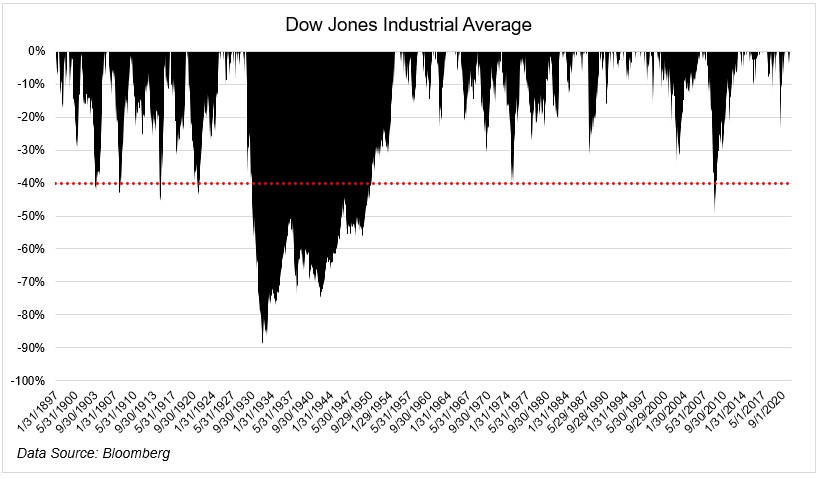

Courtesy of Michael Batnick

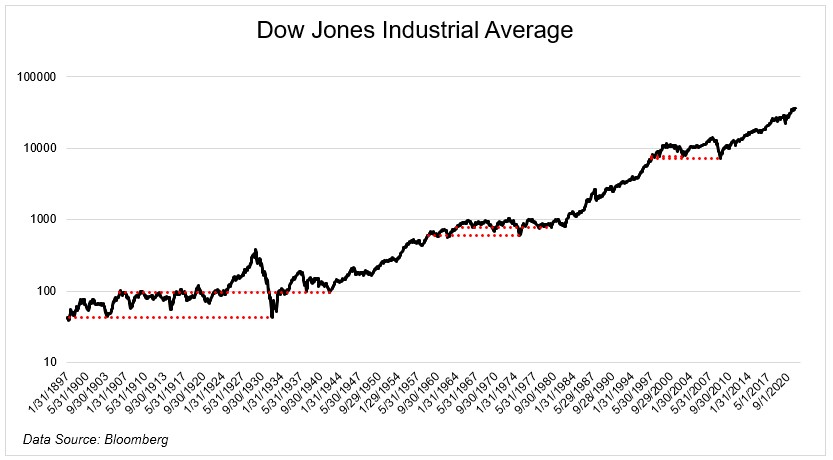

Courtesy of Michael Batnick

U.S. stocks have compounded at an annual rate of 10.4% from 1926-today. If this was the only information you had, then there would be only one logical thing to do; Buy an index fund, and never, ever sell.

Jeremy Siegel once said, “Fear has a far greater grasp on human action than the impressive weight of historical evidence.” I think this is mostly right, but doesn’t give enough consideration to the fact that bear markets really, really suck.

On Animal Spirits, Ben and I wondered if people spend too much time worrying about worst-case scenarios. I think they do, but for good reason. First, some data.

Bear markets are part of investing. Ya know, the whole risk and reward thing. Going all the way back to 1897, the Dow was in a 20% drawdown 33% of the time. But a lot of this is skewed by The Great Depression. From 1897 through 1950, the market was in a 20% drawdown 58% of the time! If we start from 1950, that number collapses to 16.5%.

But a 20% decline should hardly be enough to strike fear into a long-term investor. When you’re down 20% you start to get nervous, at 30% you start to lose sleep, at 40% you hit eject.*

So how many of these nightmare markets have U.S. investors experienced? Not many. Since 1950, the market fell 40% three times; 1974, 2002**, and 2009.

So why all the fuss? Because a bear market can wipe out years worth of gains. YEARS.

- At the bottom in 1932, the Dow was back where it was in 1903

- At the bottom in 1942, the Dow was back where it was in 1905

- At the bottom in 1974, the Dow was back where it was in 1959.

- At the bottom in 1980, the Dow was back where it was in 1964

- At the bottom in 2002, the Dow was back where it was in 1997

- At the bottom in 2009, the Dow was back where it was in 1997

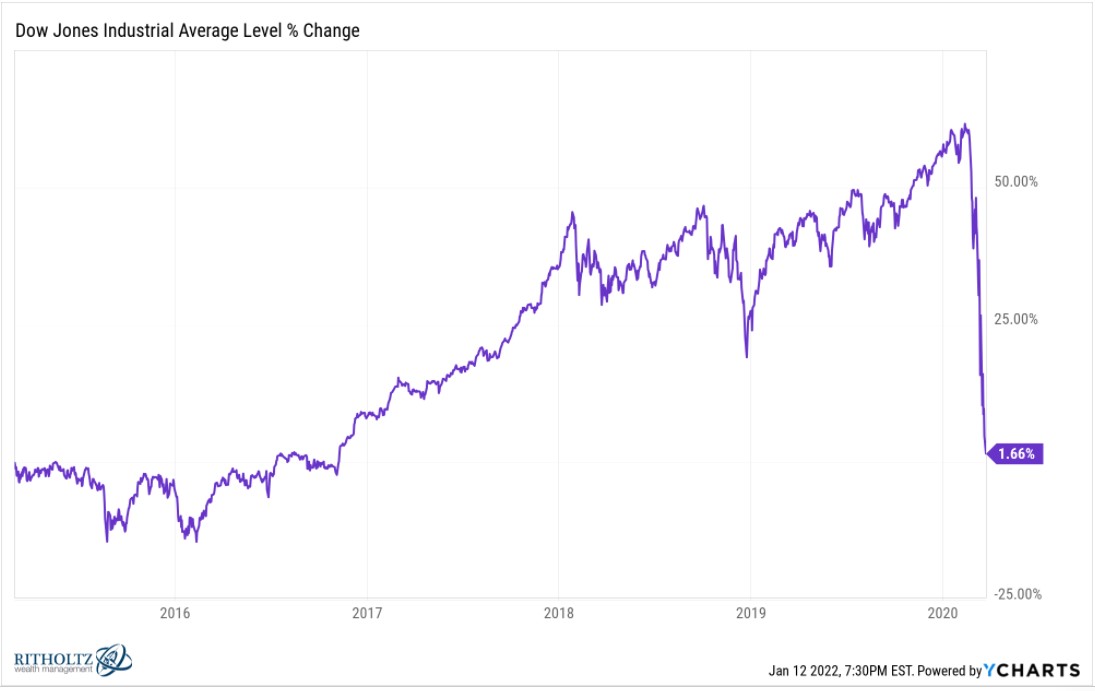

The pandemic bear market only lasted a minute, but at the bottom in 2020, the Dow was trading at the same levels it was at in March 2015!***

A bear market doesn’t just wipe out gains, it will almost assuredly wipe out your confidence in a brighter future. I’m a stocks for the long run kind of guy, but I’m pretty sure I’d sing a different tune if I experience a bear market that wipes out 15 years worth of gains, and takes another couple of years to recover.

I understand why people spend so much time preparing for an unlikely outcome, but worrying too much about the downside prevents you from participating in the upside. The most important thing is to build a portfolio that can capture the upside while allowing you to sleep at night during the inevitable downside. There is not a universal portfolio. Everyone’s gotta find what works for them.

Bear markets really suck, but so does missing a multi-year bull market. You gotta score points when you can. You have to stay in the game.

*Full disclosure, I made these levels up

**The Dow fell 38% after the dotcom bubble burst. The S&P fell 49%.

***None of these numbers include dividends, but I’m also not backing out inflation, so more or less a wash

Image by lisa runnels from Pixabay