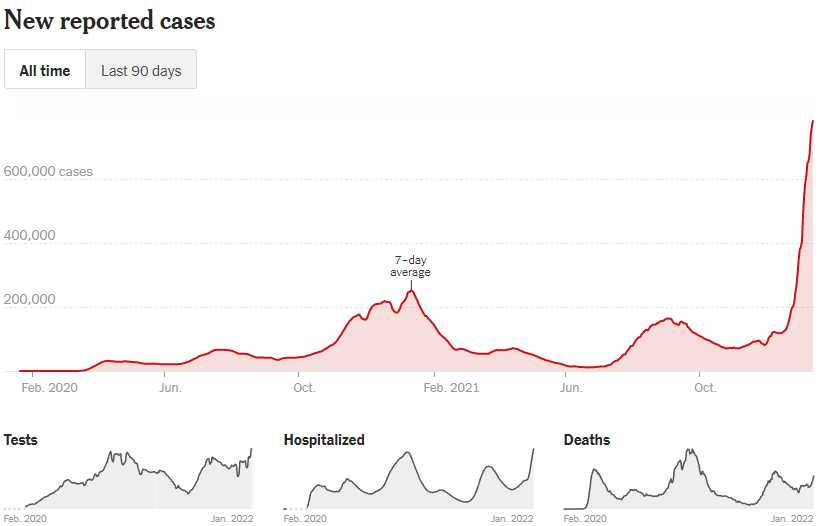

Omnicron is still surging.

Omnicron is still surging.

I know this chart can be surprising to some of you who were just watching the "news" about how Fauci is losing his cool as Republican Senators continue their campaign to discredit him and his "facts" but perhaps it's also a fact that Senator Roger Marshall (R-Kan) is a moron – as with everything else, he refuses to be tested….

What the Republicans are trying to "prove" of course is that Fauci invested in some company that makes vaccines or something (we bought GILD, PFE. MMM and MRNA early on in the Covid cycle as it seemed sensible) to "prove" this who vaccine thing is nothing but a profit-making hoax for Fauci – kind of like the way Florida's ex-Governor (and now Senator), Rick Scott pushed for welfare recipients to be drug-tested by a company he had a $62M investment in. That's one thing about Republicans – they know how all these scams work – because they originated them!

It's not so much that Covid is just a giant scam that is angering the GOP but that they didn't get in on the ground floor – since their leader was so busy pretending it didn't exist at all until he finally caught it himself. That made it impossible for Republican lawmakers to invest in vaccine companies without being branded a "traitor" to the party – and now they are bitter about missing out.

It's not so much that Covid is just a giant scam that is angering the GOP but that they didn't get in on the ground floor – since their leader was so busy pretending it didn't exist at all until he finally caught it himself. That made it impossible for Republican lawmakers to invest in vaccine companies without being branded a "traitor" to the party – and now they are bitter about missing out.

Republicans also need Covid to be over so their other investments can make money. They are working hard to start a new war with Russia or China but, in the middle of a Global Pandemic, it's hard to get people worked up about protecting the Ukraine or keeping Taiwan independent (we gave up Hong Kong without a fight). Since the virus isn't going away on it's own, they are going back to the playbook of denying it is actually a threat and attacking anyone who says it is.

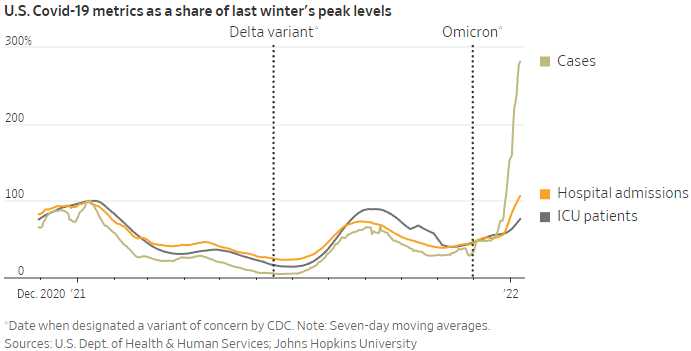

Yes, 4 TIMES as many cases as our previous, pre-vaccine peak and only 110% as many hospitalized (though it's a lagging indicator) is a "milder" form of Covid but the hospitals are being overwhelmed and we're running out of supplies and doctors and nurses are getting sick, which makes the staffing shortages worse and suppliers have the same problem so costs are skyrocketing, etc. Mild is a strange way to describe what is happening.

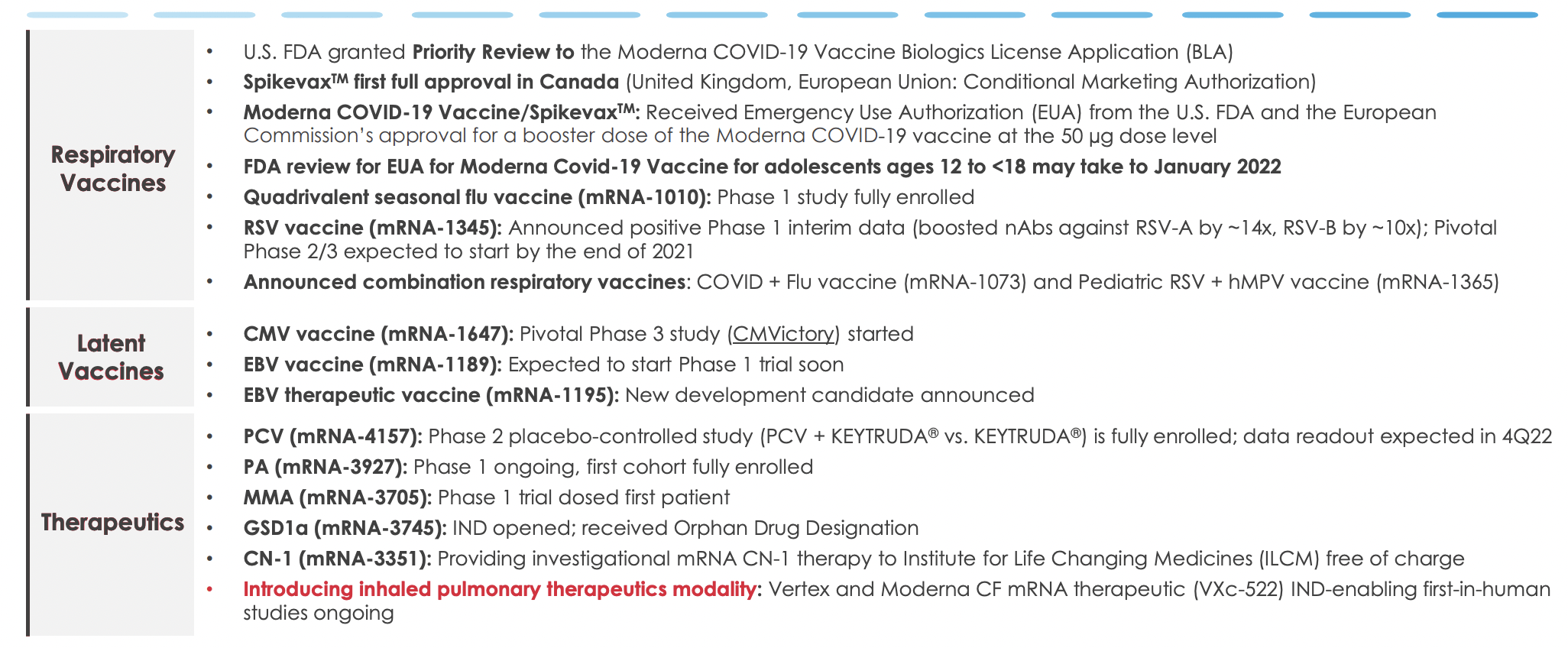

Fortunately, we don't have to be Republicans. We can still invest in stocks that benefit from their stupidity instead. Moderna, MRNA, has fallen more than 50% below it's peak and yes, it's peak was silly, but $222/share is $90Bn in market cap for a company that will make $11.5Bn in profits this year. It's being sold off because people think it's a one-trick pony but the Covid vaccine was more of a proof of concept for their process and they now have $22Bn (2 year's profits) to play with in the R&D department:

The thing about the mishandling of the pandemic is that we gave the virus a chance to spead so widely that it is now ENDEMIC, like the flu – and we're never going to be completely rid of it. That means MRNA will make money for many years to come on covid vaccines so, even if they are a one-trick pony, that trick may last a lifetime. Still, they have a robust pipeline – as noted in their recent report:

We have been waiting for MRNA to bottom out so we could get back in (we sold our old position near the top) and we discussed making a move in yesterday's Live Trading Webinar (replay available here). We sold 5 of the 2024 $200 puts for $25 and they are now $50 so we're down 100% on those but our net entry is $175 and MRNA is at $222 so it's only a loss on paper – we intend to stick it out. As a full trade for our Long-Term Portfolio (LTP), I would like to add:

- Sell 10 MRNA 2024 $180 puts for $40 ($40,000)

- Buy 20 MRNA 2024 $200 calls for $78 ($156,000)

- Sell 20 MRNA 2024 $250 calls for $59 ($118,000)

That's a net credit of $2,000 on the $100,000 spread. There's a heavy obligation there to buy 1,000 shares of MRNA at $180, or net $178 but that's a 20% discount to the current price. If MRNA fails to hold $200 or our $200 puts (the ones we already sold) go over $60, we will stop them out with a $35,000 loss and stop out of 5 of the short $180s for about $25,000 and then we'd be in for net $58,000 on the $100,000 spread and we'd reposition from there. Hopefully, it doesn't give us that kind of trouble and we make $102,000 (5,100%) against our cash investment.

Another risk the market is ignoring is inflation and Tuesday, Fed Chairman Powell testified to Congress that they can have their cake and eat it too and the markets loved it and we have rallied strongly since – albeit on low volume. As I have noted before, the trick in this market is to simply stop the sellers from selling and the inflows will take care of the rest.

Another risk the market is ignoring is inflation and Tuesday, Fed Chairman Powell testified to Congress that they can have their cake and eat it too and the markets loved it and we have rallied strongly since – albeit on low volume. As I have noted before, the trick in this market is to simply stop the sellers from selling and the inflows will take care of the rest.

The S&P topped out at 4,800 and we bottomed out at 4,600 (spikes don't count) which is a 200-point drop so the zones we watch are 40-point bounces so 4,640 was the weak bounce, 4,680 was strong, 4,720 (where we are this morning) is a strong retracement from the top and then 4,760 is a weak retracement from 4,800. Those are the zones we'll watch on the S&P 500 but the bigger concerns are that the Russell is still failing to take back 2,200 and the Nasdaq keeps failing at 16,000.

Today we hear from Lael Brainard, who is very dovish, at her Senate confirmation hearing to be #2 at the Fed and we'll see what kind of inflation hawk she has turned into since December, when the Fed was still calling inflation "transitory". Powell is Powell and we knew what he'd say but Brainard could signal the new tone for the Fed as they turn from stimulating to inflation-fighting in 2022.

Brainard is replacing Clarida, who is retiring and he had been a centrist and I think the markets think she will come in dovish, as usual but I think her concerns about the damage inflation causes to working people will trump her other concerns as we're essentially at full emplolyment with a pretty strong (stimuluated) economy – so it really is time to reign things in a bit.

We'll see how the market digests this later this morning.