We have a boring week ahead.

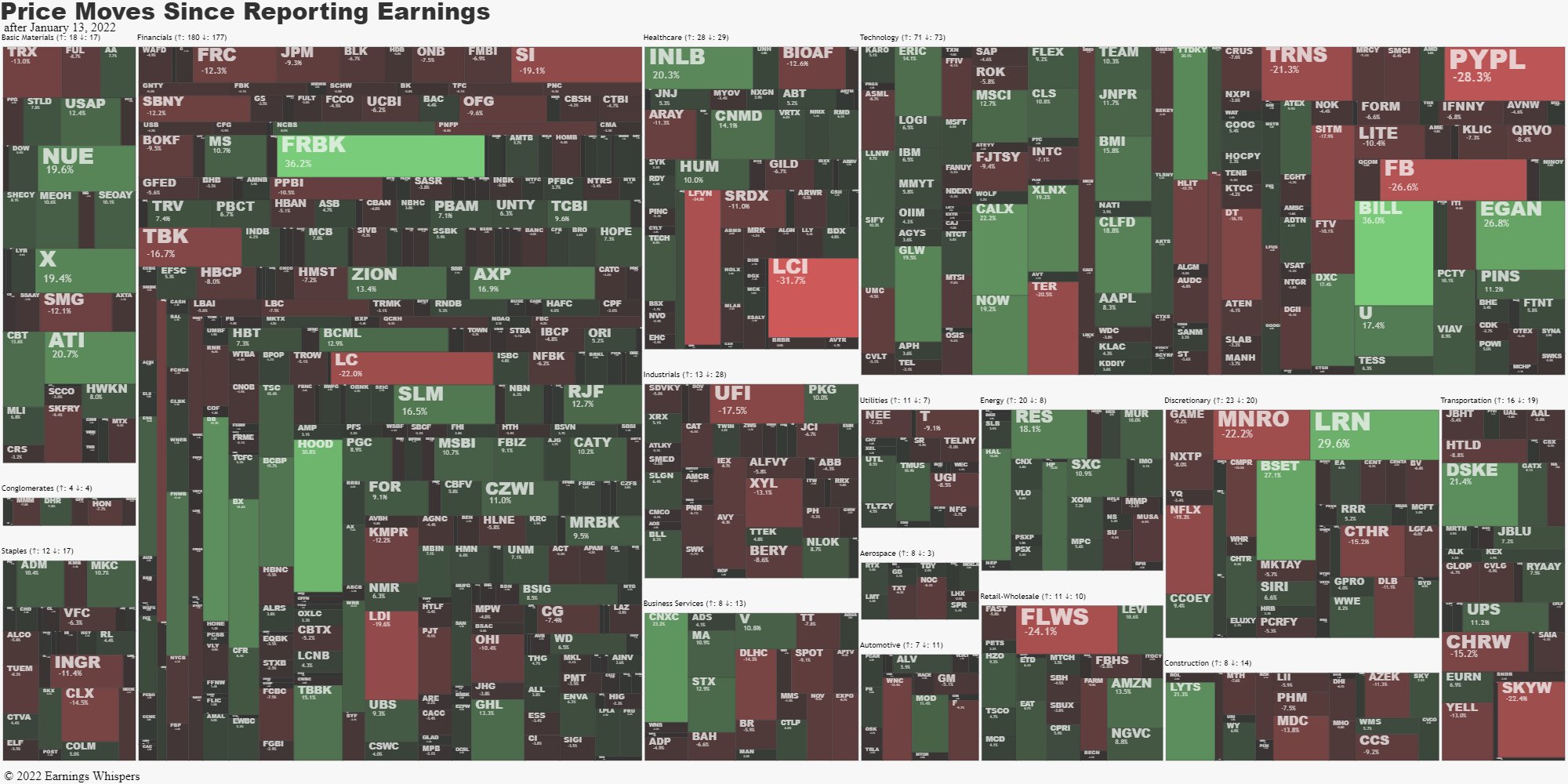

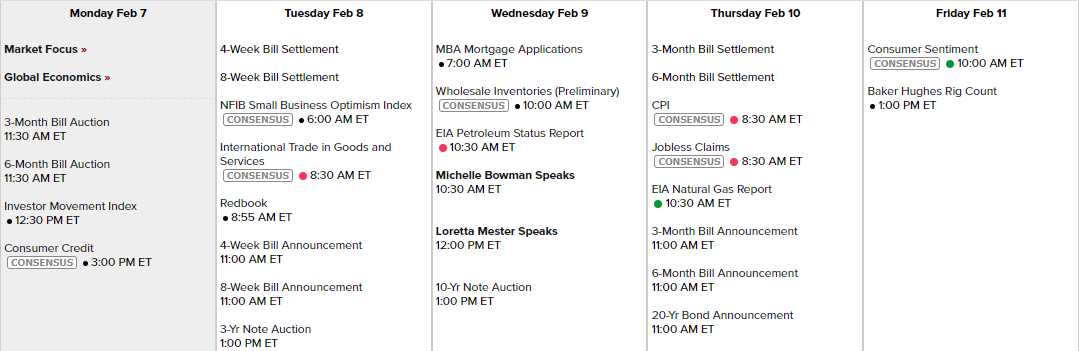

That's good as it will give things a chance to settle down. There are only two Fed speakers scheduled (both Wednesday) and not much data and earnings, so far, have been mixed:

Here's what lies ahead this week and we'll see if past sector performance is a good predictor of future results:

Both Fed speakers come ahead of the 10-year note auction – it's still critical to the Fed that people buy those at low rates or their whole plan goes off the rails – along with our economy. CPI comes on Thursday and, other than that, a bit of Consumer Sentiment and that's it for data this week. As I said, dull.

Generally, the market has trended higher in dull, low-volume weeks and this week, we don't have time to lay about as our bounce chart is wrecked and we need to be over those strong bounce lines by Friday or the whole week can be written off as a consolidation for a move lower – so let's watch our levels carefully:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

The only progress we made since Friday morning is the Dow went from red to black (on the cusp) on the strong bounce line – thanks to this morning's pre-market move back to 35,000. If that holds up, great but keep in mind we're getting an early boost from Asian markets re-opening back from New Year's and this is all dip-buying to them.

In Europe, as you can see, Germany's DAX is bouncing off the 15,000 line but the most recent bounce has been the weakest and failing to hold it would be… BAD. 16,200 to 15,000 is 1,200 points so call them 250-point bounces to 15,250 (weak) and 15,500 (strong), so that's what we'll look for overseas along with EuroStoxx, which fell from 4,400 to 4,000 so 4,080 is weak and 4,160 would be the strong bounce line we need to see over there.

In Europe, as you can see, Germany's DAX is bouncing off the 15,000 line but the most recent bounce has been the weakest and failing to hold it would be… BAD. 16,200 to 15,000 is 1,200 points so call them 250-point bounces to 15,250 (weak) and 15,500 (strong), so that's what we'll look for overseas along with EuroStoxx, which fell from 4,400 to 4,000 so 4,080 is weak and 4,160 would be the strong bounce line we need to see over there.

Other than that, we're very much in watch and wait mode with all this red on the bounce chart as it's still the bounce chart from our all-time highs – no indication of a proper correction unless we fail this zone for more than a couple of days (we only hit one red on the lower zone – Nasdaq 14,700, which is now clear). Unfortunately, the quick spike to 14,000 and low-volume recovery makes us very vulnerable to a downside follow-through on any unfortunate news.

“At times the world may seem an unfriendly and sinister place, but believe that there is much more good in it than bad. All you have to do is look hard enough, and what might seem to be a series of unfortunate events may in fact be the first steps of a journey.” – Lemony Snicket

One event still going on is the Winter Olympics in China and China has, once again, had to shut down a lot of manufacturing around the games in order to be able to see the sky or, more importantly, let the TV audience see the sky. Unlike running a totalitarian surveilance state while enforcing stringent population lock-downs – pollution is very obvious when you point a camera at it….

Of course, back in the US of A, it is Facebook's (FB) job to tell you what to think – not the state's! We will see how much of a bounce we get out of FB this week after the company lost $250Bn (25%) of their market cap on Friday. FB is left at $645Bn at $237 and they did make $40Bn last year so trading at 16x earnings shouldn't be such a crime, should it?

If we factor in the fact that AAPL cost them $10Bn with a policy change that FB will likely work around over time, I think we can expect $40Bn will be pretty normal going forward – even accounting for the pandemic easing and people having better things to do with their lives than start at Facebook all day (now we can go to the Metaverse instead!). I am certainly not saying FB is a bargain here but $200 would be less than $600Bn and even if earnings drop 25% from here – that's still a fair price (20x).

That means, selling the FB 2024 $200 puts for $27.50 is a very reasonable thing to do as it nets you into FB for $172.50 – 27% below the current price. Let's assume we REALLY want to own 500 shares of FB for $200. That would be $100,000 and we'd have to set aside $50,000 of ordinary margin to cover it but we'd collect $13,750 for it so let's sell 5 of the FB 2024 $200 puts for $27.50 in our Long-Term Portfolio and keep an eye on them – perhaps well add a bullish spread later as well.

That's how you can expect this week to go – we'll be looking for bargains we can take advantage of in case this bounce has legs. At the end of last week, we beefed up our hedges so it's time to invest a bit more on the other side – as long as our bounce chart holds up, that is.