We're waiting on inflation data this morning.

We're waiting on inflation data this morning.

CPI is expected to come in at 0.5% for January but October was 0.9% and November was 0.8% and December was 0.5% but that was when Oil FELL from $80 to $65 to start the month and we finished at $75 so there's your 0.5%. That did not happen in January as Oil blasted from $75 to $87.50 over the month.

Core CPI excludes Food and Energy but headline CPI does not, so I wonder what our Leading Economorons are thinking when they predict January will be as low as December? Yesterday morning, as we expected from Friday's discussion on rates and affordability, the Mortgage Application Index was down 8.1% and we can't read too much into one report but that's a pretty shocking decline. Wholesale Inventories blasted up 2.2% in December (they are supposed to go down) and November was revised up from 1.4% to 1.7% so two big builds during holiday shopping season is not ideal in a robust economy.

Of course, you can leave 2.2% on the shelves if you are charging 10% more for the goods and it looks like you sold ((100 x 1.1) x 0.978) = 107.58 (7.58% more) goods than last year – even though all you did was sell less stuff for more money. This is why Consumers (who are getting less stuff for more money) are not very confident – and we get that report tomorrow morning but, as you can see on the chart – we're on a track that looks more like the crisis of 2008/9 than record high market prices.

Of course, you can leave 2.2% on the shelves if you are charging 10% more for the goods and it looks like you sold ((100 x 1.1) x 0.978) = 107.58 (7.58% more) goods than last year – even though all you did was sell less stuff for more money. This is why Consumers (who are getting less stuff for more money) are not very confident – and we get that report tomorrow morning but, as you can see on the chart – we're on a track that looks more like the crisis of 2008/9 than record high market prices.

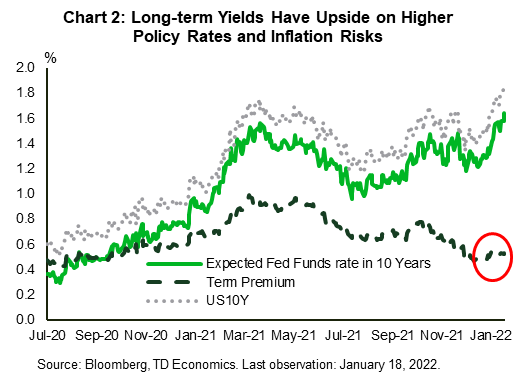

Yesterday's 10-year note auction did not go well, notes going off at 1.929% – the highest level since November of 2019 – before the pandemic. The last time they traded at 2% was August, 2019 and this is how the Fed's hand gets forced because, as much as they want to pretend there's no inflation, Bond Investors literally are not buying their BS and the wost thing the Fed can do is lose credibility so they are forced to raise rates to make it look like it was their idea and not the result of market forces that are out of their control.

The next Fed meeting is March 16th and there are only 8 meetings all year and we burned January last week so there basically HAS to be a rate hike at the next meeting as the Fed can't set the benchark at 0.25% while investors are paying 2% for 10-year notes – it makes them look silly.

The next Fed meeting is March 16th and there are only 8 meetings all year and we burned January last week so there basically HAS to be a rate hike at the next meeting as the Fed can't set the benchark at 0.25% while investors are paying 2% for 10-year notes – it makes them look silly.

8:30 Update: As we expected, CPI came in over expectations but only 0.6%, so not too terrible. What is worrying is that Core CPI is also 6% and that's a running hot which means the Fed HAS to do something about it which means rates will rise which means the Dollar will rise and the indexes will fall this morning.

We'll see how much if a hit we take as I find it hard to believe people are going to be shocked by a report showing inflation is high – why do you think we call them Economorons? They have no idea what's really going on in the World…. We've had a lovely run in our indexes in the past few days so we'll just see how much of it we give up but now, even the Junior Economorons must realize that tomorrow's Consumer Sentiment Index is likely to be BAD – so it's going to be a bumpy ride into the end of the week.

At the moment (8:40), we are still much improved from yesterday with the S&P having lost a red box (though not green yet) but the Nasdaq and the Russell still have a lot of work to do before we can call it a proper bullish trend and, as I noted on Monday – none of it matters if we don't finish the week with our weak bounces covered:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

The Dow got more good news this morning as Disney (DIS) is up $12, which adds about 100 Dow points so the +70 we're seeing on that index this morning is more than 100 DIS. We started the week at $135 so $160 is up 25 for the week and 200 Dow points out of 700 are DIS with AAPL putting in another 150, XOM 170 and CVX 145. That's why the Dow is a stupid index – just 4 stocks can account for all the gains or losses in a week.

Still watching and waiting this week. We're very well-hedged and well-balanced – just waiting for the market to give us a clear directional signal.