Whatever the next rumor is.

Now the market is running based on troop maneuvers in the Ukraine. Early this morning, Russia’s Defense Ministry said it had pulled back some troops from near Ukraine while noting that large-scale military maneuvers were continuing and Western officials warned that combat units were moving into forward positions.

The announced pullback of around 10,000 (7.6%) troops, out of a force estimated to have numbered about 130,000, came amid a new round of shuttle diplomacy aimed at defusing the crisis. Moscow has warned of unspecified consequences if the U.S. and its allies reject its security demands. While US markets are acting as if peace has broken out – In Ukraine (where they can do math), officials played down the importance of Russia’s troop announcement, saying forces could be quickly returned to Ukraine’s borders.

“We have to await confirmation from our intelligence community that this is in fact occurring,” Oleksii Danilov, the head of Ukraine’s National Security and Defense Council, said in an interview. “I cannot say that this is a turning point. The turning point will be when the Russian Federation realizes that we are a separate state, that we have the full right to be one, and stops trying to liquidate us.”

No one is liquidating the indexes as traders leap back in at the first sign of good news.

It's only a blip in the grand scheme of things but it's enough to push us back into our bullish Bounce Chart – which measures the mild retracement from the top – as opposed to our bearsh chart which measures how close we are to a 20% correction:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

As you can see – even with the morning rally we are still very much in the red on our bullish chart and what we need to see today is the more green and the Nasdaq (/NQ), which is currently at 14,540, needs to get back over the 14,700 line, which is the only red on our bearish chart. Overall, the market is still going nowhere fast – down for the year and down for the month.

Not down is Natural Gas (/NG) which popped over $4.40 this morning. Sadly, we took our money and ran yesterday and now, if you are to believe Russia, it's a good short at that line with tight stops above. Oil has already fallen $3.50 from yesterday's highs, now $92.35.

Not down is Natural Gas (/NG) which popped over $4.40 this morning. Sadly, we took our money and ran yesterday and now, if you are to believe Russia, it's a good short at that line with tight stops above. Oil has already fallen $3.50 from yesterday's highs, now $92.35.

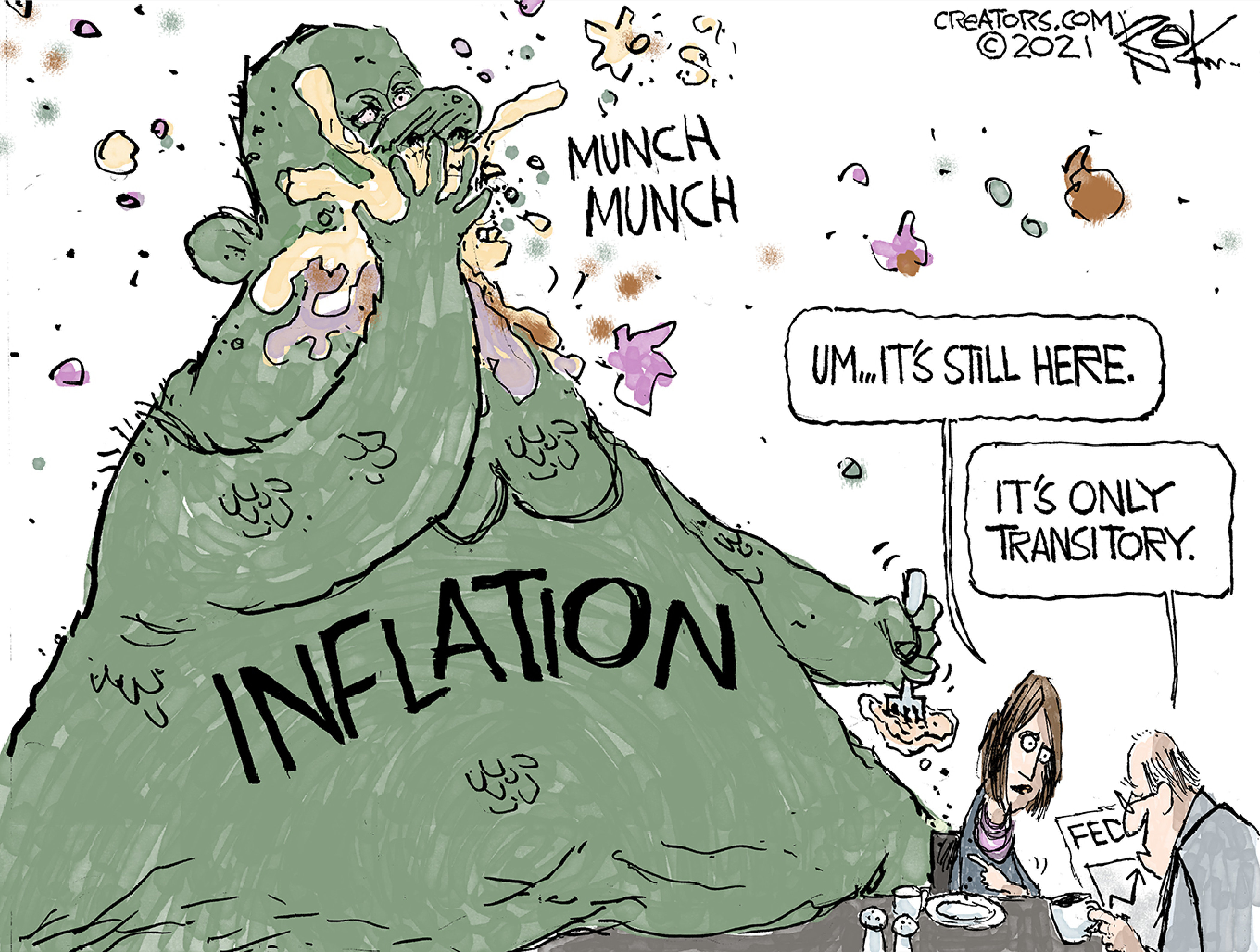

That will be good if it sticks beacuase, otherwise, we're in a huge inflationary crisis with 73% of the 200 items the Government uses to track prices saw annual price rises of 3% or higher in January, and some 55% of items saw inflation of 5% or higher. That is the worst recorded inflation since 1980, when 80% of the items were inflating 5% or more but this is early stages in our Inflationary Spiral.

Jim Bullard of the Fed is advocating for a "rapid" 1% rate hike, saying the Fed's credibility is on the line as they MUST reign in inflation before it gets out of control (as if it isn't already). “I do think we need to front-load more of our planned removal of accommodation than we would have previously. We’ve been surprised to the upside on inflation. This is a lot of inflation.” Bullard insisted that inflation has been running hot for months and the Fed needs to be forceful in using its tools to control price increases.

Jim Bullard of the Fed is advocating for a "rapid" 1% rate hike, saying the Fed's credibility is on the line as they MUST reign in inflation before it gets out of control (as if it isn't already). “I do think we need to front-load more of our planned removal of accommodation than we would have previously. We’ve been surprised to the upside on inflation. This is a lot of inflation.” Bullard insisted that inflation has been running hot for months and the Fed needs to be forceful in using its tools to control price increases.

By "a lot," Bullard may be referring to the average annual cost of daycare in the United States now hitting $12,300, according to a new report from Child Care Aware. That's why you keep hearing these stories about it not being worth having a job if you have to pay for daycare to take it – it's hard to believe if you aren't suffering through it. For two children, that's $24,600 AFTER-TAX money you need to come up with so you can go to work for minimum wage which, even at $15/hr, would pay you $30,000 BEFORE taxes, SS, unemployment, etc are removed.

“Since 1990, child-care costs have risen 214%, according to the Bureau of Labor Statistics (BLS) Consumer Price Index analysis, while the average family income has increased by 143%,” the First Five Years Fund report said. In all four regions, the annual price of child care is more than the annual cost of in-state tuition at a public four-year university. (Public in-state tuition ranges from $9,702 in the South to $13,878 in the Northeast.)

These are not the kind of problems that will go away with a wave of the Fed's magic wand. We have embedded, not transitory inflation and, like Covid, we are going to have to learn to live with it. Speaking of which, infections are down to just over 5M people per month in the US but 2,454 people are still dying EACH DAY – no worries, right?

| Avg. on Feb. 12 | 14-day change | ||

|---|---|---|---|

| New cases | 178,705 | –67% | |

| New deaths | 2,454 | –5% | |

That's as if every single person who was at the SuperBowl on Sunday was dead at the end of the month. Don't worry folks – take those masks off – learn to "live" with it. What's really tragic is the US death rate is 5x what it is in other countries – that's the real issue! We COULD be saving 60,000 people a month – we're CHOOSING not to…

No wonder we like Squid Games. Some countries think it's cruel and inhumane but only 456 players start out in Squd Games – we kill that may people before breakfast and, at least in Squid Games – there's a prize!