I will be on Bloomberg's Money Talk this evening.

That means it's time to review our Money Talk Portfolio, a portfolio we only trade on the show so, roughly once per quarter we make trades and adjustments and, the rest of the time, we leave it alone. That means our trades have to be fairly bullet-proof and able to handle the insane ups and downs of the market so the key is to pick great value stocks and keep them diversified.

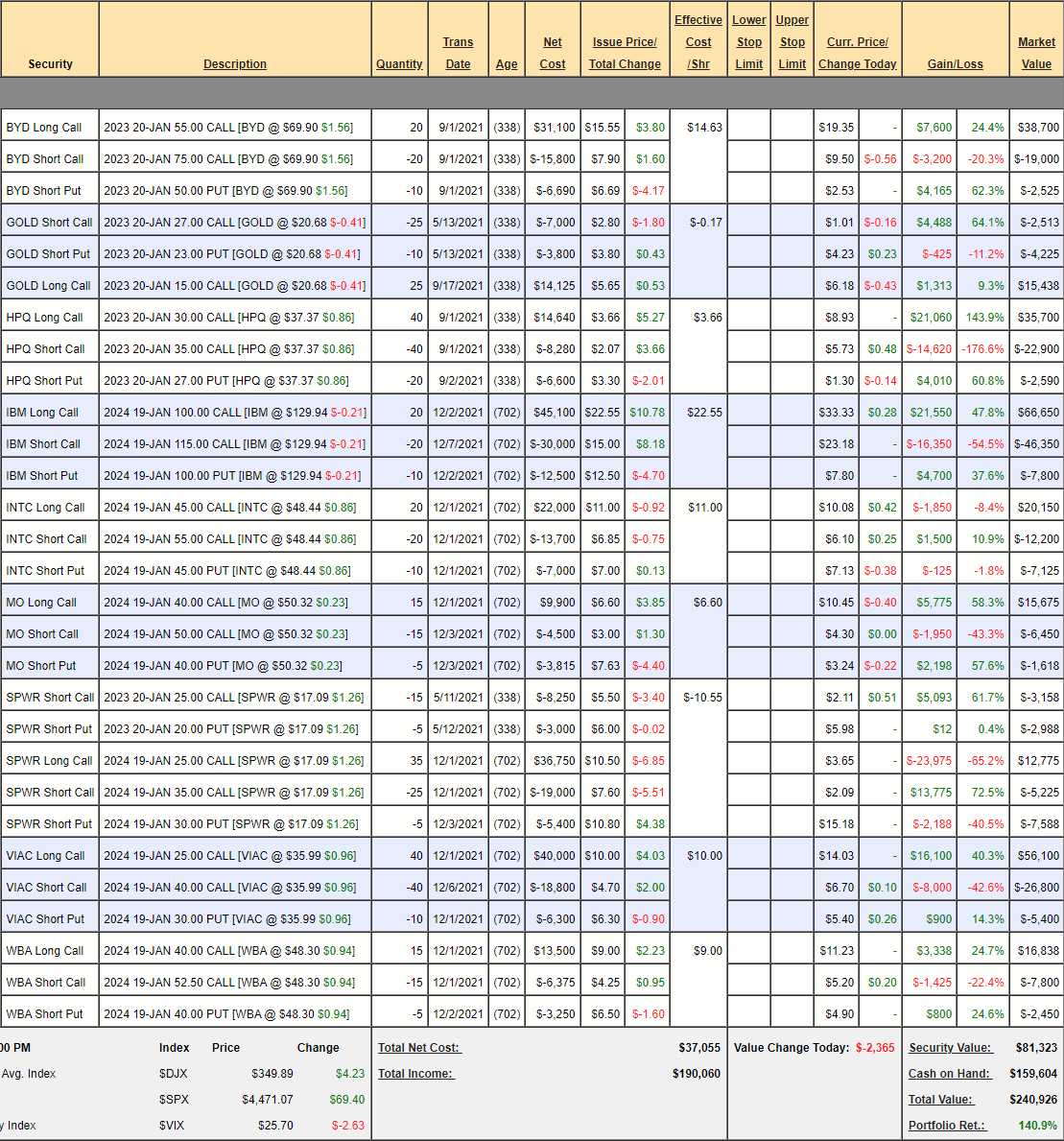

We began this portfolio on November 13th, 2019 – just before the pandemic and we took an early hit but we bounced back very nicely and, as of our last review on December 1st, the portfolio was up exactly 100% and we had plenty of cash, so we added 4 new positions, including our PhilStockWorld 2022 Trade of the Year: IBM. We also made a big adjustment to VIAC, which had been lagging. You can view the whole past show HERE.

IBM (IBM), Altria (MO) and ViacomCBS (VIAC) have? all performed well already and we're still waiting for Intel (INTC) and Walgreen's (WBA) to pick up but that makes them still good for a new trade. Our 4 new trades plus VIAC had $121,400 of upside potential and have already gained $27,158 and the overall portfolio now stands at $240,926 – up $40,967 since December 1st and our low-touch, $100,000 portfolio is now up 140% in just over two years.

IBM (IBM), Altria (MO) and ViacomCBS (VIAC) have? all performed well already and we're still waiting for Intel (INTC) and Walgreen's (WBA) to pick up but that makes them still good for a new trade. Our 4 new trades plus VIAC had $121,400 of upside potential and have already gained $27,158 and the overall portfolio now stands at $240,926 – up $40,967 since December 1st and our low-touch, $100,000 portfolio is now up 140% in just over two years.

You can always follow our BNN Money Talk Portfolio trades at: https://www.philstockworld.com/category/moneytalk/

As you can seee, we are at 2/3 CASH!!! in our portfolio and that's about when we face market uncertainty. As of our last set of adjustments, the positions in the portfolio had $235,336 worth of upside potential and we gained $40,000 of it already but it doesn't mean a thing until you convert those gains to CASH!!! (realize them) so we are only going to add one new trade this quarter as we're still in a very dicey market and we want to maintain the ability to adjust.

At PhilStockWorld, we teach our Members how to conserve CASH!!! by using option for hedging and for leverage. Although the positions require margin and are not ideal for margin-restricted retirement accounts, the potential for gains against your deployed cash is amazing and it's a tool every trader should have in their toolbelt:

- BYD – Boyd was in trouble back in December and cheaper than our September entry but they've turned around nicely and we're up to net $17,175 on the $40,000 spread so there's still $22,825 (132%) of upside potential and we're already up almost 100% from our original entry in just 5 months. Meanwhile, we can collect $2,125 by selling 5 of the June $75 calls for $4.25 – so a nice little income while we wait.

- GOLD – If we didn't already have it, GOLD would have been our Stock of the Year for 2022 as it's a fantastic inflation hedge. This is Barrick Gold, not the commodity but it may as well be as they tend to move in lockstep. However, I prefer holding GOLD to Gold because GOLD MAKES $2Bn a year while Gold just sits there and looks pretty. This is a $30,000 spread at net $8,700 despite being $14,200 in the money – THAT is why I LOVE options! We have $21,300 (244%) of upside potential at $27, which would put Gold at about $2,200.

- HPQ – I guess we were too conservative with our September entry as we're already past out goal. Still, it's a $20,000 spread that's currently only net $10,210 so $9,790 (95%) left to gain if it just holds $35. And look how well it held up during the sell-off.

- IBM – Our PhilStockWorld 2022 Trade of the Year and we couldn't be prouder as it's already 13% over goal and up 480% from our original $2,600 cash outlay just three months ago. $115 held during the sell-off so I think we're in good shape. It's a $30,000 spread currently at net $12,500 so we still have $17,500 (140%) of upside potential if we can simply hold $115.

- INTC – Intel was a runner up for Trade of the Year but it didn't have a strong catalyst but, other than that, I love them long-term and they are cheaper now than where we came in at net $825 on this $20,000 spread. We can take advantage of this by rolling the 20 INTC 2024 $45 calls at $10.08 to 20 INTC 2024 $40 calls at $12.65. That will cost us $5,140 but it puts us $10,000 deeper in the money and in a better position to sell short calls later. Now it's a $30,000 spread and our new net is $5,965 so we have $24,035 (402%) of upside potential. The fact that we originally spent $1,300 on the spread doesn't factor in as it's already a part of the portfolio's overall P&L – we're simply realizing the loss by taking some of our cash and using it to move the position.

- MO – Another one of our new trades and already at goal! Still just net $7,607 on the $15,000 spread leaves us with $7,393 (97%) of upside potential if they can hold onto $50.

SPWR – This trade has been holding back our whole portfolio but that's more of an opportunity than anything else as people simply don't understand what SunPower is doing. SPWR is selling their commercial division to TTE for $310M and SPWR's total income for 2022 was projected to be $35M so another $310M will certainly help! Their market cap at $16 is $2.7Bn. TTE is the majority owner of SPWR as well (50.83%). The cash improves SPWR financially and allows them to finance their transition to Consumer, which we already expected. It's a long-term play and we need to be patient but that doesn't mean we can't make adjustments:

- Buy back 25 short 2024 $35 calls at $2.09 ($5,225)

- Buy back 15 short 2023 $25 calls at $2.11 ($3,158)

- Roll 35 2024 $25 calls at $3.65 ($12,775) to 35 2024 $15 calls at $6.75 ($23,625)

This is a very aggressive adjustment and we're not going to sell short calls into earnings. We're spending $19,233 but we expect to cover with $35 calls again at at least $6 so that will be $21,000 if all goes well and we'd be back to (or below) our original net $1,100. Earnings are today so let's hope they go well! I'm not going to call an upside to this as it's still so unsettled.

- VIAC – No THIS would have been our Stock of the Year if we didn't already have it. Notice this portfolio is full of Stock of the Year contenders. You have to have the best of the best for a portfolio you can't even touch between quarters! As it stands, we are $40,000 in the money on this $60,000 spread but only net $23,900 so far so we have $16,100 (67%) of upside potential.

- WBA – Another new one that's doing well already. We came in at net $3,875 and now we're at net $6,588 after 3 months but it's a $18,750 spread so we still have $12,162 (184%) upside potential.

So our current plays, not counting SPWR, have $131,105 of upside potential and we've used $22,248 of our cash to make adjustments. We have 3 Techs, so no more Tech and that's counting SPWR as Energy and not Tech. BYD is Entertainment, I guess and so is VIAC then. MO and WBA are Consumer Sales and HPQ is Tech but Consumer Tech. So definitely no more Tech!

We cashed out Pfizer (PFE) not too long ago so, as a new play, I'd like to add the 3x BioTech ETF (LABU), which has been insanely beaten-down recently. Rather than sell puts in LABU. Originally, we were going to sell puts in Medtronic (MDT) to offset but selling 5 of the 2024 $90 puts for $9 would only raise $4,500 and obligate us to own 500 shares for $45,000 while selling 15 of the LABU 2024 $20 puts for $9.20 raises $13,800 in exchange for promising to buy 1,500 share for $20 ($30,000) – so a much more efficient way to raise funds.

- Sell 15 LABU 2024 $20 puts for $9.20 ($13,800)

- Buy 30 LABU 2024 $10 calls for $13.25 ($39,750)

- Sell 25 LABU 2023 $28 calls for $5 ($12,500)

This configuration will allow us to sell 10 short-term calls, like the June $25 calls for $3.30 ($3,300) to recoup our net $13,450 outlay. We have 5 uncovered longs and it's unlikely we'd get into trouble with 10 short calls but not yet, as we hope for a move up before we sell more covers. Also, once the 2023 calls expire, we will be able to sell 2024 calls (or roll the 2023 calls to 2024 calls at higher strikes but, overall, let's just call it a $54,000 spread with $40,550 (301%) of upside potential – that's plenty to add for the quarter!

That brings our overall upside potential to $171,655 without even counting SPWR and we still have $123,906 of CASH!!! on the sidelines – about 50% of our portfolio.

We will review our other Member Portfolios in our Live Chat Room this week – join us there!