By Jacob Wolinsky. Originally published at ValueWalk.

Alpine Capital Research commentary for the month of February 2022, titled, “Beta No Longer Has a 40-Year Tailwind.”

Q4 2021 hedge fund letters, conferences and more

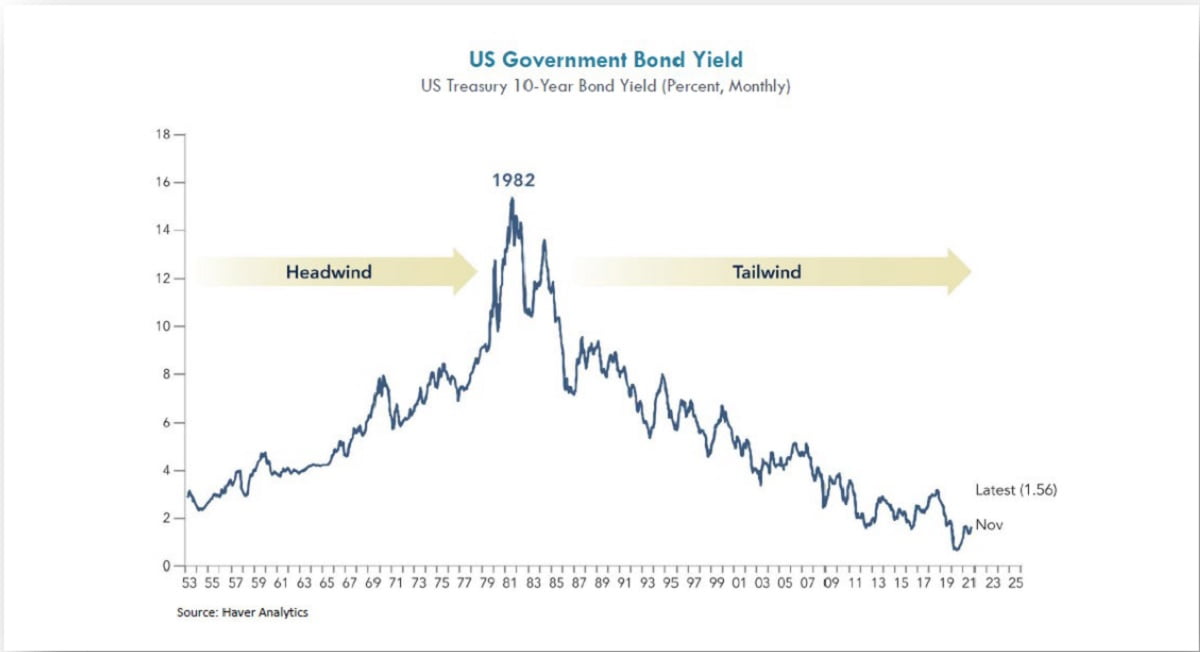

Circa 1981-82, then Fed Chairman Paul Volcker hawkishly slayed 1970’s era inflation, thereby unleashing a 40-year secular bull market in both bonds and stocks, that are now likely nearing their end. Hence, there has been a cacophony of recent commentary about the return of meaningful inflation, rising interest rates and slumping equity prices.

Investors who’ve become accustomed to Central Bank accommodation, double-digit annual returns and who’ve been programmed to “buy the dip” and “dollar cost average” may be confounded by the paucity of future returns as today’s Fed attempts to gingerly de-lever its balance sheet and the financial system at large.

This phenomenon is ominously underscored by the preponderance of Capital Market Assumptions (CMAs) that have been issued by a plethora of estimable industry practitioners. Those organizations are almost unanimously forecasting an extended future comprised of dismally inadequate and unsatisfactory inflation-adjusted investment returns—in the low single digits or worse.

The problem is that most institutions have an inherent minimum return threshold that can broadly be defined as “spending plus inflation”. Endowments and foundations, in particular, are required to distribute at least 5% of their corpus per year. Add 2% as a now optimistic estimate of inflation, and the imposing height of the 7% hurdle becomes clear.

Beta No Longer Has A 40-Year Tailwind

Suddenly, without the likelihood of ample monetary liquidity sloshing around, the conventional methods of constructing public equity beta have lost their potency and beneficial utility. Why? Because most traditional long-only equity allocations have relied on relative return-seeking strategies that are tethered—either implicitly or explicitly—to the future performance of a long-duration equity index. As per those foreboding CMAs referenced earlier, future equity index returns are not expected to dazzle or impress. Logically, any passive or active strategy tied to an index will incur disappointingly inadequate, below-threshold results.

The bottom line is that benchmark-aware active management is likely to be horribly insufficient to meet a public-equity, absolute-return target for the foreseeable future. Successful long-only active equity management will likely be defined by absolute results rather than relative returns. Beta no longer has a 40-year tailwind, and it can’t be counted on as a rising tide that will lift all boats [see Chart #1]. Winning by not losing will take on much greater importance in a flat to down public-equity market environment. Especially one where most asset classes entered 2022 excessively valued due to decades of extremely loose monetary and fiscal policy.

Chart 1: Is 40 Years of Central Bank Accommodation Over?

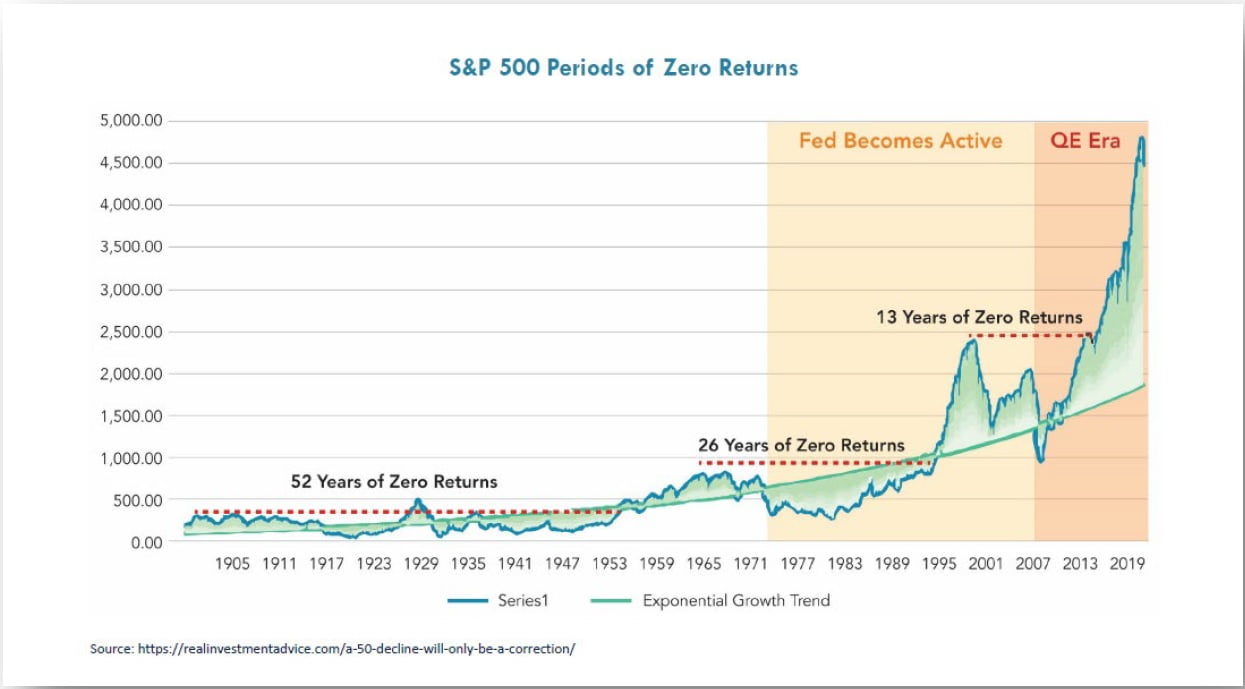

With public-equity returns universally expected to be inadequate, begrudgingly accepting absolute return inadequacy for 7 to 10 years in one’s public equity “book” is not an optimal solution—and not unprecedented [see Chart #2]. Despite the seductive allure of private markets and the efficacy therein, a reasonable allocation to public equities will always remain an essential component of any asset allocation due to liquidity and diversification requirements.

Chart 2: A 10+ Year, Range-Bound, Sideways-Trending Market with Zero Returns Will Erode the Value of Institutional Portfolios.

Now is the time to change the status quo. Successful long-only active equity management going forward will have wider discretion to build portfolios that studiously ignore the benchmark’s underlying characteristics. Robust tracking error will be welcomed, rather than scorned, as the now shopworn benchmark-relative equity strategies—so routinely utilized for three to four decades—continue to slavishly “track” the dismal returns of their corresponding index.

It’s time to consider an absolute return-seeking, public-equity strategy. One that has a private equity-ethos. A strategy that, comparable to a private equity fund, has a limited number of portfolio companies—but that are publicly traded. Further, a strategy that only deploys capital into new investments when they’ve been individually underwritten and only when they are expected to produce a satisfactory, equity-like return that is in excess of most investors’ minimum return threshold. Valuation discipline dictates that until such time that the next satisfactory return stream is uncovered, excess capital (i.e., cash) will not be robotically deployed into the next marginally inadequate opportunity. Valuation excellence dictates that we wait for the next proverbial “fat pitch”. And naturally, with an absolute return-seeking, public-equity manager that can provide historical attribution of their investment team’s underwriting prowess.

Finally, to deliver an adequate return in the forthcoming low-return decade, investors will need to beg, borrow, or steal to obtain precious tracking error, rather than avoid it. Yet, with every additional position, traditional hyper-diversified, hyper-segmented, fully invested, long-only equity strategies axiomatically lose their potential for tracking error. Therefore, a concentrated portfolio of quality companies, each skillfully underwritten to deliver an absolute return, may be the equity investor’s best and only hope for a satisfactory return in the coming decade.

Chris Scibelli

Managing Director

February 2022

cscibelli@acr-invest.com

Updated on

Sign up for ValueWalk’s free newsletter here.