That is why, perhaps, electing a comedian to run your country may not turn out to be the best idea. Ukraine's comic-turned-president got tangled up in the impeachment of Donald Trump, then he had to deal with the Covid pandemic and now he’s facing the prospect of a full-scale invasion by Russia since taking office in May of 2019.

Zelensky's lack of real experience has not been helping and now the wolves are at his doorstep as Russia has, like Crimea, endorsed the breakaway Donbas Region and sent in troops "to support their independence from Ukraine." This is much like the way America elected a TV President and he too, ineptly destroyed America's reputation in the World and destroyed America's Economy at home – that show is still running with a brief Biden intermission. And it's a LOT of support Russia is offering with 190,000 Russian Troops on the border – as opposed to the "removal" of troops the market rallied on last week.

Speaking of last week – for all the gyrations we've been having, the S&P is only down 50 points since Valentine's Day and 225 points (5%) off our Feb 9th high – no big deal. The Nasdaq, however, is hitting our 13,500 correction goal. That's still the only red on the 20% Bounce Chart (where we project the correction will take us) but the S&P is on the cusp of turning red – so we'll be watching that closely this week:

Speaking of last week – for all the gyrations we've been having, the S&P is only down 50 points since Valentine's Day and 225 points (5%) off our Feb 9th high – no big deal. The Nasdaq, however, is hitting our 13,500 correction goal. That's still the only red on the 20% Bounce Chart (where we project the correction will take us) but the S&P is on the cusp of turning red – so we'll be watching that closely this week:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong) is where we are this morning (again).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,580. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

You don't want to see ANY red on a chart which confirms our predicted 20% correction zone but this is the Nasdaq's second visit to the land down under and, if it breaks – it's taking everyone with it (which makes them good hedging bets, by the way). The Russell, don't forget, already made a 20% correction from 2,400 back to 1,920 – 1,600 is the worst-case scenario for the small-caps and we REALLY don't want to see any redness there at all.

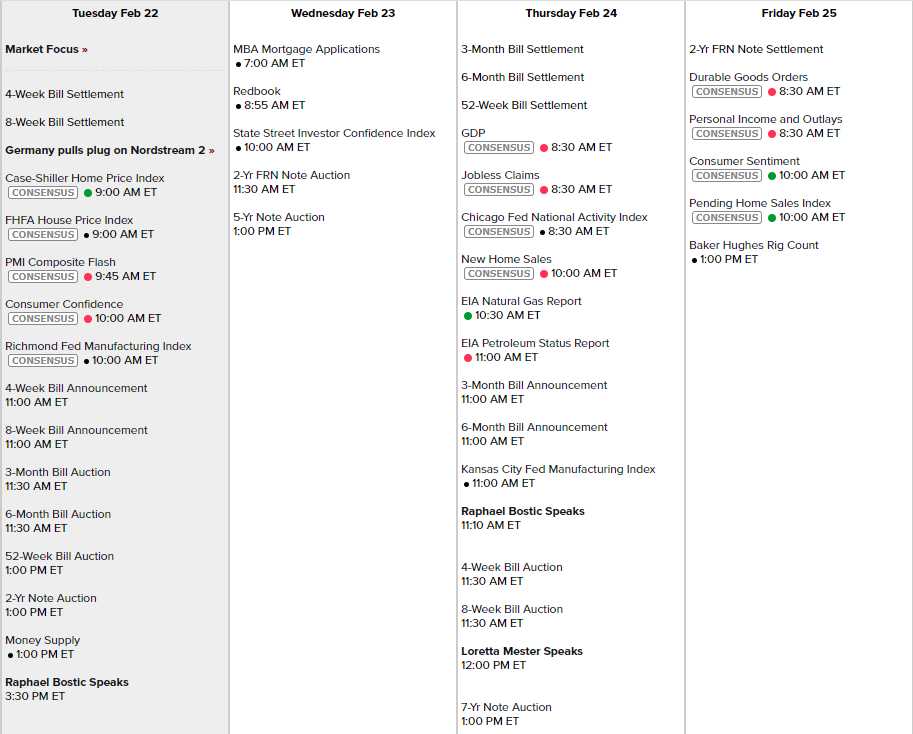

Amazingly, February ends next Monday already and then it's March and then it's time for Q1 earnings. Things are just happening too fast this year and we have a fairly busy data week after yeasterday's holiday – peppered with Fed Speak:

And earnings don't end – they don't even fade away at this pace:

We are certainly not going to be bored as 2022 races along on us. Over in Hong Kong Chinese Overlord, Carri Lam, has ordered all residents to have 3 Covid tests in March so, if you are wondering why you can't find one in CVS – that's why. They are having a major Covid outbreak despite an over 80% vaccination rate and it's freaking China out – so they want to get to the bottom of it right away and the "independent" territory of Hong Kong is fully cooperating with Lam's bosses.

Queen Elizabeth, who gave up Hong Kong in 1997 on the condition it remain autonomous until 2047 (oh well), also has Covid and, at 95. Both Charles and Cimilla had it recently as well – as have much of the staff. It is thought they all caught Covid on Feb 8th, the first time the Queen had been out in 3 months for her 70th anniversary on the throne celebration. Meanwhile, despite this demonstration of Covid spreading at mass gathering – Prime Minister BoJo is lifting all restricions – including requiring people who have Covid to self-isolate. Maybe I'm missing something but shouldn't that ALWAYS be a rule in ANY rational civilization?

Not America, of course, you can get right on a plane with Covid – as long as you wear your mask.