Well, well, well.

Those scruffy little Ukrainians have been holding off Russia this weekend – even though they are outgunned and outmanned about 10:1. That has caused Lord Vladimort to ready the nukes Citing “aggressive statements” by NATO and tough financial sanctions, Putin issued a directive to increase the readiness of Russia’s nuclear weapons, raising fears that the invasion of Ukraine could lead to nuclear war, whether by design or mistake.

Like Trump, I thought Putin was a smart guy but he's not been playing this smart. He could have easily taken over the diputed territiories in the Eastern Ukraine (Donetsk and Luhansk), where the separtatists already have control but instead they attacked the whole country, blowing his "I was just trying to help" narrative out the window and causing the collateral deaths of thousands of civilians, which is a war crime – but one the US commits all the time, so no one is making a big deal about that.

What Putin is actually doing is undoing the damage Trump did by re-uniting Nato and re-establishing the US, UK and Germany as the go-to team in a crisis – even though Boris Johnson is still in office – that's quite an accomplishment! When people start looking to Boris Johnson for steady leadership in a crisis – you know things are getting weird. BoJo (as he is called by the cool kids) has dismissed Vladimir Putin’s announcement that he is putting Russia’s strategic nuclear deterrent on high alert as a “distraction” from struggle his troops are facing in Ukraine.

What Putin is actually doing is undoing the damage Trump did by re-uniting Nato and re-establishing the US, UK and Germany as the go-to team in a crisis – even though Boris Johnson is still in office – that's quite an accomplishment! When people start looking to Boris Johnson for steady leadership in a crisis – you know things are getting weird. BoJo (as he is called by the cool kids) has dismissed Vladimir Putin’s announcement that he is putting Russia’s strategic nuclear deterrent on high alert as a “distraction” from struggle his troops are facing in Ukraine.

Not only has Putin perhaps overplayed a weak hand but now he's actually gotten the West to move on to strict banking sanctions. Russian banks are being cut from the SWIFT System, which is how money is transferred internationally. Roughly 1% of SWIFT traffic goes through Russia and that action alone dropped the Ruble 30% this weekend and the Russian markets are shut down today as their entire financial system is now in chaos.

Putin might be able to get on the alternate Chinese system but his bombing of civilian targets may cause China to say no as well (even though they would love another customer for their "Cross Border Interbank Payments System") and there are people who think Russia will use BitCoin as an alternative but even Putin isn't dumb enough to pay $40,000 for one of those useless things.

Of course we went long on Silver (/SI) again as it tested $24 on Friday – that's easy money and already at $24.40, which is up $2,000 per contract over the weekend. We also took a long on Natural Gas (/NG) at $4.56 and that hasn't moved much yet, so still good for a new trade as it will skyrocket if Putin cuts Europe off.

Of course we went long on Silver (/SI) again as it tested $24 on Friday – that's easy money and already at $24.40, which is up $2,000 per contract over the weekend. We also took a long on Natural Gas (/NG) at $4.56 and that hasn't moved much yet, so still good for a new trade as it will skyrocket if Putin cuts Europe off.

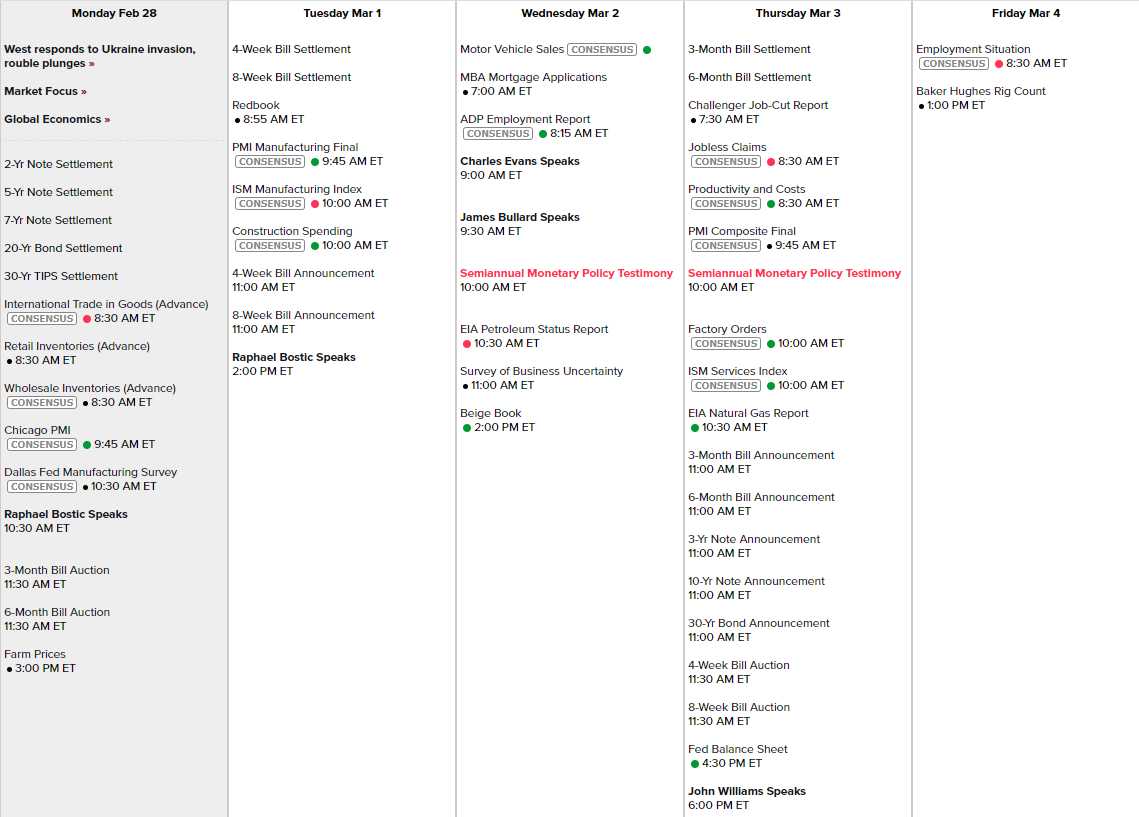

The Futures were down over 2%, but that was before it was time to manipulate them and now they are only down about 1% but none of that matters other than our Bonce Chart, which is still the same as it was on Friday afternoon, when we reviewed it in our Live Member Chat Room. We also tilted a bit more bearish in our Short-Term Portfolio as we didn't see any upcoming data likely this week to improve conditions:

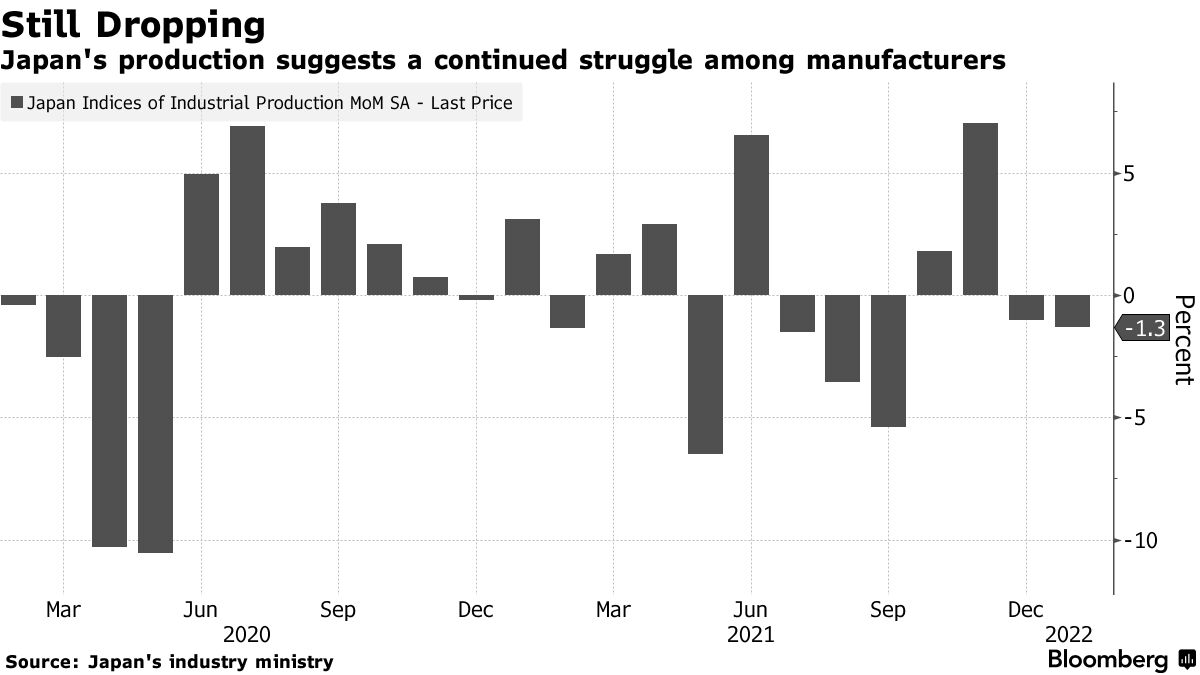

Bostic speaks twice and Powell testifies to Congress Wednesday and Thursday and the always doveish John Williams talks us into the weekend. No one is speaking after the Non-Farm Payroll Report on Friday – so it's probably pretty good. I'm more concerned about what's going on in the rest of the World as Industrial Production in Japan fell for the 2nd straight month (so the quarter is doomed) and it's far worse than expected – even by leading Japanes Economorons (or Keizaimorons, as they are known in Japan) and now the war at their doorstep – NOT GOOD!

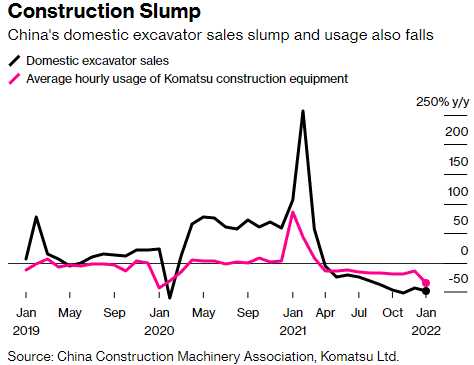

Over in China – exactly as we predicted but shocking everyone else – the Construction Slump is getting worse and their stimulus is not helping because Evergrande and others still having even begun to book their true losses – much like US Financial Institutions in 2007. The PMI was down ahead of New Year's (Feb 1st) and, obviously, New Year's killed February too but no sign of recovery since then either. NOT GOOD!

Over in China – exactly as we predicted but shocking everyone else – the Construction Slump is getting worse and their stimulus is not helping because Evergrande and others still having even begun to book their true losses – much like US Financial Institutions in 2007. The PMI was down ahead of New Year's (Feb 1st) and, obviously, New Year's killed February too but no sign of recovery since then either. NOT GOOD!

Now, gather the kids around and I'll tell you a very important economic lesson: You can't build things if you don't have any money and no one is going to give money to builders who are already defaulting on hundreds of Billions in debt to build more empty cities. The Government would like to give them money – as soon as they are done bailing out the Trillion Dollar debt they have already run up and the Politburo (or "Parrot-Donkey" in English) is almost as screwed up as our Congress so good luck getting a Trillion-Dollar aid bill passed to bail out rich assholes while people are still starving from the Covid crisis.

Of course, many of the Politburo members are rich assholes themselves and a lot of them invested in real estate – so there's still hope for the Everland Gang – just not much of it. ING Groep NV cut its prediction for China’s 2022 growth last week to 4.8% from 5.4%, saying investment growth isn’t picking up as strongly as it should be.

There are, surprisingly, still quite a lot of earnings coming in – mostly from the small cap side but we have some huge retailers reporting this week – so let's pay particular attention to what they say as well.