By Arkadiusz Sieron. Originally published at ValueWalk.

Russia underestimated Ukraine’s fierce defense. Instead of quick conquest, the war is still going on. The same applies to pulling the rope between gold bulls and bears.

Q4 2021 hedge fund letters, conferences and more

It was supposed to be a blitzkrieg. The plan was simple: within 72 hours Russian troops were to take control of Kyiv, stage a coup, overthrow the democratically elected Ukrainian authorities, and install a pro-Russian puppet government. Well, the blitzkrieg clearly failed. The war has been going on for five days already, and Kyiv (and other major cities) remains in Ukrainian hands, while the Russians suffer great losses.

Indeed, the Ukrainians are fighting valiantly. The Kremlin apparently did not expect such high morale among the troops and civilians, as well as such excellent organization and preparation. Meanwhile, the morale among Russian soldiers is reported to be pathetically low, as they have no motivation to fight with culturally close Ukrainians (many of whom speak perfect Russian). The invaders are also poorly equipped, and the whole operation was logistically unprepared (as the assumption was a quick capitulation by Ukrainian forces and a speedy collapse of the government in Kyiv). Well, pride comes before a fall.

What’s more, the West is united as never before (Germany did a historic U-turn in its foreign and energy policies) and has already imposed relatively heavy economic sanctions on Russia (including cutting off some of the country’s banks from SWIFT), and donated weapons to Ukraine.

However – and unfortunately – the war is far from being ended. Military analysts expect a second wave of Russian troops that can break the resistance of the Ukrainians, who have fewer forces and cannot relieve the soldiers just like the other side. Indeed, satellite pictures show a large convoy of Russian forces near Kyiv. Russia is also gathering troops in Belarus and – sadly – started shelling residential quarters in Ukrainian cities. According to US intelligence, Belarusian soldiers could join Russian forces. The coming days will be crucial for the fate of the conflict.

Implications for Gold

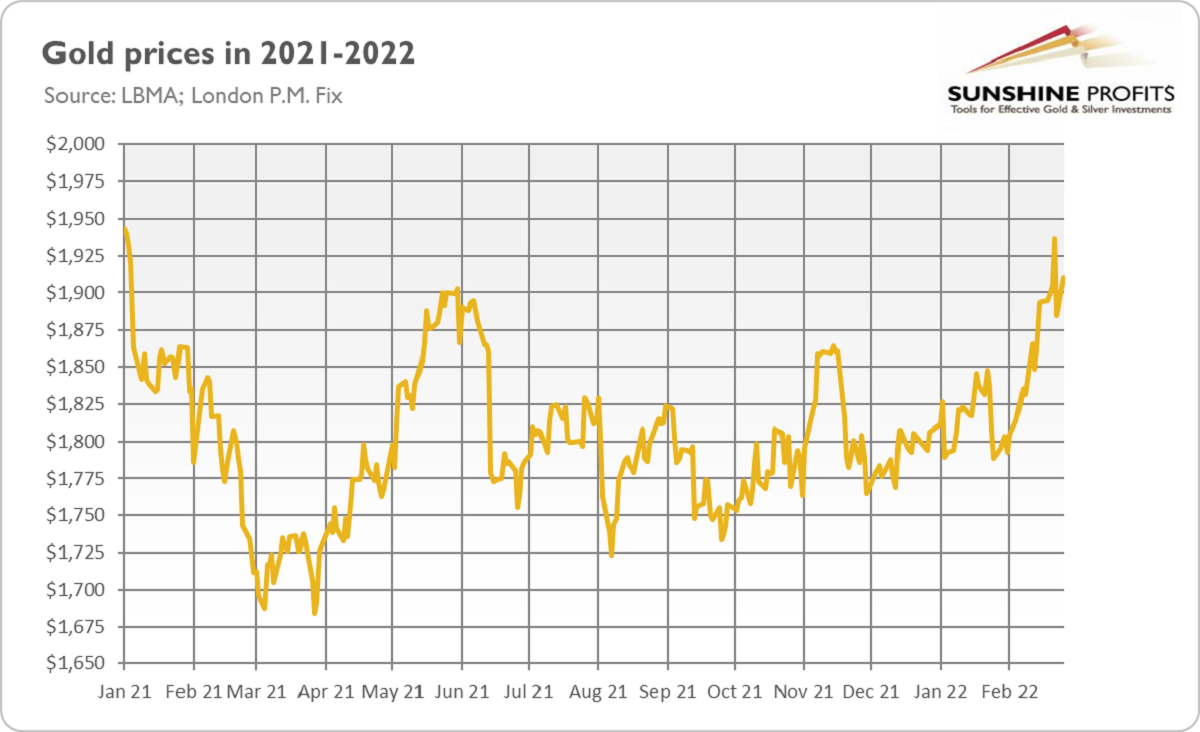

What does the war between Russia and Ukraine imply for the gold market? Well, initially, the conflict was supportive of gold prices. As the chart below shows, the price of gold (London Fix) soared to $1,936 on Thursday.

However, the rally was very short-lived, as the very next day, gold prices fell to $1,885. Thus, gold’s performance looked like “buy the rumor, sell the news.” However, yesterday, the price of the yellow metal returned above $1,900, so some geopolitical risk premium may still be present in the gold market. Anyway, it seems that I was right in urging investors to focus on fundamentals and to not make long-term investments merely based on geopolitical risks, the impact of which is often only temporary.

Having said that, gold may continue its bullish trend, at least for a while. After all, the war not only increases risk aversion, but it also improves gold’s fundamental outlook. First of all, the Fed is now less likely to raise the federal funds rate in March. It will probably still tighten its monetary policy, but in a less aggressive way. For example, the market odds of a 50-basis point hike decreased from 41.4% one week ago to 12.4% now.

What’s more, we are observing increasing energy prices, which could increase inflation further. The combination of higher inflation and a less hawkish Fed should be fundamentally positive for gold prices, as it implies low real interest rates.

On the other hand, gold may find itself under downward pressure from selling reserves to raise liquidity. I’m referring to the fact that the West has cut Russia off from the SWIFT system in part. In such a situation, Russia would have to sell part of its massive gold reserves, which could exert downward pressure on prices. Hence, the upcoming days may be quite volatile for the gold market.

At the end of my article, I would like to point out that although the war in Ukraine entails implications for the precious metals market, it is mostly a humanitarian tragedy. My thoughts and prayers are with all the casualties of the conflict and their families. I hope that Ukraine will withstand the invasion and peace will return soon!

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care

Updated on

Sign up for ValueWalk’s free newsletter here.