By Monica Kingsley. Originally published at ValueWalk.

S&P 500 is turning around, and odds are that would be so till the FOMC later today. The pressure on Powell to be really dovish, is on. I‘m looking for a lot of uncerrtainty and flexibility introduction, and much less concrete rate hikes talk that wasn‘t sufficient to crush inflation when the going was relatively good, by the way.

As stated yesterday:

(…) The rising tide of fundamentals constellation favoring higher real asset prices, would continue kicking in, especially when the markets sense a more profound Fed turn than we saw lately with the 50bp into 25bp for Mar FOMC. Make no mistake, the inflation horse has left the barn well over a year ago, and doesn‘t intend to come back or be tamed.

Q4 2021 hedge fund letters, conferences and more

Not that real assets including precious metals would be reversing on a lasting basis here – the markets are content that especially black gold keeps flowing at whatever price, to whatever buyer(s) willing to clinch the deal. Sure, it‘s exerting downward pressure on the commodity, but I‘m looking for the extraordinary weakness to be reversed.

We‘re seeing such a reversal in commodities already, and precious metals have a „habit“ of joining around the press conference. Yesterday‘s performance of miners and copper, provides good enough a hint.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 upswing looks like it can go on for a while. Interestingly, it was accompanied by oil stocks declining – have we seen THE risk-on turn? This looks to be a temporary reprieve unless the Fed really overdelivers in dovishness.

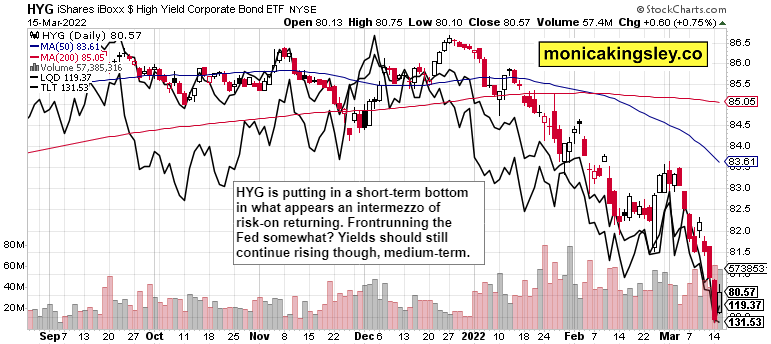

Credit Markets

HYG is catching some bid, and credit markets are somewhat supporting the risk-on turn. Yields though don‘t look to have put in a top just yet, which means the stock market bears would return over the coming days.

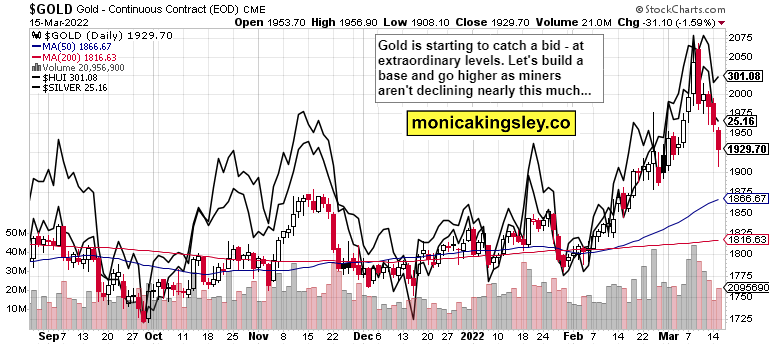

Gold, Silver and Miners

Precious metals are looking very attractive, and the short-term bottom appears at hand – this is the way they often trade before the Fed. I‘m fully looking for gold and silver to regain initiative following the cautious and dovish Fed tone.

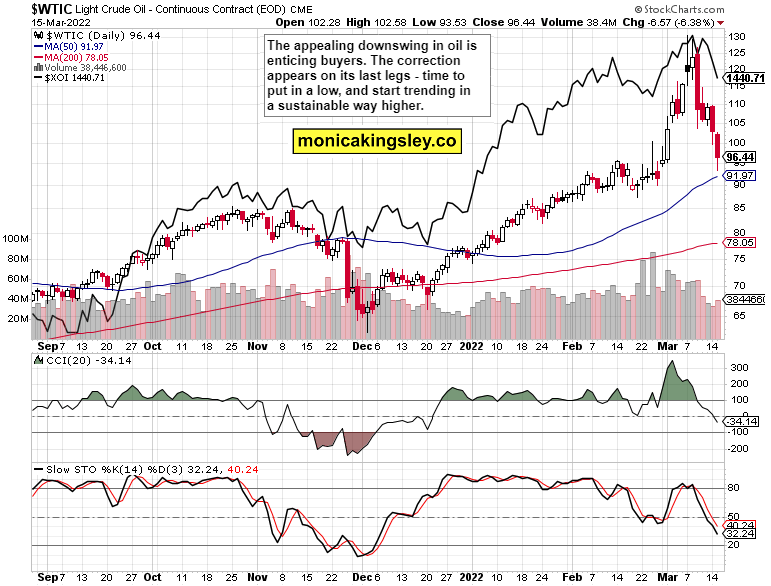

Crude Oil

Crude oil didn‘t test the 50-day moving average, and I would expect the bulls to step in here – after all, the Fed can‘t print oil, and when they go dovish, the economy just doesn‘t crash immediately…

Copper

Copper is refusing to decline, and the odd short-term weakness would be reversed – and the same goes for broader commodities, which have been the subject of my recent tweet.

Bitcoin and Ethereum

Cryptos aren‘t fully risk-on, but cautiously giving the bulls benefit of the doubt. Not without a pinch of salt, though.

Summary

S&P 500 bulls are on the (short-term) run, and definitely need more fuel from the Fed. Significant dovish turn – they would get some, but it wouldn‘t be probably enough to carry risk-on trades through the weekend. The upswing is likely to stall before that, and commodities with precious metals would catch a fresh bid already today. This would be coupled with the dollar not making any kind of upside progress to speak of. The true Fed turn towards easing is though far away still (more than a few months away) – the real asset trades are about patience and tide working in the buyers favor. The yield curve remains flat as a pancake, and more stagflation talk isn‘t too far…

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on

Sign up for ValueWalk’s free newsletter here.