MORE FREE MONEY!!!

MORE FREE MONEY!!!

This time it's China's turn to wave the stimulus wand with Vice Premier Liu saying Beijing will roll out more measures to boost the Chinese economy as well as (and this is more important) "favorable policy steps for its capital markets." China had been cracking down on their own Tech Oligarchs sending stocks like BABA, BIDU and DIDI down more than 2/3 but it was beginning to get real and those companies were about to start laying people off – and that is where the Chinese Government had to relent.

It's all well and good to be hating on Capitalism – but you have to have something to replace it with. No one seems to have figured that out yet. So the Hang Seng is up 9% this morning and BABA is up a ridiculous 21% pre-market, BIDU up 15% and DIDI up 45% – how insane is that? Investors also took comfort from Ukrainian President Volodymyr Zelenskiy's comments on Wednesday that peace talks with Russia were sounding more realistic.

So everything is awesome again this morning and the S&P is running right back to test resistance at 4,320, where it wil fail because the Death Cross just happened and this news doesn't actually change the fact that China is in lockdown and Russia is at war and the Fed is tightening anyway due to out-of-control Inflation and the Supply Chains are still F'd and the planet is daying. Happy Wednesday!

Ignoring World events, it's actually good news to see us bounce off the weak bounce line on /ES and go right back to the strong bounce line but it's only REALLY good news if we get back over it and hold it and that's unlikely with the downward pressure from the Death Cross but that Powell is a silver-tounged devil – and he's been excellent in the past at telling the markets what they want to hear so it ain't over 'till the Fed lady sings this afternoon, at 2:30 and we will be covering it during our Live Trading Webinar, which begins at 1pm, EST. – YOU CAN JOIN US HERE.

We got throuogh our Future is Now portfolio review during our Live Member Chat (you can join that here) and there was nothing there we want to get rid of, so I guess I'm satisfied with the 20% market correction though not enough so that we don't have $1M worth of hedges in our Short-Term Portfolio. On the whole, as I said we'd be through mid-March, we're still waiting to see how our Bounce Chart resolves itself:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,103. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

Nothing at all has changed since Last Wednesday. While it would be encouraging to see 4,320 turn green this week – it won't matter much if the Nasdaq is still below the weak bounce at 14,100 and, even after this 2-day rally, they are still down at 13,700. Keep in mind that 1,600 is down 33% for the Russell as it passed its 20% line (1,920) back in January. At least it's back over that now.

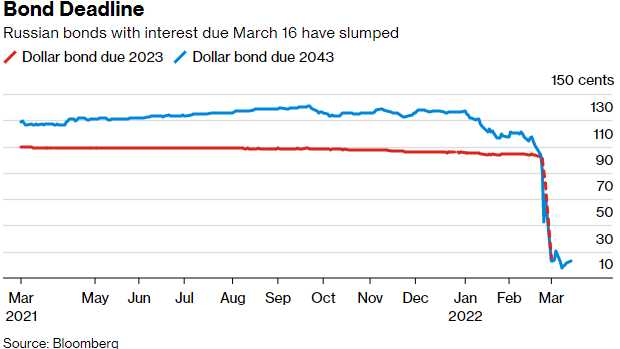

Now, on to the next crisis. Russia is about to default on up to $150Bn worth of debt if they follow through with their plan to make interest payments in Rubles instead of Dollars (as required). They can't get Dollars and the Ruble is essentially worthless due to sanctions and the bill is due today. As noted by Bloomberg:

Now, on to the next crisis. Russia is about to default on up to $150Bn worth of debt if they follow through with their plan to make interest payments in Rubles instead of Dollars (as required). They can't get Dollars and the Ruble is essentially worthless due to sanctions and the bill is due today. As noted by Bloomberg:

Failure to pay, or paying in local currency instead of dollars, would start the clock ticking on a potential wave of defaults on about $150 billion in foreign-currency debt owed by both the government and Russian companies including Gazprom, Lukoil and Sberbank.

Because much of Russia’s debt was rated investment grade just weeks ago, the securities were pervasive across global fixed-income portfolios and benchmarks, meaning the impact could ripple across pension funds, endowments and foundations. Russian businesses and households are facing a double-digit economic slump and inflation accelerating toward 20%. About half of the country’s foreign-exchange reserves, some $300 billion, have been frozen. Regardless of the Kremlin's policy on foreign debt payments, companies will find it harder to service their obligations as falling demand hits sales and profits.

Possible Default Scenarios

Russia pays in dollars Debt crisis averted, for now. Investors will then look ahead to other payments, such as a dollar bond maturing April 4. Russia pays in rubles Some of the bond contracts have a built-in rule allowing this. But the ones with interest payments due on Wednesday don’t, so most investors would consider it a default. Russia doesn’t pay at all After a grace period, this would be a classic, hard default. Russia is locked out of markets until it is remedied.

Technically, Russia will have 30 days to cure it's default so, as long as they end aggression in the Ukraine and the US removes sanctions by April 15th – everything will be fine… sure it will… Can you name any other countries with crashing bond values due to out-of-control Inflation and crushing Debt? Anyone? Bueller?

Technically, Russia will have 30 days to cure it's default so, as long as they end aggression in the Ukraine and the US removes sanctions by April 15th – everything will be fine… sure it will… Can you name any other countries with crashing bond values due to out-of-control Inflation and crushing Debt? Anyone? Bueller?

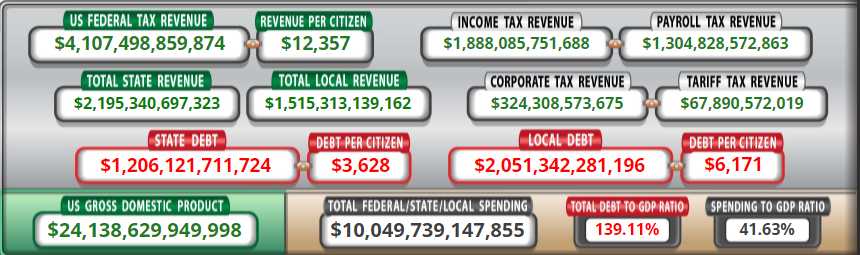

At this moment, our own National Debt is $30.3Tn and I have long been warning we will hit $32Tn by the end of the year but I was wrong as the Budget Deficit for 2022 – even WITHOUT more stimulus – is $2.7Tn so we will pass $32Tn in the 3rd quarter at this pace. Additionally, if the Fed raises rates just 0.25% this afternoon, that will be an additional $75Bn in interest due on the current debt. So, if it's $75Bn per 1/4-point rate hike then the 6 rate hikes expected in 2022 will cost the Government an additional $450 BILLION – and that is JUST a 1.5% rate hike for the year.

So pay close attention to Russia's default, we are not far behind them! Now, the Fed could NOT raise rates but then inflation will run out of control and then the Government that spends $6.8Tn a year would spend 10% more and that's $680Bn so, really, there's no way to win – either inflation continues and we spend outselves to death or we contain inflation and Government spending pops to $7.3Tn with a $3Tn deficit.

Since Government revenues are $4Tn, covering the $3Tn deficit would mean raising all taxes by 75%. Though not all taxes can be raised. Our glorious Corporate Masters are already paying $324Bn in taxes – that is almost 8% of all tax revenues and almost 5% of what they make – surely we can't expect them to do more for the country – they will leave! Well, that's what they keep saying but they never do. How has Russia and China worked out for them so far?

That's right, Globalization is no longer a given and suddenly the US is looking like a very safe haven to conduct your business (although we may elect Trump again and then you are on your own) – companies SHOULD pay a premium for that. Instead we give them a discount and the country falls apart, destroying the very same safe haven status they have profited from. Doesn't matter to the corporations – they will just relocate – but it would have been smarter to contribute to protecting the haven they were in, right?