By Anna Peel. Originally published at ValueWalk.

- The Bank of England raised the base rate another 0.25 percentage points to 0.75%.

- It may not be enough to dampen inflation.

- It’s bad news for borrowers – as the cost of debt rises.

- And sad news for savers, as no big rate bumps are on the cards

- But it’s better news for anyone considering an annuity.

Q4 2021 hedge fund letters, conferences and more

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown:

“With the shadow of stagflation looming, the Bank of England is in a difficult predicament, so it restricted the rate rise to 0.25 percentage points to try and ensure growth isn’t choked off while it tries to get a grip on rampant prices. But this limited move means inflation will slip away and slide upwards again. The commodity chaos unleashed by the conflict in Ukraine, is set to feed through to consumer prices, and unwelcome energy bills are already poised to land on mats in April. The Bank is now predicting inflation rises to 8% in April and remains there for the rest of the quarter. It’s also expecting another peak in October, when the energy price cap rises again.

The price rises across the board are already feeding into wage demands, and although real wages (without bonuses) fell in the three months to January, policymakers want to avoid an upwards spiral of wages and prices, by trying to suppress demand for goods and services to help try and bring down prices.

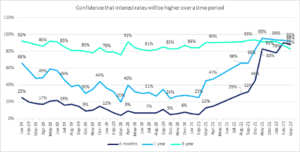

So the central bank grip is highly likely to intensify in the months to come, with higher borrowing costs set to tighten the uncomfortable cost-of-living belt by a few more notches. But there is still plenty of uncertainty around the table about the path of those rate rises. Similarly there is still worry among investors about the unfolding events in Ukraine and how the tense situation will affect the economy and monetary policy in the UK. In the HL monthly survey, confidence that interest rates are going to be higher fell for the short, mid, and long term. 88% of clients said they were confident that rates would be higher over the next six months, compared to 90% last month.”

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown:

Savings

“Every Bank of England rate rise builds frustration for savers, as savings rates resolutely refuse to move. Despite three Bank of England rate hikes, the high street giants are still offering just 0.01% on most easy access savings accounts, and the best rates only reflect a fraction of the increase. In order to squeeze 1% out of the easy access market you have to open a Virgin current account.

The big banks are carrying on as if we haven’t had a rate rise at all, because there’s really no need for them to do anything else. During the pandemic, savers flooded back to familiar high street banks with their lockdown savings. With so much cash sloshing around, they can continue offering rock bottom savings rates and cheap mortgage deals. It means newer and smaller banks need to offer cheap mortgages to compete, so they can’t afford to boost their savings rates dramatically either.

There is some hope of rate rises though. As more people spend their lockdown savings, and as savers regain some confidence in life returning to normal, it will deflate the cushion of cash that the big banks are sitting on, and make it increasingly likely they’ll start to nudge rates up. In the interim, it’s well worth keeping your eyes peeled for better rates from the newer players. There are so many easy access accounts bunched between 0.7% and 0.8% that there’s a good chance we’ll get more of them breaking above this level as the market slowly grinds towards 1%.

Debt

Rising rates bring bad news for borrowers. We’ve got used to bargain basement borrowing over the past few years, so we’re going to have to adjust to paying more on our debts.

Our mortgages are protected to a large extent by the fact that most of us are on fixed rate deals. New borrowers have also been sheltered from the full impact of the rate rise, because the high street banks are still sitting on such a cushion of cash that they can afford to offer exceptionally cheap deals. However, new rates are starting to creep up, and in February, Moneyfacts put the average two-year deal at 2.44% – up from 2.38% in January but down from a year earlier.

Meanwhile, anyone on a tracker or standard variable rate has been hit hard. The average SVR jumped 0.15 percentage points in March to an eye-watering 4.61%. It means that it’s well worth considering fixing your rate sooner rather than later if it makes sense for your circumstances.

Today’s rate rise will feed into the cost of credit cards, both on existing cards and on new ones, because we always tend to get a round of rate increases when the Bank of England makes a move. After February’s announcement, we had a flood of new cards at higher rates, and Moneyfacts figures show that the average credit card rate jumped to 26.3% in the first quarter.

If you’ve locked into a fixed rate personal loan, it’s fixed for the life of the loan, but it will make new loans more expensive. It might also make them harder to get your hands on if banks start to worry about our ability to stick to higher repayments.

Overdrafts are largely divorced from the Bank of England rate so they haven’t risen since the Bank of England started hiking rates: they’re so much higher that even if they crept up with rates it would be a drop in the ocean compared to what you’re already paying.”

Annuity rates

Helen Morrissey, senior pensions and retirement analyst at Hargreaves Lansdown:

“Today’s rate rise could hold better news for retirees planning to use an annuity for their retirement income. Interest rate increases push up the gilt yields used to determine annuity rates, so we could get another bump in rates.

They’ve been on the up in recent months, which has come as a welcome relief after concerns about the pandemic and a possible no-deal Brexit sent gilt yields crashing in early 2020. A 65-year-old man retiring with a £100,000 pension today can generate around £500 more a year from an annuity than he would have done at the start of the pandemic.

We’re not expecting a rush for annuities though. Current annuity incomes are still pretty low and it will probably take a significant further uplift to tempt retirees, especially if they think further interest rate increases could be on the cards.

Once an annuity is bought it can’t be unwound and so people will be wary of locking into low rates. Rather than annuitising your whole pension on one day it can be a good idea to buy annuities in slices throughout your retirement. This enables you to take advantage of higher rates as they become available.”

dsadsdsa

About Hargreaves Lansdown

Almost 1.7 million clients trust us with £141.2 billion (as at 31 December 2021), making us the UK’s number one platform for private investors. More than 98% of client activity is done through our digital channels and over 600,000 access our mobile app each month.

Updated on

Sign up for ValueWalk’s free newsletter here.