I don't know what everyone is so happy about.

I don't know what everyone is so happy about.

Yes, Powell said he feels the economy is strong but that was in the context of saying he wants rates to be close to 2% by the end of the year, that's up almost 10 TIMES from 0.25% we started the year with! Just because Powell says he doesn't think it will hurt the economy much doesn't mean it's true, does it? In fact, if you take a look at the Fed's own projections – things really don't look that good at all:

| Variable | Median1 | Central Tendency2 | Range3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2022 | 2023 | 2024 | Longer run | 2022 | 2023 | 2024 | Longer run | 2022 | 2023 | 2024 | Longer run | |

| Change in real GDP | 2.8 | 2.2 | 2.0 | 1.8 | 2.5–3.0 | 2.1–2.5 | 1.8–2.0 | 1.8–2.0 | 2.1–3.3 | 2.0–2.9 | 1.5–2.5 | 1.6–2.2 |

| December projection | 4.0 | 2.2 | 2.0 | 1.8 | 3.6–4.5 | 2.0–2.5 | 1.8–2.0 | 1.8–2.0 | 3.2–4.6 | 1.8–2.8 | 1.7–2.3 | 1.6–2.2 |

| Unemployment rate | 3.5 | 3.5 | 3.6 | 4.0 | 3.4–3.6 | 3.3–3.6 | 3.2–3.7 | 3.5–4.2 | 3.1–4.0 | 3.1–4.0 | 3.1–4.0 | 3.5–4.3 |

| December projection | 3.5 | 3.5 | 3.5 | 4.0 | 3.4–3.7 | 3.2–3.6 | 3.2–3.7 | 3.8–4.2 | 3.0–4.0 | 2.8–4.0 | 3.1–4.0 | 3.5–4.3 |

| PCE inflation | 4.3 | 2.7 | 2.3 | 2.0 | 4.1–4.7 | 2.3–3.0 | 2.1–2.4 | 2.0 | 3.7–5.5 | 2.2–3.5 | 2.0–3.0 | 2.0 |

| December projection | 2.6 | 2.3 | 2.1 | 2.0 | 2.2–3.0 | 2.1–2.5 | 2.0–2.2 | 2.0 | 2.0–3.2 | 2.0–2.5 | 2.0–2.2 | 2.0 |

| Core PCE inflation4 | 4.1 | 2.6 | 2.3 | 3.9–4.4 | 2.4–3.0 | 2.1–2.4 | 3.6–4.5 | 2.1–3.5 | 2.0–3.0 | |||

| December projection | 2.7 | 2.3 | 2.1 | 2.5–3.0 | 2.1–2.4 | 2.0–2.2 | 2.4–3.2 | 2.0–2.5 | 2.0–2.3 | |||

| Memo: Projected appropriate policy path | ||||||||||||

| Federal funds rate | 1.9 | 2.8 | 2.8 | 2.4 | 1.6–2.4 | 2.4–3.1 | 2.4–3.4 | 2.3–2.5 | 1.4–3.1 | 2.1–3.6 | 2.1–3.6 | 2.0–3.0 |

| December projection | 0.9 | 1.6 | 2.1 | 2.5 | 0.6–0.9 | 1.4–1.9 | 1.9–2.9 | 2.3–2.5 | 0.4–1.1 | |||

The US GDP has been downgraded 30% from 4% growth to 2.8% growth for 2022 and inflation is up over 50% from 2.6% to 4.3% this year and that's AFTER more than DOUBLING the target raise in Fed funds from 0.9% to 1.9%. What exactly are the markets excited about here?

Of course, they are really not that excited as the S&P 500 (/ES) is barely at the Strong Bounce line at 4,320 and it must hold for 2 consecutive closes without breaking intra-day for us to count it as clear. The Nasdaq is still 200 points away from a weak bounce at 14,100 as well so what we'll see today and tomorrow is whether or not Powell's happy talk has any legs.

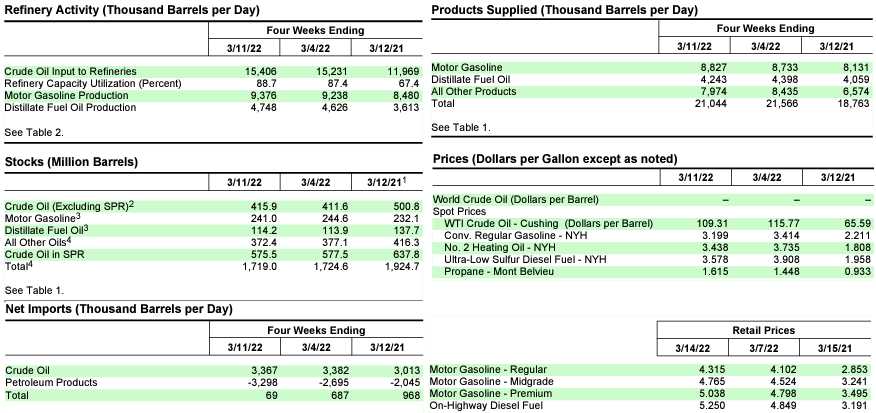

Oil blasted back to $100 this morning and we were so busy with Fed nonsense yesterday in our Live Trading Webinar that we didn't get to the Petroleum Status Report and what we were looking for was whether the 4.3Mb build in Oil was caused by a release from the Strategic Petroleum Reserve but only 2Mb was released and, what's really interesing is, for all the whining we're hearing about needing to produce more oil – the United States is currently EXPORTING 3.3Mb/d of petroleum products – that's 23 MILLION barrels per week, which is an ENTIRE DAY of US "consumption" (21Mb/d) and, more importantly, it is as much as ALL of the oil we import (3.36Mb/d)!

Does anyone in Congress understand this stuff? Does anyone in the media? Have them call me (seriously) and I will explain how oil production and consumption actually work in the US and the World at large. The short story is this EIA Report clearly indicated that the US does not need to import ANY oil at all – we are simply using imports to benefit the refineries who turn the oil into other products and ship them back out of the country. There is no crisis in the US – as Robert Reich keeps saying, it's a sham being generated by the Oil Companies to wring additional profits out of US consumers.

Does anyone in Congress understand this stuff? Does anyone in the media? Have them call me (seriously) and I will explain how oil production and consumption actually work in the US and the World at large. The short story is this EIA Report clearly indicated that the US does not need to import ANY oil at all – we are simply using imports to benefit the refineries who turn the oil into other products and ship them back out of the country. There is no crisis in the US – as Robert Reich keeps saying, it's a sham being generated by the Oil Companies to wring additional profits out of US consumers.

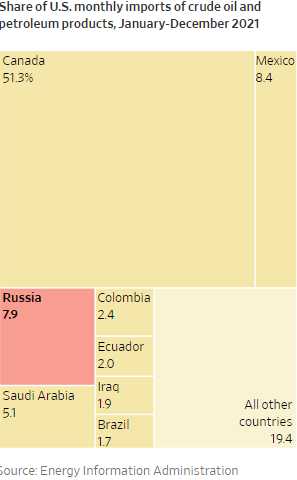

Russian oil constitutes just 7.9% of our imports – just 266,000 barrels per day of our 21,044,000 barrels per day consumption. The vast majority of our imported oil comes from Canada. Does anyone at Fox News understand this at all? So yes, we can live without Russian oil and we don't have to let the oil companies dig up your back yard to do it either…

On the global stage, Russia is a huge exporter of oil – sending out 8M barrels per day to other countries. Not much goes to us but, if they were to stop supplying, then all the other oil we buy would become scarce. Of course, 8M x 365 x $85 is $248Bn or 20% of Russia's economy so it's not at all likely they will stop exporting oil or they will also stop their economy.

We're in week 4 of the war and possible peace talks were also boosting the markets yesterday but then Russia bombed a shelter housing hundreds of women and children so we'll see how that plays out. We're sending weapons and money to Ukraine so Putin is going to need that $1Bn/day of oil money to buy more tanks if we keep blowing them up. Wars are expensive, we spent Trillions on Iraq and Afghanistan in order to ????? and Putin doesn't have that kind of money. In fact, that's how they lost the Cold War – they went bankrupt trying to keep up with Reagan's crazy defense spending (which is now called our normal military budget).

If the war ends soon, great, maybe we can get back to normal(ish) but Jeff Gundlach sees a Recession next year and the Fed has embarked on a precarious balancing act, trying to rein in high inflation while simultaneously avoiding a severe economic slowdown (Recession). Whether the economy can withstand rising rates during a period of geopolitical turmoil and a lingering pandemic is a question without an immediate answer.

“I think the recession risk is very high,” said David Rosenberg, chief economist of his own firm, Rosenberg Research, in Toronto. “The Fed is caught in a box of its own making because it didn’t move quickly enough on raising rates. Now it has to be seen to move aggressively.”

One major thing Powelll said yesterday, in answer to a reporter's question was: "OBVIOUSLY" the Fed should have begun tightening rates earlier – before inflation got so high. In the table above you'll notice the Fed stil hasn't accepted the reality of inflation in 2023 and 2024 – acting as if what they do in 2022 will be enough to fix everything. If it's not, Gundlach will have his Recession – and we will all share in the pain.