"We'll be fighting in the streets

With our children at our feet

And the morals that they worship will be gone

And the men who spurred us on

Sit in judgement of all wrong

They decide and the shotgun sings the song" – The Who

A month of fighting!

So far, Russia has attacked 50 health-care targets in Ukraine – to prevent civilians from receiving care after they bomb their homes, churches and schools. This isn't just a "war crime" – this is Terrorism but, because it's being carried out by a "Super-Power" – we're just letting it happen.

What is the point of NATO, what is the point of the UN if we don't step in and stop aggression like this? If your kid was being beaten up every day by a bully and you the Principle told you "Don't worry, it will affect the bully's PERMANENT Record" while your kid kept getting his daily beatings – would you consider that competent oversight? Well, that's what we're doing with Sanctions – in now way, shape or form does it stop Russia from murdering Ukrainians and stealing their land – but we can pretend we've done our part.

What is the point of NATO, what is the point of the UN if we don't step in and stop aggression like this? If your kid was being beaten up every day by a bully and you the Principle told you "Don't worry, it will affect the bully's PERMANENT Record" while your kid kept getting his daily beatings – would you consider that competent oversight? Well, that's what we're doing with Sanctions – in now way, shape or form does it stop Russia from murdering Ukrainians and stealing their land – but we can pretend we've done our part.

After all, as Joe Biden reminds us, we don't want to start World War III. Well, here's a secret for him that we should have learned in WWII – It's already been started and, once again, it's the lack of response by the Allied Forces that is allowing it to grow. "Tyranny shall not be tolerated" is not supposed to be just some phrase from a history textbook – what's happening now will BE history one day, you know.

“We are seeing an uneasy calm in markets right now — markets have bought Mr Powell’s messaging so far but they could easily have a second think about it this week, while Ukraine-Russia news remain volatile,” said Andrew Ticehurst, rates strategist at Nomura Holdings Inc. “Markets are completely subject to headline risk.”

Anyway, the war did not magically go away over the weekend and Oil is back to $107 after hitting $108 overnight. The Dow and the S&P are going to take a hit this morning, not because of the war no one seems to care about but because yet another Boeing 737 has crashed – this time in China just a few hours ago. It was a 737-800, not the MAX but the crash profile was similar, with the plane suddenly going into a dive. Regardless of the fault – BA stock will take a big hit this morning.

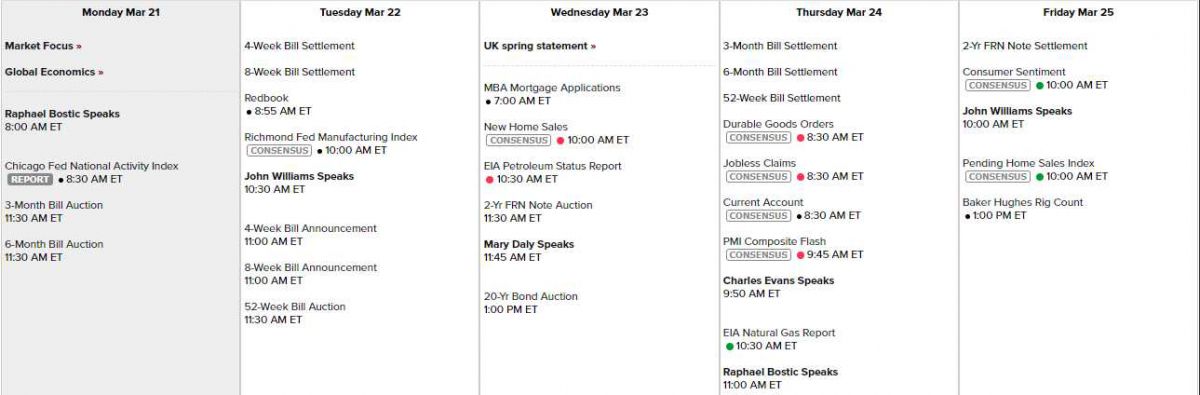

This is not a very exciting week, economically, as we're waiting for Q1 earnings reports to begin in a couple of weeks. While we wait, it's pretty much just the Richmond Fed and Home Sales this week with Consumer Sentiment on Friday and a Fed Speaker per day except Thursday (and Bostic is hawkish) – so I imagine PMI will be running hot and they want to talk it down.

And we still have plenty of Earnings Reports coming at us:

The indexes had a technically constructive week last week – we'll see if they hold it.