By Przemyslaw Radomski, CFA. Originally published at ValueWalk.

The Fed’s hawkish alerts seem like a voice in the wilderness to gold investors. However, a carefree attitude can backfire on them – in just a few months.

An epic battle is unfolding across the financial markets as the Fed warns investors about its looming rate hike cycle and the latter ignores the ramifications. However, with perpetually higher asset prices only exacerbating the Fed’s inflationary conundrum, a profound shift in sentiment will likely occur over the next few months.

Q4 2021 hedge fund letters, conferences and more

To explain, I highlighted in recent days how the Fed has turned the hawkish dial up to 100. Moreover, I wrote on Mar. 22 that it’s remarkable how much the PMs’ domestic fundamental outlooks have deteriorated in recent weeks. Yet, prices remain elevated, investors remain sanguine, and the bullish bands continue to play.

Inflation Is Still Rising

However, with inflation still rising and the Fed done playing games, the next few months should elicit plenty of fireworks. For example, with another deputy sounding the hawkish alarm, San Francisco Fed President Mary Daly said on Mar. 22: “Inflation has persisted for long enough that people are starting to wonder how long it will persist. I’m already focused on letting make sure this doesn’t get embedded and we see those longer-term inflation expectations drift up.”

As a result, Daly wants to ensure that the “main risk” to the U.S. economy doesn’t end up causing a recession.

Please see below:

Source: Reuters

Likewise, St. Louis Fed President James Bullard reiterated his position on Mar. 22, telling Bloomberg that “faster is better,” and that “the 1994 tightening cycle or removal of accommodation cycle is probably the best analogy here.”

Please see below:

Source: Bloomberg

Falling on Deaf Ears

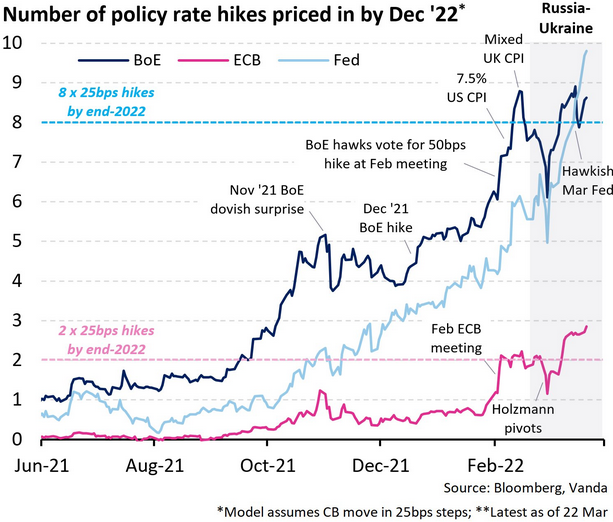

To that point, while investors seem to think that the Fed can vastly restrict monetary policy without disrupting a healthy U.S. economy, a major surprise could be on the horizon. For example, the futures market has now priced in nearly 10 rate hikes by the Fed in 2022. As a result, should we expect the hawkish developments to unfold without a hitch?

Please see below:

To explain, the light blue, dark blue, and pink lines above track the number of rate hikes expected by the Fed, BoE, and ECB. If you analyze the right side of the chart, you can see that the light blue line has risen sharply over the last several days and months. For your reference, if you focus your attention on the material underperformance of the pink line, you can see why I’ve been so bearish on the EUR/USD for so long.

Also noteworthy, please have a look at the U.S. 2-Year Treasury yield minus the German 2-Year Bond yield spread. If you analyze the rapid rise on the right side of the chart below, you can see how much short-term U.S. yields have outperformed their European counterparts in 2021/2022.

Source: Bloomberg/ Lisa Abramowicz

Investors Are Fighting The Fed

More importantly, though, with Fed officials’ recent rhetoric encouraging more hawkish re-pricing instead of talking down expectations (like the ECB), they want investors to slow their roll. However, investors are now fighting the Fed, and the epic battle will likely lead to profound disappointment over the medium term.

Case in point: when Fed officials dial up the hawkish rhetoric, their “messaging” is supposed to shift investors’ expectations. As such, the threat of raising interest rates is often as impactful as actually doing it. However, when investors don’t listen, the Fed has to turn the hawkish dial up even more. If history is any indication, a calamity will eventually unfold.

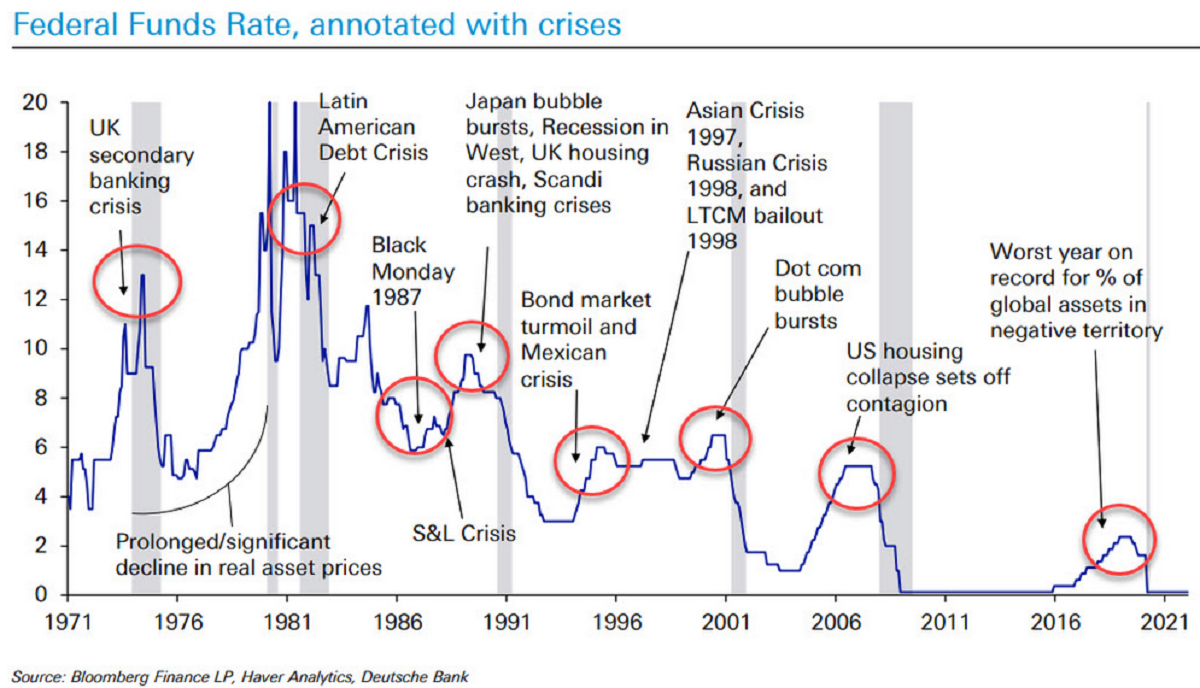

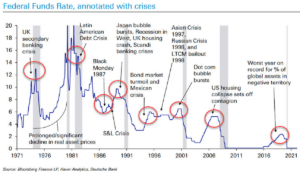

Please see below:

To explain, the blue line above tracks the U.S. federal funds rate, while the various circles and notations above track the global crises that erupted during the Fed’s rate hike cycles. As a result, standard tightening periods often result in immense volatility.

However, with investors refusing to let asset prices fall, they’re forcing the Fed to accelerate its rate hikes to achieve its desired outcome (calm inflation). As such, the next several months could be a rate hike cycle on steroids.

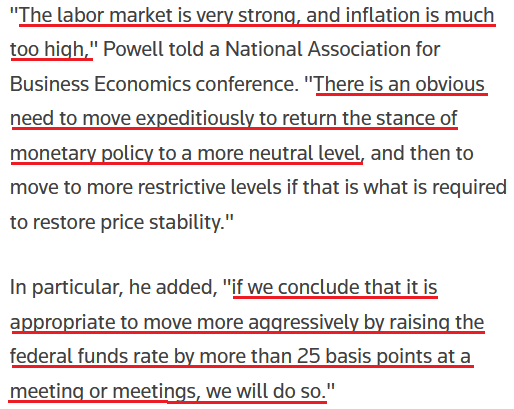

To that point, with Fed Chairman Jerome Powell dropping the hawkish hammer on Mar. 21, I noted his response to a question about inflation calming in the second half of 2022. I wrote on Mar. 22:

“That story has already fallen apart. To the extent it continues to fall apart, my colleagues and I may well reach the conclusion we’ll need to move more quickly and, if so, we’ll do so.”

To that point, Powell said that “there’s excess demand” and that “the economy is very strong and is well-positioned to handle tighter monetary policy.” As a result, while investors seem to think that Powell’s bluffing, enlightenment will likely materialize over the next few months.

Please see below:

Source: Reuters

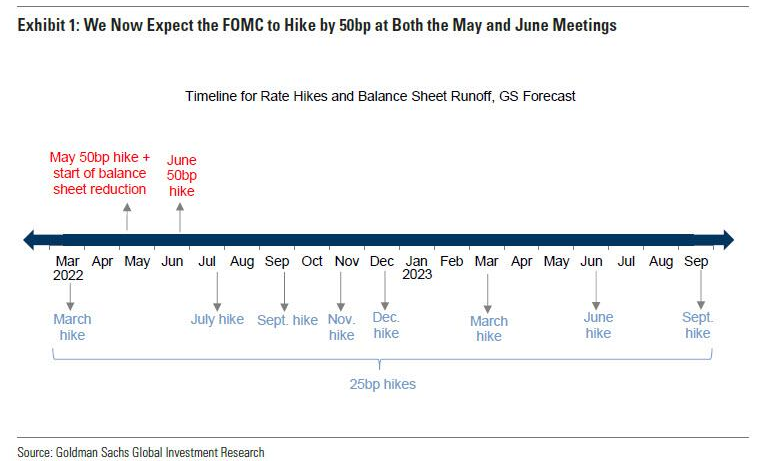

Furthermore, with Goldman Sachs economists noting the shift in tone from “steadily” in January to “expeditiously” on Mar. 21, they also upped their hawkish expectations. They wrote:

“We are now forecasting 50bp hikes at both the May and June meetings (vs. 25bp at each meeting previously). The level of the funds rate would still be low at 0.75-1% after a 50bp hike in May, and if the FOMC is open to moving in larger steps, then we think it would see a second 50bp hike in June as appropriate under our forecasted inflation path.”

“After the two 50bp moves, we expect the FOMC to move back to 25bp rate hikes at the four remaining meetings in the back half of 2022, and to then further slow the pace next year by delivering three quarterly hikes in 2023Q1-Q3. We have left our forecast of the terminal rate unchanged at 3-3.25%, as shown in Exhibit 1.”

Please see below:

In addition, this doesn’t account for the Fed’s willingness to sell assets on its balance sheet. For context, Powell said on Mar. 16 that quantitative tightening (QT) should occur sometime in the summer and that shrinking the balance sheet “might be the equivalent of another rate increase.” As a result, investors’ lack of preparedness for what should unfold over the next few months has been something to behold. However, the reality check will likely elicit a major shift in sentiment.

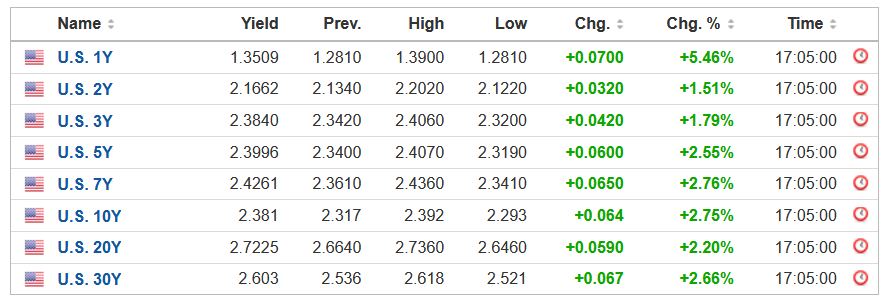

In contrast, the bond market heard Powell’s message loud and clear, and with the U.S. 10-Year Treasury yield hitting another 2022 high of ~2.38% on Mar. 22, the entire U.S. yield curve is paying attention.

Please see below:

Source: Investing.com

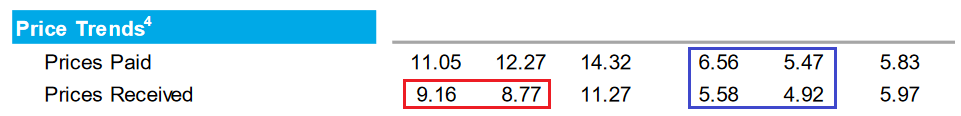

Finally, the Richmond Fed released its Fifth District Survey of Manufacturing Activity on Mar. 22. With the headline index increasing from 1 in February to 13 in March, the report cited “increases in all three of the component indexes – shipments, volume of new orders, and number of employees.”

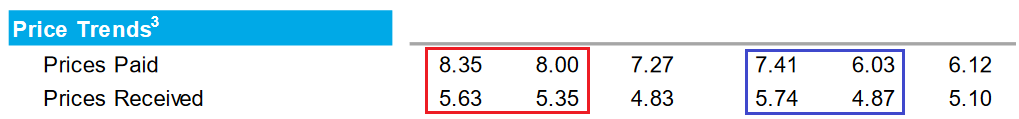

Moreover, the prices received index increased month-over-month (MoM) in March (the red box below), while future six-month expectations for prices paid and received also increased (the blue box below). As a result, inflation trends are not moving in the Fed’s desired direction.

Please see below:

Source: Richmond Fed

Likewise, the Richmond Fed also released its Fifth District Survey of Service Sector Activity on Mar. 22, nd while the headline index decreased from 13 in February to -3 in March, current and future six-month inflationary pressures/expectations rose MoM.

Source: Richmond Fed

The bottom line? While the Fed is screaming at the financial markets to tone it down to help calm inflation, investors aren’t listening. With higher prices resulting in more hawkish rhetoric and policy, the Fed should keep amplifying its message until investors finally take note. If not, inflation will continue its ascent until demand destruction unfolds and the U.S. slips into a recession. As such, if investors assume that several rate hikes will commence over the next several months with little or no volatility in between, they’re likely in for a major surprise.

In conclusion, the PMs declined on Mar. 22, as the sentiment seesaw continued. However, as I noted, it’s remarkable how much the PMs’ domestic fundamental outlooks have deteriorated in recent weeks. Thus, while the Russia-Ukraine conflict keeps them uplifted, for now, the Fed’s inflation problem is nowhere near an acceptable level. As a result, when investors finally realize that a much tougher macroeconomic environment confronts them over the next few months, the shift in sentiment will likely culminate in sharp drawdowns.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Updated on

Sign up for ValueWalk’s free newsletter here.