"Still don't know what I was waitin' for

And my time was runnin' wild

A million dead end streets and

Every time I thought I'd got it made

It seemed the taste was not so sweet

So I turned myself to face me

But I've never caught a glimpse

How the others must see the faker

I'm much too fast to take that test"Ch-ch-ch-ch-changes

Turn and face the strange

Ch-ch-changes

Ooh, look out, you rock 'n' rollers

Ch-ch-ch-ch-changes

Turn and face the strange

Ch-ch-changes

Pretty soon now you're gonna get older" – Bowie

I love it when I mention something in the Webinar and, the next day, it becomes a major article in the mainstream media.

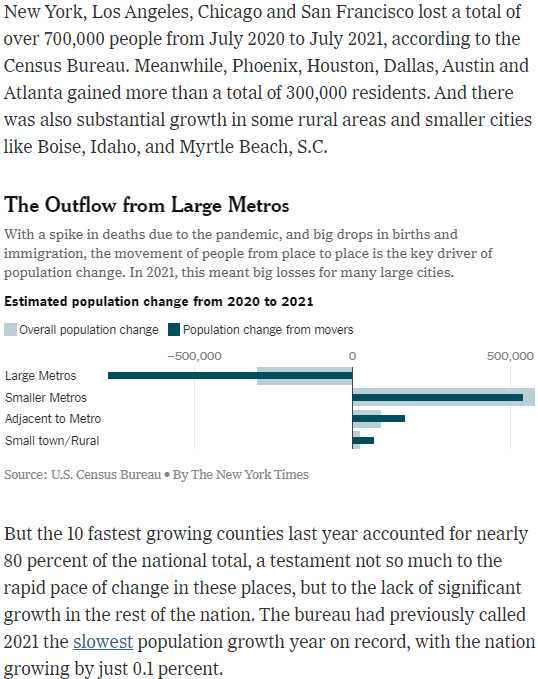

We were discussing how Covid is permanently changing the cities and I was looking for statistics and now here they are. NY, LA and Chicago alone lost 700,000 people last year – the population of a large city itself. US population on the whole was the flattest it's ever been, with 0.1% growth so please, tell me again how GDP is going to grow this year?

The good news is that job growth is much more impressive when it doesn't have to keep up with population growth. In a normal year, the US adds about 2M people – so you need 150,000 jobs per month just to employ the growing population but the population only grew by 300,000 all of last year – not even enough to staff Popeye's (QSR).

NY (8.3M), LA (4M) and Chicago (2.7M) have 15M people, so we're talking about an exodus of 5% of their population in a single year – you would think it was Kyiv! The map on the right shows how many vacant buildings there are in NY's Greenwich Village and it would be a LOT worse if most commercial leases didn't run 5 and 10 years – so there are many, many lots that are technically occupied but with non-paying tenants.

NY (8.3M), LA (4M) and Chicago (2.7M) have 15M people, so we're talking about an exodus of 5% of their population in a single year – you would think it was Kyiv! The map on the right shows how many vacant buildings there are in NY's Greenwich Village and it would be a LOT worse if most commercial leases didn't run 5 and 10 years – so there are many, many lots that are technically occupied but with non-paying tenants.

Restaurants average ten-year leases, and twenty-plus isn't unheard of for larger chain retail. With a fixed yearly percentage increase normally locked-in, landlords want to get the highest possible rent at the outset; taking a cheaper tenant means leaving lots of money on the table over the term of the lease. In a hot neighborhood, a tenant could end up paying below market by the end of the lease term as neighboring rents (and property taxes) increase. Rather than take the risk, landlords leave spaces vacant and hold out for big tenants.

Rent in desirable, high-traffic locations is always expensive: a small Lower East Side storefront goes for $8,000/mo, cavernous spaces in glitzy midtown high-rises run into the hundreds of thousands (often hidden behind 'Call for price' or 'Negotiable' on listings.) The pool of tenants for a 2200sf, $36,000/mo restaurant space by Union Square is shallow, the one for a $1,600/sf/yr space on Madison Ave (making that same restaurant $290,000/mo) is barely a puddle. Only the biggest chains can afford the spaces, usually at a loss absorbed by other stores. With a limited selection of tenants to woo, plus large corporations' glacial negotiating pace, expensive storefronts sit empty for years.

Add to all this the fact that (as we investigated yesterday) 1M people PER DAY, who used to commute to NYC may never do so again and another 1M have left the city. For NYC's 7,000 restaurants that's 285 less lunches EACH and for 25,000 bars, that's 80 less drinks at happy hour (maybe 160). Yeah, that's right, we drink almost 4 times more than we eat in NYC! And you know what? We drink at the restaurants too – take that Boston!

So the situation in the cities is this: 5% of their population left last year and a large portion of the commuters aren't showing up. That is devastating for retailers and restaurants (and tourism is way down too). All this has been papered over by $11Tn in bailouts over the past two years (25% of our GDP per year!) but the fact of the matter is that many, many retailers and restaurants are stuck in leases they can no longer afford and if we have another year or two of population outflows – you're going to start to see these cities die slow, painful deaths.

![Data] 2021 Restaurant Inflation and Its Impact | 7shifts](https://blogassets.7shifts.com/2021/09/Inflation-Graphs---Receipts.png) One of the reasons you are seeing such sharp increases in restaurant costs isn't just the food costs or the staff costs – you are paying for the customers who aren't there. The restaurant has to cover their fixed costs and whether it's divided by 6,000 customers per month of 4,000 customers per month – the costs are essentially the same so let's say that $36,000/month restaurant used to charge $6 per meal for rent, now they charge $9 – inflation! If more people move out – the restaurant has to charge more to the people who remain – causing them to want to move as well.

One of the reasons you are seeing such sharp increases in restaurant costs isn't just the food costs or the staff costs – you are paying for the customers who aren't there. The restaurant has to cover their fixed costs and whether it's divided by 6,000 customers per month of 4,000 customers per month – the costs are essentially the same so let's say that $36,000/month restaurant used to charge $6 per meal for rent, now they charge $9 – inflation! If more people move out – the restaurant has to charge more to the people who remain – causing them to want to move as well.

It's downright depressing walking around Manhattan these days with 1 in 4 stores you pass boarded up:

Urban Decay is now a brand of cosmetics so good luck Googling the concept and I guess they thought it was a fun name because most people have forgotten the 70s and early 80s when many cities turned into war zones (remember Robocop, Death Wish, Escape from New York?) and NYC almost went bankrupt? Here's the Wikipedia take on it:

Urban decay (also known as urban rot, urban death and urban blight) is the sociological process by which a previously functioning city, or part of a city, falls into disrepair and decrepitude. It may feature deindustrialization, depopulation or deurbanization, economic restructuring, abandoned buildings or infrastructure, high local unemployment, increased poverty, fragmented families, low overall living standards or quality of life, political disenfranchisement, crime, elevated levels of pollution, and a desolate cityscape known as greyfield or urban prairie.

Since the 1970s and 1980s, urban decay has been a phenomenon associated with some Western cities, especially in North America and parts of Europe. Cities have experienced population flights to the suburbs and exurb commuter towns; often in the form of white flight.[1] Another characteristic of urban decay is blight—the visual, psychological, and physical effects of living among empty lots, buildings and condemned houses.

The same conditions we had then are hitting us now and we are WAY too distracted by all the other problems to give a second's thought to cities that MIGHT be in trouble but 5% of the population fleeing in one year is A BIG F'ING WARNING SIGN and I strongly suggest politicians heed it now – rather than when it's already too late to stop it.

Oh, who am I kidding – most of the problems we do have now are exactly because no one wanted to address them when they were smaller. We're just screwed…