171 points.

171 points.

That is the summary of March so far – we're up 171 (3.9%) S&P points from 4,373 where we closed on Feb 28th, despite the war – and everything else that's going on. The S&P has closed higher in 7 of the past 9 sessions with one flat and only a single down day in the past two weeks – last Wednesday when the Fed announce a rate hike but then Powell spoke and saved us from the drop.

As I have been saying, there's simply nothing better to do with your money but store it in US Equities.

“The view is we should just rotate to sectors which are more favorable to the situation, because there’s really not much of an alternative to equities,” said Ilya Feygin, managing director and senior strategist at WallachBeth Capital.

Yes, I just said that! Large-cap stocks in the U.S. offer more safety and value than small and mid-cap shares since they tend to generate reliable income for investors, especially companies that can maintain dividend payouts. In addition, the U.S. equity market’s swoon to start the year may have largely priced in a spike in oil prices and softening of economic growth, meaning they aren’t as expensive anymore

“Stocks appear to have largely priced in near-term geopolitical and interest-rate risks,” Gina Martin Adams, chief equity strategist at Bloomberg Intelligence, wrote in a note. “Earnings forecasts are climbing again, as analysts get more comfortable with supply-chain risks and revenue estimates keep improving.”

S&P 500 firms took their bailout money (YOUR tax Dollars) and bought back $882 billion of their own stock last year, up 9.3% from the prior record set in 2018, according to S&P Dow Jones Indices. These massive buybacks reduce the overall share count which we divide the earnings by – making it look like Earnings Per Share is going up – even when earnings are flat because there are less shares to divide them by.

S&P 500 firms took their bailout money (YOUR tax Dollars) and bought back $882 billion of their own stock last year, up 9.3% from the prior record set in 2018, according to S&P Dow Jones Indices. These massive buybacks reduce the overall share count which we divide the earnings by – making it look like Earnings Per Share is going up – even when earnings are flat because there are less shares to divide them by.

Keep in mind the market cap of the ENTIRE S&P 500 is "just" $40Tn so $1Tn is 2.5% of that so, when you hear about Earnings for Q1 being up 5% from last year – 2.5% of that is simply because there are now less shares to divide the earnings among (letting the rich get even richer) and, of course, the other 10% is inflaion.

That's how you can be in the middle of a Recession and not even know it.

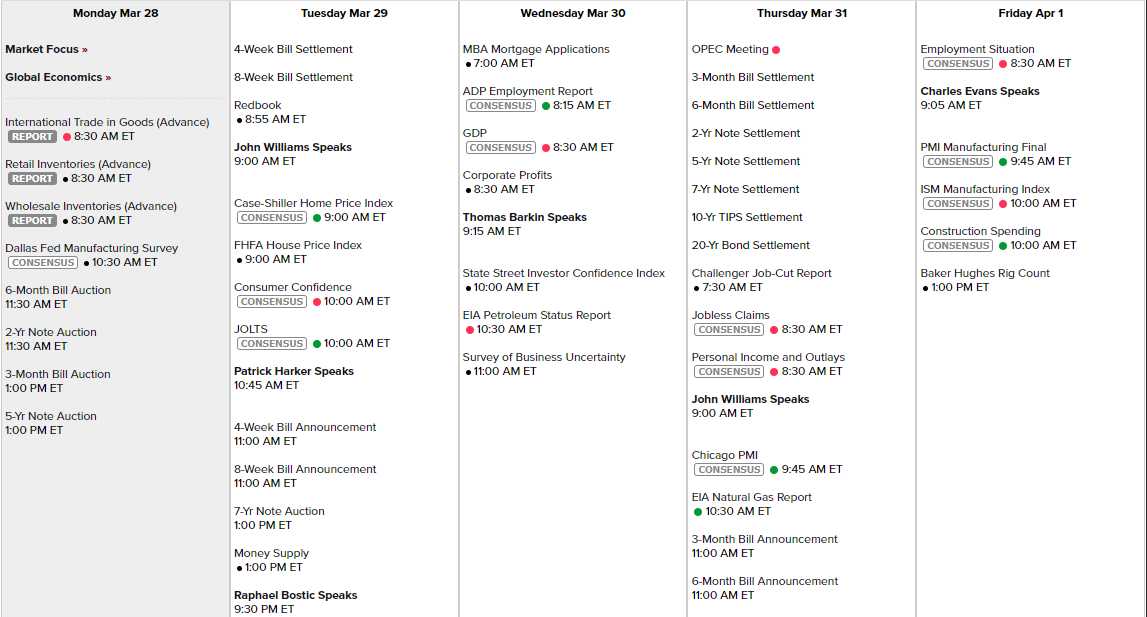

Not that Data matters but we do have Non-Farm Payrolls on Friday and those are going to be bad enough that the Fed has scheduled super-Dove, Charlie Evans to speak right after the report and before the market opens. We also have PMI and ISM – both likely to also be disappointing. Before that, we have the Dallas Fed today and Retail Inventories were up 1.1% already – but not very important. Tomorrow we have Williams, Harker and Bostic to take the heat off declining Consumer Confidence, Wednesday Thomas Barkin will put the spin on GDP ahead of Investor Confidence and Thursday, Williams again is tasked with spinning Personal Income and the Chicago PMI – it's going to be a bumpy ride:

And still we have plenty of Earnings Reports rolling in:

I'll be curious to hear what Micron (MU) has to say tomorrow as Goldman Sachs (GS) just slashed their estimates for Semis, citing "a more challenging macro backdrop over the next 12 months." Last I heard, we use semis to make a lot of stuff so it's hard to imagine strong GDP growth with declining semis but, since when has logic had anything to do with this market?

Things are only going to get crazier….