"Well I don't know why I came here tonight.

I've got the feeling that something ain't right.

I'm so scared in case I fall off my chair,

And I'm wondering how I'll get down the stairs.Clowns to the left of me!

Jokers to the right!

Her I am stuck in the middle with you." – Stealers Wheel

Well, shorting certainly didn't work out yesterday as the S&P blasted back over 4,400 and is now testing the 200 dma at 4,496 and we'll see if that goes but WHY are we suddenly so bullish – that is baffling.

Even this morning, Netflix (NFLX) is dropping over 25% but the Nasdaq seems unphased by the $50Bn loss in market cap. If the indexes are determined to simply ignore earnings and resume their daily uptrend – we should start seeing progress on the Retracement Bounce Chart – which tracks how far we've come off the highs – at the moment though, we're still pretty red:

- Dow 36,000 to 34,200 has bounce lines of 34,560 (weak) and 34,920 (strong)

- S&P 4,700 to 4,465 has bounce lines of 4,512 (weak) and 4,559 (strong)

- Nasdaq 16,500 to 15,675 has bounce lines of 15,840 (weak) and 16,005 (strong)

- Russell 2,400 to 2,080 has bounce lines of 2,144 (weak) and 2,208 (strong)

As usual, the Dow pretty much does its own thing with just 30 stocks in the index (and they are mostly Blue Chip, safety stocks that people panic into in rough times) but the broader Russell 2000 is barely off the lows – so we need to see some kind of catching up in htat index. 35,000 will be a tough line for /YM to cross this morning – we'll see how that goes and then 4,500 on the S&P (/ES) would conform a bit of bullishness ahead of the weak bounce line being tested.

I would say both those lines make good shorting spots but the way the S&P burned us yesterday – I think watching and wating is our best move at the moment…

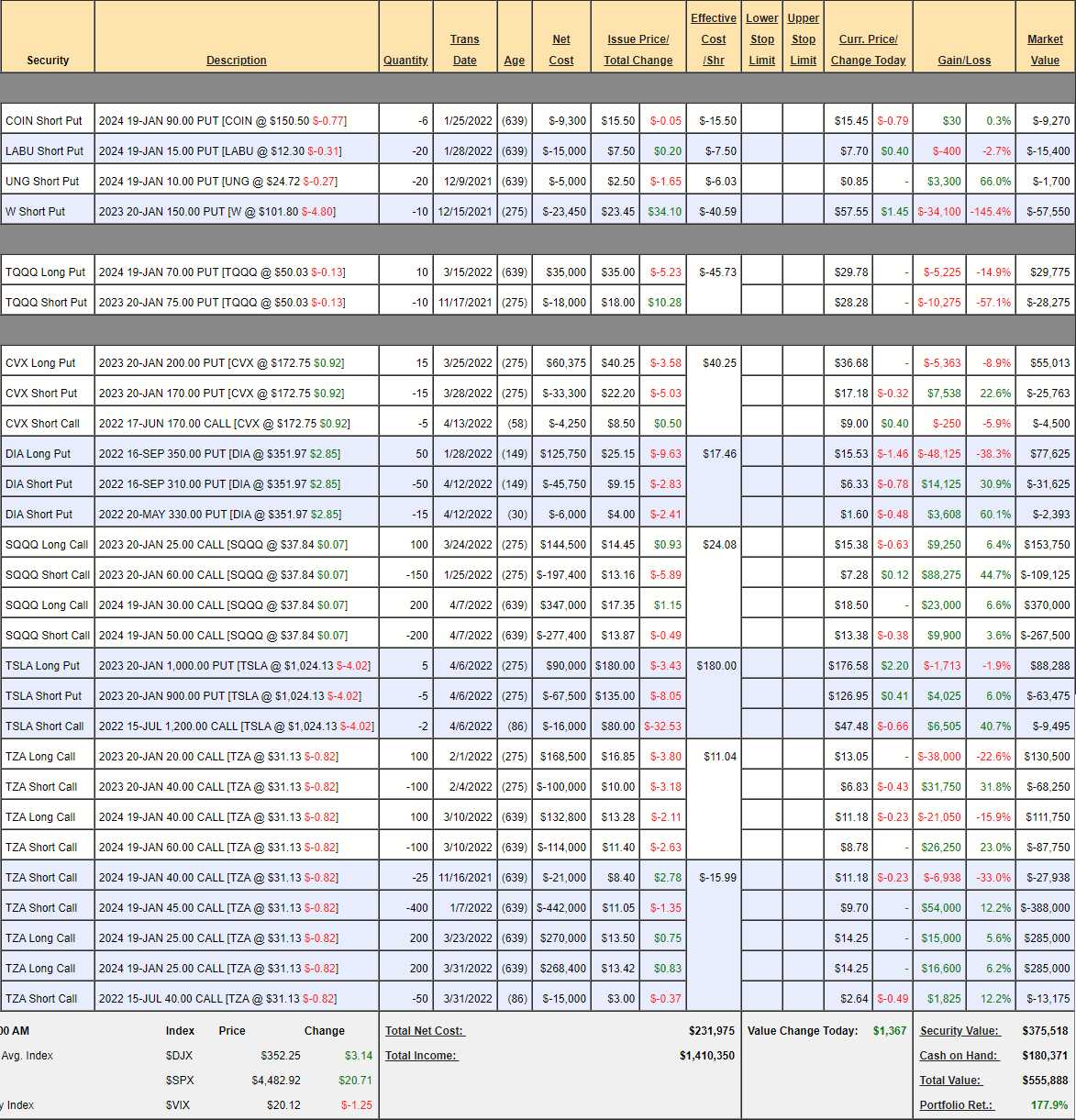

While we wait, however, we might be able to take advantage of the move up and press our hedges (since they are cheaper this week). We barely touched our Short-Term Portfolio (STP) in last week's review so let's see if there's anything we can take advantage of today:

- DIA – Last week we widened the spread and sold $6,000 worth of short puts. While our long puts are down 38%, we can take advantage on that side and roll them to 50 of the Jan $400 ($51.50)/350 ($22.50) bull call spreads at $29 and we can roll 25 (1/2) of our Sept $310 puts at $6.33 to 25 May $350 puts at $6.25 to shorten the time decay on those and we'll buy back the short May $330 puts so as not to be over-covered.

- SQQQ – This is a good time to address the imbalance on our Jan $60 calls as they are up about 50% so let's buy 50 of them back and that puts us in a position to sell more short-term calls on the next bounce.

- TZA – The only change I want to make is buying back 100 short 2023 $40 calls for $6.83 as it frees us up to sell 100 shorter-term calls on the next bounce. The July $34 calls are, for example, $4 and only using 86 days and selling them can't hurt us but it sets us up to make twice as much money selling calls for the rest of the year.

And that's how it should be when you have a well-balanced portfolio – just some minor adjustments to stay on top of these market changes.