Katy bar the door

Courtesy of Joshua M Brown

Scotland, 1437.

King James I had been sitting on the throne for just 12 years but virtually every moment of his reign was chaotic. Usurpers from within several branches of the nobility had been out to get him from the moment he ascended with his English bride after a decade of captivity. He fought with the Highland lords, he quarreled with the Catholics, he jailed and assassinated his familial rivals. And when he wasn’t scrapping, he retreated to the serenity of the tennis court. James spent a lot of time playing tennis. So much so that he requested an adjacent sewer drain be closed off because too many of the tennis balls were rolling into it and getting lost – a minor annoyance that would eventually have major consequences, but we’ll get there in a moment…

James and his wife, Queen Joan, had been spending the winter at Blackfriars, a Dominican abbey in Perth. One February night, some of the nobles who supported a rival claim to the throne came for him. Sir Robert Graham and his co-conspirators came bursting through the entryway to the church compound on horseback and quickly began chasing down members of James’s family. Queen Joan escapes the plot but her husband is not so lucky. James finds himself trapped in a room with one of the queen’s handmaidens, Catherine Douglass – Kate. When the marauders attempt to break through, Catherine thrusts her arm through the brackets to replace the missing bar in an attempt to hold the door closed. This doesn’t work and her arm is broken. She does become famous for this attempted defense of the king, eventually becoming known as “Kate Barlass”.

When the Scots-Irish immigrated to America, many settled in the South and they brought their folk songs and idioms with them. “Katy bar the door” included. It means watch out or brace for trouble. If you were ever wondering where the expression originally came from, now you know.

We’re about to experience a Katy bar the door moment in the US stock market thanks to the fact that the two most important stocks are now reaching a moment of truth that could have big ramifications for psychology. Apple and Microsoft, both in newly established downtrends, are close enough to important support levels that all of us ought to be paying close attention to what happens next.

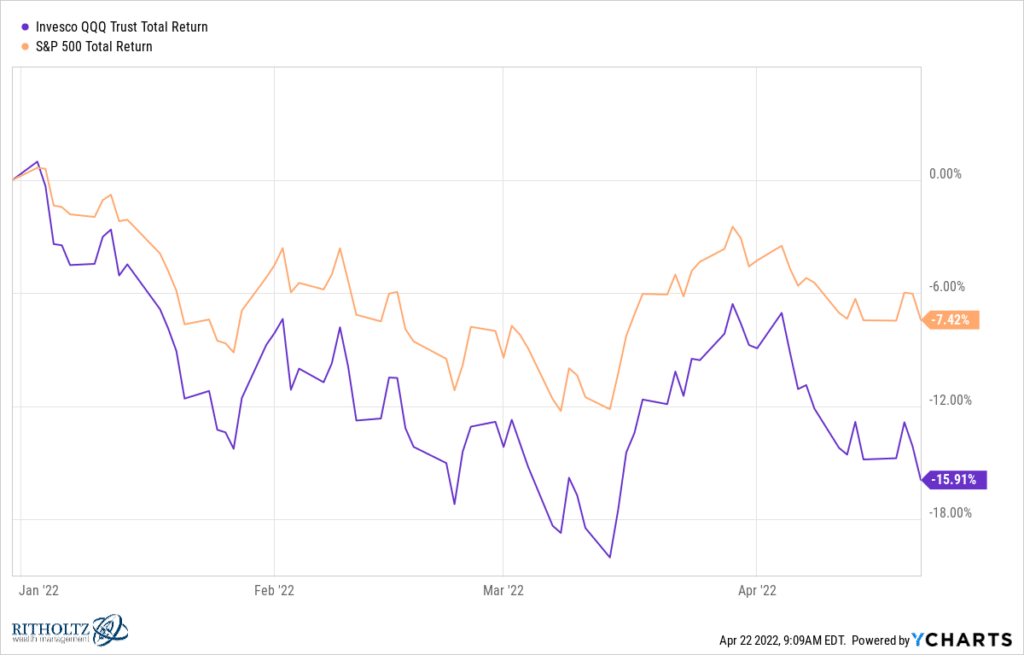

First, let’s get a year-to-date glance at returns for the only two stock indices that really matter – S&P 500 and the Nasdaq 100 QQQ’s – this is where all the market capitalization is and the stocks that make up these indices are the ones that influence people’s feelings and opinions about the near-term prospects for their portfolios…

It feels worse than it is for the S&P 500. While massively popular tech and communications stocks like Meta and Netflix have recently blown up, the stock market as a whole has held up. This is, in part, because so many other non-technology stocks are benefiting from robust demand – industrials, materials, energy, etc. But the truth is, most of the stocks in those sectors are tiny and not mathematically important. What’s really holding up the whole tent from collapsing into a full-blown bear market is the strength of Apple and Microsoft. These two names are a combined $5 trillion in market cap and are major weights for the QQQ’s, the S&P and even the Dow Jones. They’re widely owned, highly regarded and closely followed by millions of professionals all over the world and tens of millions of amateurs.

And if they break, the stock market is f***ed. Royally. The relatively mild year-to-date drawdown of 7% will become something much more serious if and when the bulls lose either of these stocks to a technical breakdown. First comes the statistical damage and then comes the blow to sentiment. You could make the argument that, because these are the last men standing, they have to break down in order for the market-wide correction to finally come to an end (it’s been slow-rolling since February 2021). Okay, that’s one perspective. My perspective is that this correction cannot end with Apple still selling for 27 times earnings and Microsoft at 29. So, no, I don’t believe a breakdown for these stocks would be the end of something, I think it would be a big event on the road to our eventual destination: A double-digit drawdown for the S&P 500 and a 20% bear market for the Nasdaq.

I’ve been talking about it since January and now I think the moment is at hand. And my attitude has always been “Let’s just get it over with.”

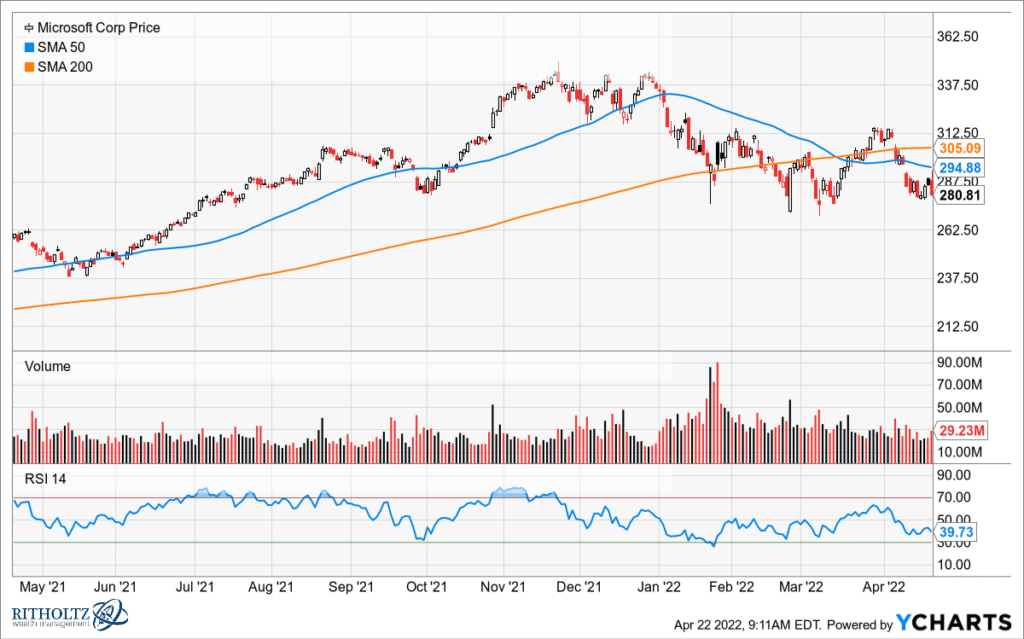

Let’s look at the charts. I don’t do a lot of fancy indicators or draw all these lines and levels. You can take a glance at MSFT, for example, and see that the stock has been putting in lower highs on each successive bounce and lower lows on the way down. The trend is lower. And we’re now challenging 275 – a level at which buyers have come in multiple times to support the stock. The more times that support level is challenged, the more likely it eventually gives way. The buyers exhaust themselves and the sellers take control. Microsoft reports earnings next Tuesday April 26th. Two questions: Can they beat estimates and, even if they can, will it matter?

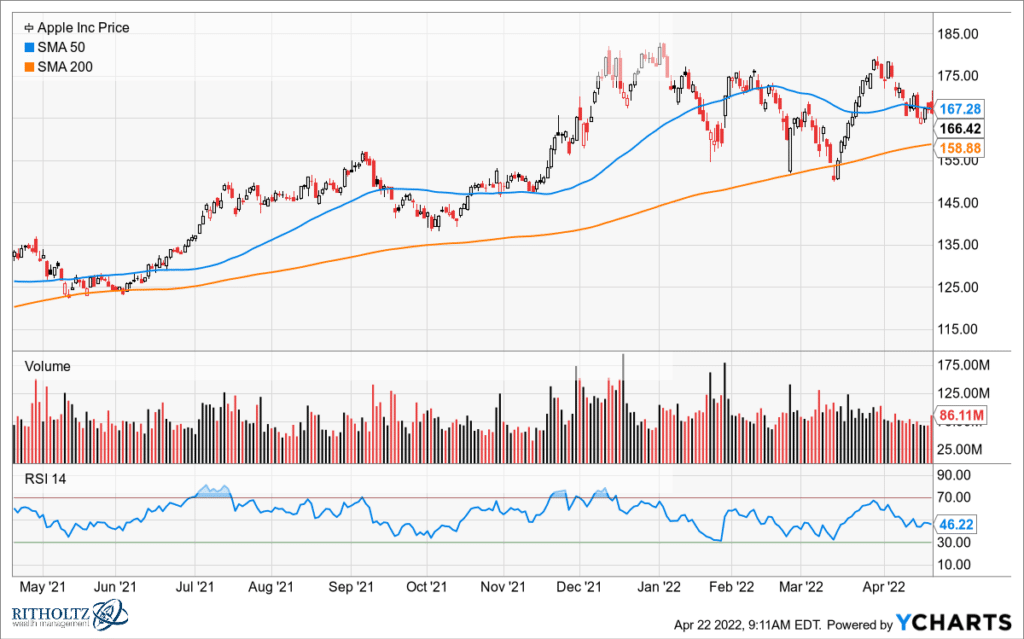

Apple looks better than Microsoft even though its recent high was also below the previous high. This is a stock that actually seems to benefit while other stocks suffer – almost as if the market cap is being magnetically sucked into Apple’s orbit as it bleeds away from other sectors and stocks. At $2.7 trillion it’s the most important stock in the world. It’s been almost completely impervious to the fall of the stay-at-home stocks and the ARK-onauts and the rest of the growth equity complex. It’s not merely another planet in the Nasdaq solar system like PayPal or Amazon, it is the sun itself. There are very few examples of mega-cap technology stories that remain this close to all-time highs. Tesla, Alphabet, can’t think of any others off the top of my head. An elite club. Apple reports next Thursday, April 28th after the close. Which means next Friday we will know whether or not we’re in a bear market.

The 155 level seems to have some meaning to market participants. It was resistance last September and then support in February and March. That kick save and then vertical rally a month ago probably saved the whole US stock market. Want to bet on that happening twice?

So, for me, those are the levels to keep an eye out for next week – we don’t know what the earnings reports will be or how the market may react to them. But we know that the bulls failing to show up for a Microsoft retest at 275 would not be good. And Apple below 150 is Katy bar the door.

Back to Scotland…

How is it that King James found himself cornered to begin with while most of his retinue had been able to escape the raid? Well, he did attempt to run down through the sewer into the outlet leading to the Blackfriars tennis court, which would put him outside the walls and on his way to freedom. Unfortunately, that very week he had ordered that the drain be blocked so as to stop his tennis balls from getting lost. Ironically, the sport he had been pursuing to restore his health would ultimately be the thing that would cost him his life. James is stabbed sixteen times and bleeds to death while attempting to fend off his attackers.

The metaphorical bloodshed that a breakdown in Apple or Microsoft – or both – might cause this market is probably the biggest unknown hanging over our heads this earnings season. With a little luck and a pair of great earnings reports, we won’t have to find out. Or will we?