By Fintel. Originally published at ValueWalk.

Big 5 Sporting Goods Corporation (NASDAQ:BGFV) is a sporting goods retailer headquartered in El Segundo, California with 434 locations across more than 10 states.

BGFV released first-quarter results today that saw profits almost halve, reporting EPS of $0.41 compared to the $0.96 in the prior year. While EPS fell, it was above BGFV’s guidance range of 30-41 cents for the quarter. Group sales came in at $242 million, falling ~$30 million in the prior period. Management noted that it would be hard to beat strong pandemic results from increased spending that occurred over the past 2 years and as inflationary pressures push selling and administrative expenses higher. Big 5 maintained the quarterly dividend at 25 cents per share which annualizes to a ~6.3% dividend yield.

Q1 2022 hedge fund letters, conferences and more

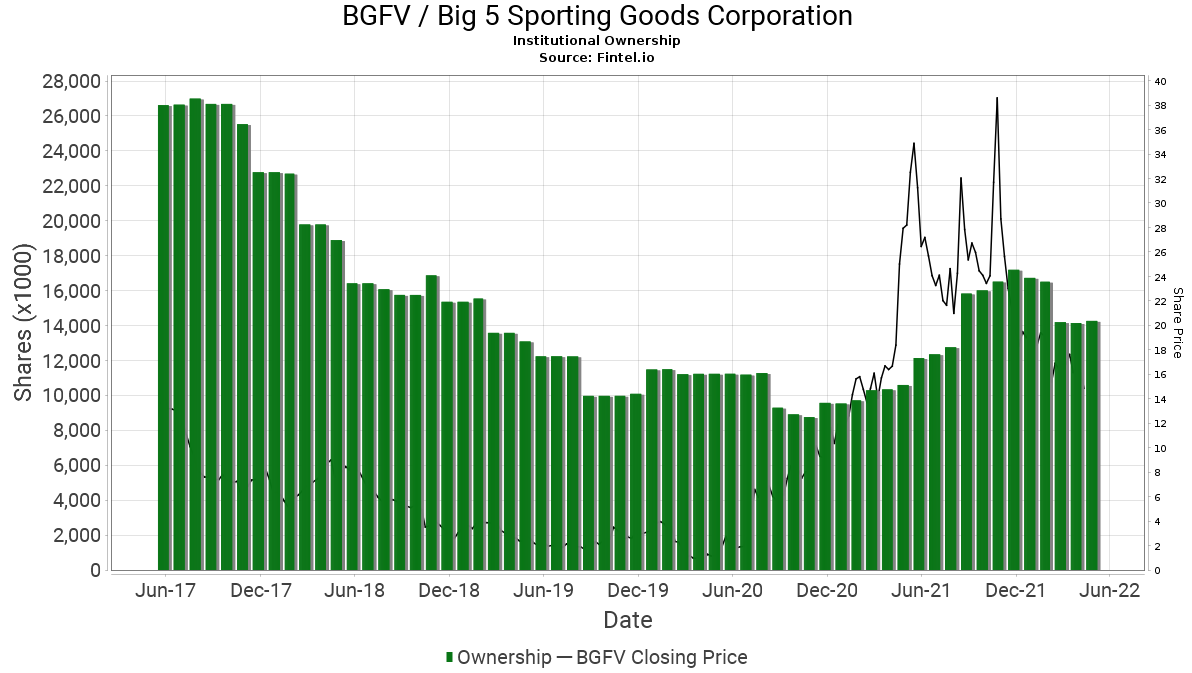

BGFV shares have fallen -21% since the start of 2022 and have been gradually trending lower since a spike in the share price around Q3-21 results that saw the share price rally to an annual high price of $47.65.

Big 5 Sporting Goods’ Guidance And Management Outlook

Management guided second-quarter EPS between 40-50 cents per share, implying 10-20% growth over Q1.

CEO and Chairman, Steven Miller included outlook commentary for the next quarter:

“Our Q2 to date business continues to perform well above historical rates and we expect to generate sales and earnings significantly exceeding any pre-pandemic Q2 in our history. While last year’s record Q2 certainly was remarkable, beating last year’s pandemic-driven results is not a prerequisite to producing another very profitable and successful quarter for the business. We are in a great position, as we stand to continue to benefit from many of the drivers of our success over the last two years, including favorable product trends, higher merchandise margins, and meaningfully reduced print advertising spend. We look forward to continuing to generate very positive bottom-line results.”

When we conducted our own analysis, we discovered that BGFV has a Quality/Value/Momentum score of 76.55 which ranks it well compared to other small-cap peers. The QVM Score is a proprietary scoring model that combines Quality, Value, and Momentum into a single metric that ranks companies from 0 to 100. Included in this score, BGFV has a Quality Score of 86.43 (based on cash-generating efficiencies), a Value Score of 96.41 (relative valuation vs peers) and lags in the Momentum with a score of only 13.15 (6-month momentum).

While the stock lags in the momentum department, we highlight that it was trading on a PE Ratio (TTM) of 3.49x at the close before the results. This is significantly lower than the market average. We think a cheap stock with a strong dividend yield that can be maintained in an interest rate rising environment looks attractive to us!

When we looked at Institutional Ownership, we noticed the stock had a score of 43.50 that ranks it slightly below the midpoint of 24,000 compared stocks. BGFV has 330 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). The scoring model uses a combination of the total increase in disclosed owners, the changes in portfolio allocations in those owners and other metrics. The number ranges from 0 to 100, with higher numbers indicating a higher level of accumulation than its peers, and 50 being the average.

We noticed one analyst covering the stock from Lake Street Capital markets. They have a ‘buy’ rating on the stock with a target price of $28 per share (pre-result), which implies ~75% upside to the current share price levels.

Article by Ben Ward, Fintel

Updated on

Sign up for ValueWalk’s free newsletter here.