By Shane Neagle. Originally published at ValueWalk.

Anyone who has even a tangential familiarity with a Tesla Inc (NASDAQ:TSLA) electric vehicle gets the impression it is a highly advanced computer on wheels. Some would even say Tesla EVs are becoming a subscription-based mobility service. And they wouldn’t be too far off the mark.

Presently, Tesla offers a Full Self-Driving (FSD) feature at $199 per month, if there is a Basic Autopilot present, or $99 per month, if there is an Enhanced Autopilot (EAP) present. In both cases, an FSD computer would have to be installed. However, even without this special feature, Tesla cars are effectively becoming something akin to a software-as-a-service (SaaS) platform.

Q1 2022 hedge fund letters, conferences and more

From premium connectivity subscription to regular OS updates, Tesla’s SaaSification has ramped up so much that one could have bought an “Acceleration Boost” all the way back in 2019. This $2,000 software upgrade reduced Model 3 Dual Motor Long Range acceleration to 3.9 seconds.

Tesla calls these “over-the-air” upgrades, but what they really represent is an overhaul of how the vehicle industry itself is monetized. Morgan Stanley took note of this important development two years ago:

“Tesla is the only company today, to the best of our knowledge, that is fully monetizing its autonomous driving assets at scale. This can potentially provide a large competitive advantage from both a consumer value proposition perspective and technological advancement perspective, given the large amounts of data that Tesla is able to collect from its vehicle fleet vs. the traditional OEMs.”

In other words, the EV industry is not just an EV industry. It is becoming an on-ramp for SaaS services as well. And who is better at marrying hardware with SaaS than Apple Inc (NASDAQ:AAPL)? It is no secret that Apple sales growth (not sales per se) is declining.

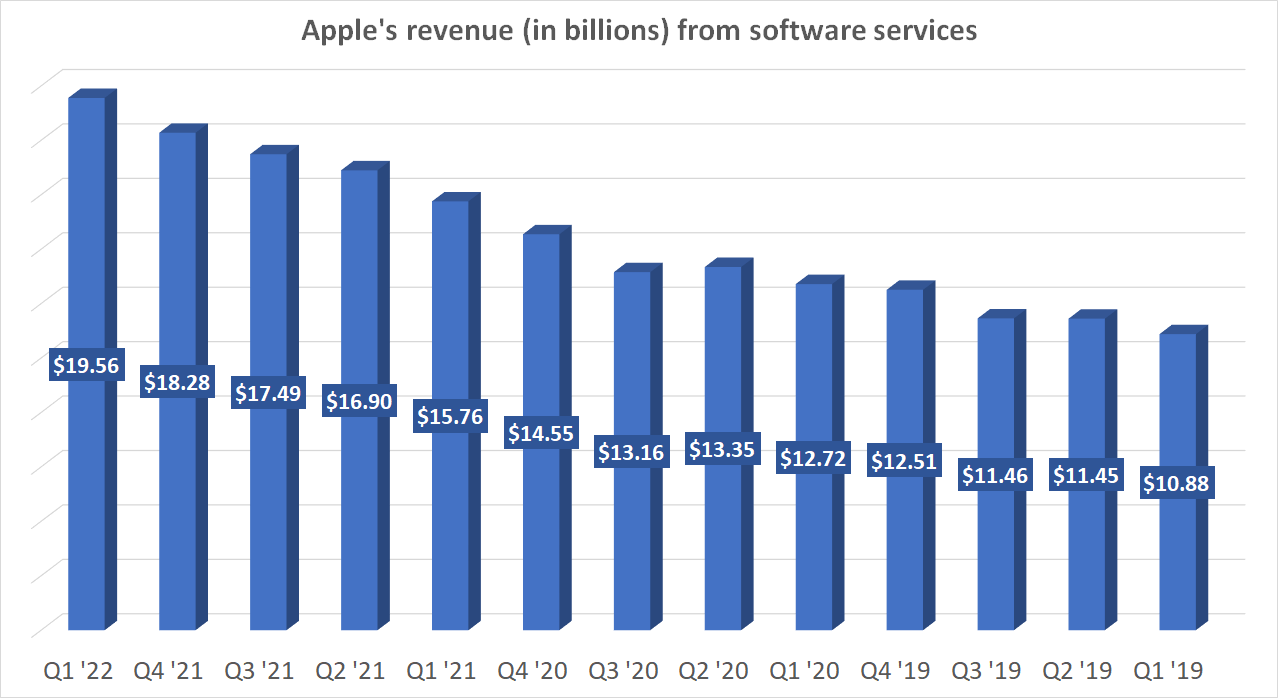

As the Q2 2022 report showed, Apple’s profit climbed by 6%, at $25 billion. However, this is a major slowdown from previous five consecutive quarters that held double-digit range growth. In contrast, Apple’s SaaS revenue has been on a rampage, nearly doubling from 2019.

Source: Statista.com

AAPL and TSLA are both very heavily traded stocks on most popular stock trading apps. But it seems as if they’re about to have much more than just stock trading popularity in common. With 1.23 billion active devices deployed last year, Apple is seeking to expand this SaaS foundation into electric vehicles.

Apple EV as the Next Cog in Apple’s SaaS Ecosystem?

According to insider knowledge reported by Bloomberg, Apple is accelerating its drive toward Apple EV. Although Apple car rumors have been percolating for years, a major step at realizing this project is the recent hiring of Desi Ujkashevic, former veteran Ford Motor executive with over 31 years of experience.

This experience includes automotive safety, engineering chassis and electrical equipment found in Ford models Explorer, Escape, Focus and Fiesta. Furthermore, she worked with Ford’s SUV luxury lineups, Lincoln MKC, and Aviator.

As far as Ujkashevic’ EV experience goes, she was one of the managers for the Ford Rouge Electric Vehicle Center located in Dearborn, Michigan, similar to Tesla’s gigafactories, having opened this year.

Judging by her previous positions, Apple seems to need an executive that can tackle EV development from top to bottom. Given Apple’s sporadic gains in the EV venture so far, the latest hire couldn’t have come sooner.

Apple Car: A Series of Cancellations and Layoffs

First hints at Apple developing an EV can be traced to 2014. Back then, the man in charge of the project was the former CEO of Mercedes-Benz Research and Development, Johann Jungwirth.

The result of his work emerged in February 2015, outlining the Apple EV as a minivan, riddled with sensors and cameras. Codenamed Titan, the car was rumored to go into production by 2020. However, in January 2019, Apple let go over 200 employees from the project, only to buy autonomous vehicle startup Drive.ai five months later.

Last year, South Korean giant, Hyundai Motor, ceased talks with Apple on a shared autonomous vehicle technology. Apparently, Hyundai executives grew concerned that this partnership would place the company in a subservient position, much like Taiwainese Foxconn is now known as Apple phone builder.

To top it off, if Apple is going the self-driving route, which appears to be the case, it is not an easy feature to be released as a finished product. Remember Tesla’s Full Self-Driving (FSD)? It too suffered a series of setbacks and continuous updates, to the point of Elon Musk admitting that self-driving is much more difficult than anyone thought.

Indeed, from merely parking or even just pulling over your car on a highway, it can be surprising how many hundreds of varying factors come into play.

Can Apple Car Compete with Tesla at This Late Stage of the Game?

Tesla has been running FSD since October 2020, meticulously collecting real-world data and honing the necessary synergy between hardware and software for self-driving to work. That is a lot of engineering, mountains of data, and man-hours to overcome.

With that said, Tesla’s vulnerability is the high price range of its EVs, with the cheapest Model 3 at nearly $50k, putting it into luxury class. Supply chain disruptions further exacerbated the situation, causing even used Tesla cars prices to skyrocket.

Is it likely that Apple will release an affordable car to counter Tesla? Many indicators suggest the answer to that would be no. Apple’s brand revolves around exclusivity, high-end products, and status-signaling. In 2017, Tim Cook set the course for what kind of car that would be – autonomous.

“We’re focusing on autonomous systems. It’s a core technology that we view as very important. We sort of see it as the mother of all AI projects. It’s probably one of the most difficult AI projects actually to work on.”

Cook charged two key people to accomplish this. The present Apple AI chief, John Giannandrea, together with Kevin Lynch, responsible for the Apple Watch. On the electronic/computing side of the equation, Apple has it covered. As a continuation of the high-performing M1 chips, Apple is likely to use C1 chips, according to EETimes analyst Colin Barnden.

The biggest problem is the automotive part, to take advantage of that computing power and get the production done right at scale. All considered, the hiring of Desi Ujkashevic is aimed at solving the automotive side of the self-driving EV equation.

However, in the current macroeconomic environment, this seems as far off as it was in 2020. In the best case scenario, a finished Apple EV is likely to emerge in 2025. By that time, the demand for Apple devices may dwindle further, just as more affordable EVs enter the market.

Nonetheless, with Apple’s honed SaaS machine churning, and its deep pockets, the company can afford the delays. If anything, it is Apple’s comfortable layers of fat that kept it from deploying its car faster.

Get Smarter on Crypto and Macro Finance. Get the 5-minute newsletter that keeps investors in the loop. Five Minute Finance is a free, independently run newsletter covering the latest and most important trends in crypto, macro, and global markets.

Updated on

Sign up for ValueWalk’s free newsletter here.