By Fintel. Originally published at ValueWalk.

Camping World Holdings (NYSE:CWH) gained 21 spots this week to finish 5h on Fintel’s United States Short Squeeze Screener and Leaderboard.

Camping World shares have seen a rollercoaster of a ride since initially floating on the New York Stock Exchange back in 2016 where the IPO was first priced at $22. The first year post listing saw the stock rally over 100% to trade over $45 by the start of 2018. In the two years that followed, the stock entered a strong bear trading pattern with shares losing up to 90% of their value from the peak, falling below $5 per share.

Q1 2022 hedge fund letters, conferences and more

In March 2020, CWH’s senior management began purchasing shares at the all-time low point which saw support and confidence build in the share price. Fintel’s Latest Insider Trade screen would have identified the transactions through the platform’s advanced screening techniques. The May 2020 first-quarter results sent shares soaring as they posted an almost profitable quarter with EPS of ($0.03), compared to the prior year of ($0.67) and group revenue of over $1 billion. In addition to the result, CWH declared a special dividend above the regular dividend. Shares performed extremely well over the pandemic but have started a new downward trend yet again.

Shares peaked above $46 last November before starting the current bear trading pattern that has seen the stock lose over -36% in 6 months. The bear trend is currently bucking with a short-term rally occurring this week as Q1 2022 results hit the market. The stock rallied +10% this week as the firm posted a slight EPS miss of $1.15 vs the market’s estimate of $1.33 and a slight beat in group revenue with $1.66 billion in sales vs estimates at around $1.64 billion. Interestingly, new and used vehicle inventories rose by $938 million to $1.8 billion with the firm attributing the increase to strategic growth in the used vehicle business, 14 additional locations, and easing of supply chain constraints which excited the market.

This week’s momentum has pushed the CWH Short Squeeze Score to 92.27 and places the stock 5th out of 5,500 included companies. CWH currently has 46.80% of its float currently shorted according to the NYSE and Capital IQ. The Short Squeeze Score is the result of a sophisticated, multi-factor quantitative model that identifies companies that have the highest risk of experiencing a short squeeze. The scoring model uses a combination of short interest, float, short borrow fee rates, and other metrics. The number ranges from 0 to 100, with higher numbers indicating a higher risk of a short squeeze relative to its peers, and 50 being the average.

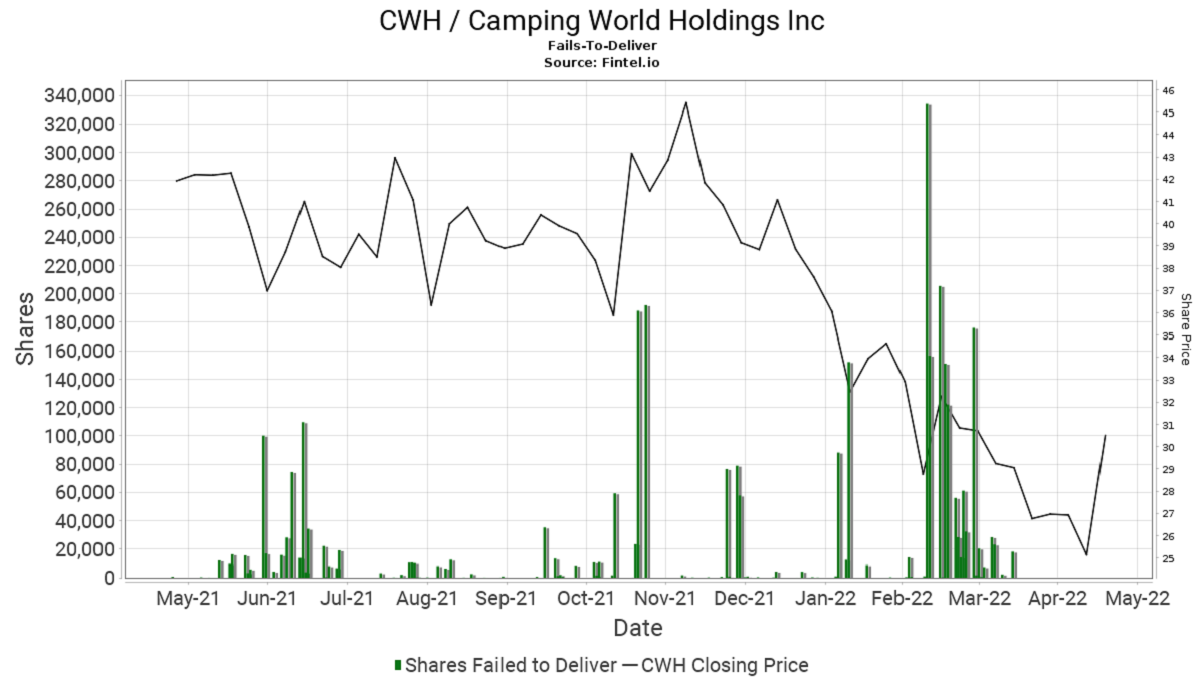

We included a chart below from the Fintel platform that shows the ‘Fails-To-Deliver’ activity on the stock. We noticed that the sudden spike and rallies in the share price over the last year have tended to be highly correlated with shorters failing to return stock.

When looking at other Fintel quant analysis, we noticed CWH has a Value Score of 85.97 and a PE Ratio (TTM) of 8.83. The value score is a proprietary scoring model that ranks companies based on their relative valuation. Scores range from 0 to 100, with 100 being the most undervalued.

For those value-conscious investors, this could be a stock worth looking at that also pays an annualized dividend yield of 6.25%.

Interesting Analyst Commentary Post Q1 Result

Bret Jordan from Jefferies continues to see the service segment as a key driver to long term earnings growth as the installed fleet has grown by over 1 million units in the last few years. The firm maintains a ‘hold’ rating with a target of $32.

Craig Kennison from Baird noted in commentary that bears on the stock will need to weigh the cost to remain short given CWH’s capital allocation plan. The firm reduced estimates following the result and lowered their target from $40 to $36 while maintaining an ‘outperform’ recommendation.

Did you know that Camping World has a consensus ‘overweight’ rating with an average target price of ~$36.50, implying +24.5% upside to the current share price. We note that the consensus price target has been trending lower since February 2022.

More on Fails-To-Deliver

The values of total fails-to-deliver shares represent the aggregate net balance of shares that failed to be delivered as of a particular settlement date. Fails to deliver on a given day are a cumulative number of all fails outstanding until that day, plus new fails that occur that day, less fails that settle that day. The figure is not a daily amount of fails, but a combined figure that includes both new fails on the reporting day as well as existing fails. In other words, these numbers reflect aggregate fails as of a specific point in time, and may have little or no relationship to yesterday’s aggregate fails. Thus, it is important to note that the age of fails cannot be determined by looking at these numbers. If all shares were delivered on a particular day, then there will be no entry in the table.

Article by Ben Ward, Fintel

Updated on

Sign up for ValueWalk’s free newsletter here.