Our Dotcom Bubble

Courtesy of Michael Batnick

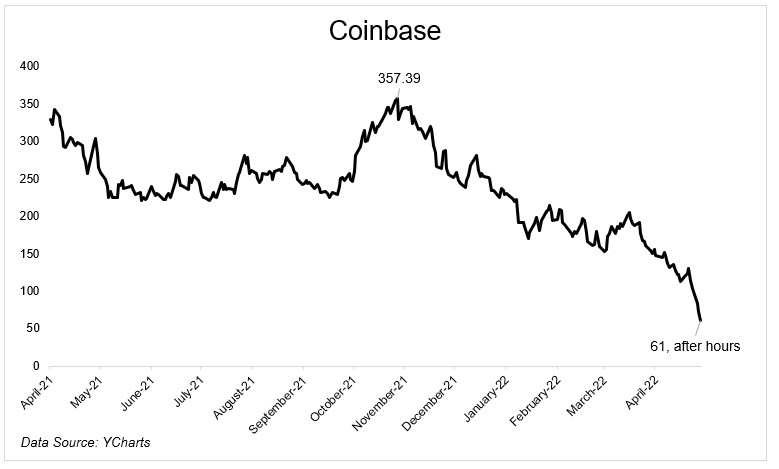

Add Coinbase to the pile of stocks that were down 80% from their highs going into earnings that falls 15% after the announcement.

The stock is at $61 in the after hours. It was $130 last Wednesday.

I was 15 years old when the dot-com bubble burst, so I didn’t get to experience that through the lens of an investor. This is a first for me, and for many of you. Watching brand-name companies lose 80 or 90% of their value is…hard to put into words.

Part of Coinbase’s decline is macro related, but a lot of it is straight-up its own doing.

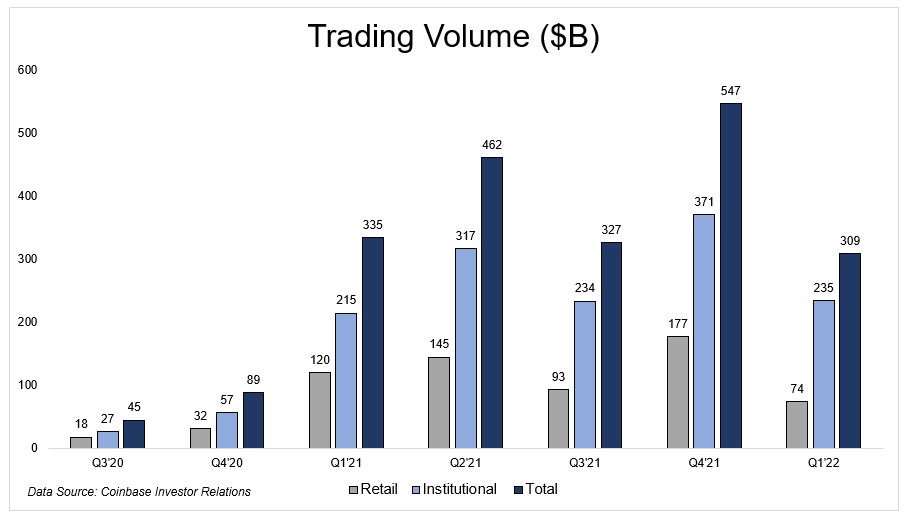

It turns out that trading crypto is a lot more fun when it’s going up. Retail volume fell 58% q/o/q.

Fine, nothing they can really do about the price of Bitcoin. But the expenses and hiring are out of control.

They added 3,200 employees over the past twelve months. That’s almost twice as many employees as they had last year. In the shareholder letter, they wrote:

“We ended Q1 with 4,948 full-time employees, up 33% from last quarter, and are pleased with our ability to attract and retain top talent.”

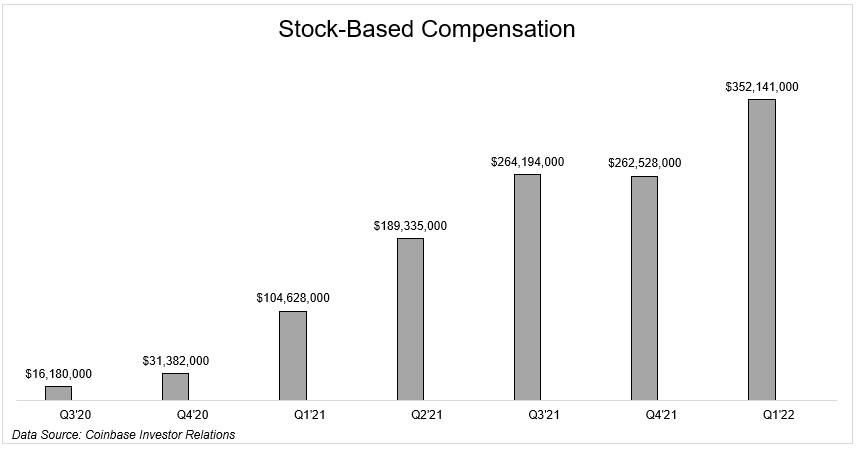

One of the ways that you do this is by paying them with equity. And boy did they ever. Stock-based compensation this quarter was $352 million. I’ll let you do the math on that. It’s a lot.

A 35% SBC increase q/o/q while revenue falls 53% over the same period is not a great look.

Investors have no tolerance for companies that are careless with money. Those days are over.

Josh and I spoke about this and much more on tonight’s What Are Your Thoughts?