Down 1%.

Down 1%.

That's a huge move for the Dollar and it's only 7am. The 2022 World Economic Forum kicked off this morning in Davos, Switzerland for the first time in 2 years as the World's rich and powerful took a pass on getting together at the height of Covid. With nothing else to do, the World's Top 10 richest people got 100% richer and, Globally, Billionaires gained $5,000,000,000,000 during the pandemic – in case you are wondering what happened to all that stimulus money the Government borrowed on your behalf.

Now the rich and powerful are back at Davos with a sense of urgency – as people are starting to talk about taxing them as tens of millions of people have fallen into EXTREME Poverty in order for the Wolrd's 2,668 Billionaries to get $1.874Bn richer – EACH!

"The last two years have dramatized and clarified what has been true for some time now, which is an elite plutocratic class is not just leaving the rest of the world behind, but is thriving precisely by stepping on the necks of everybody else," said Anand Giridharadas, author of the book "Winners Take All: The Elite Charade of Changing the World."

There's a notable absence of Russian Oiligarchs at this year's convention. At last year's virtual event, Putin was a featured speaker… Putin and everyone with an oil well is certainly getting their $1.8Bn with oil over $110 this morning and Gasoline (/RB) at $3.70 wholesalre (just under $5 at the pump, USA average). I'm starting to hear more and more people say "that's an expensive drive" when talking about vacation plans.

There's a notable absence of Russian Oiligarchs at this year's convention. At last year's virtual event, Putin was a featured speaker… Putin and everyone with an oil well is certainly getting their $1.8Bn with oil over $110 this morning and Gasoline (/RB) at $3.70 wholesalre (just under $5 at the pump, USA average). I'm starting to hear more and more people say "that's an expensive drive" when talking about vacation plans.

Kristalina Georgieva, IMF managing director, said Russia’s invasion was “devastating lives, dragging down growth and pushing up inflation”, and urged countries not to “surrender to the forces of geoeconomic fragmentation that will make our world poorer and more dangerous”.

European nations are still debating whether or not to go ahead and boycott Russian Oil, which could send prices as high as $8-10 at the pump this Summer in the US (Europe is already there). Meanwhile, there is a call to keep all frozen Russian assets to pay for damages done to Ukraine – estimated to be about $600Bn so far. Forced reparations like that are how we moved Germany along from WWI to WWWII – so why not try that trick again?

Of course, Russians are better at suffering than Germans are – they've been trained for it for 100 years. Also, the wealth that's being taken is from so few Russians that it will have very little effect on the average citizen – unless the Oligarchs put the squeeze on them in order to rebuild their fortunes – then it could get ugly.

What's really going on in Davos though, is the rich people that ARE there are telling the Governments that they should fix Ukraine with money from the peole who aren't there (Russians) and not from the Top 2,668 as part of a massive global effort to rebuild – like we did after WWII because THAT might lead to taxes – like 10% of what our Oiligarchs made in the past 24 months. THAT would be a tragedy, right?

What's really going on in Davos though, is the rich people that ARE there are telling the Governments that they should fix Ukraine with money from the peole who aren't there (Russians) and not from the Top 2,668 as part of a massive global effort to rebuild – like we did after WWII because THAT might lead to taxes – like 10% of what our Oiligarchs made in the past 24 months. THAT would be a tragedy, right?

What they've accomplished so far though, is weakening the Dollar and that's popping our indexes this morning but not even 1% and, as our Members know – if the inexes don't move at least with the Dollar – it's not a real move at all.

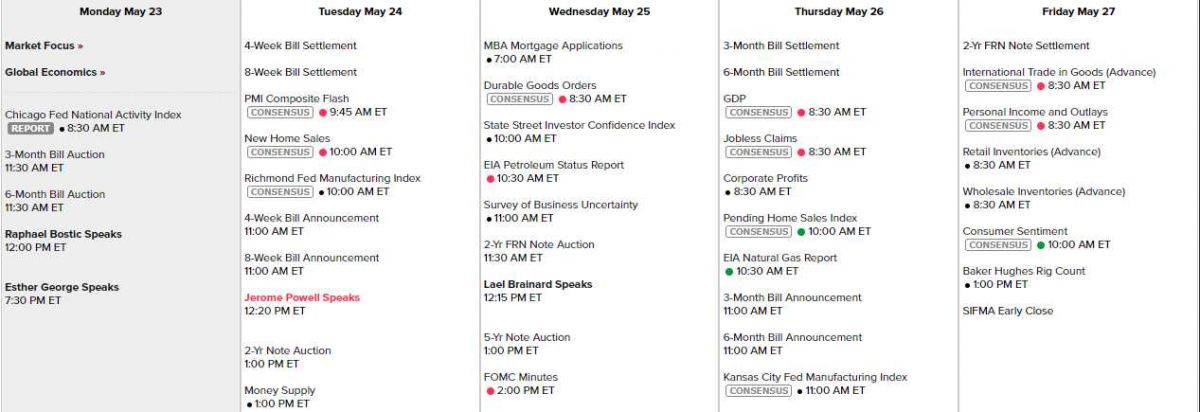

Things that might move the market this week are PMI tomorrow, followed by Powell speaking at lunch. Durable Goods, Investor Confidence (or lack thereof) and a 5-year auction on Wednesday will be followed by the Fed Minutes and Thursday is GDP, but it's just a revision of Q1's -1.4% disaster and the 7-year auction can be a nasty surprise if it's weak. We finish the weak with Personal Income & Outlays as well as Consumer Sentiment – it will be a surprise if the Consumer is not indicated to be out of gas at this point:

We should also keep an eye on those Regional Fed Reports as NY and Philly were a disaster last week and you know that old saying: "Ignore on distaster – shame on you. Ignore two disasters – shame on me. Ignore three disasters and we're F'd." – at least that's what my Grandma used to say…

By the way, speaking of Bush (in the link) – hows this for a Freudian slip?

And, for some crazy reason, companies are still insisting on reporting their earnings – as if they matter any more. They do matter to us as we've been adding and adding to a lot of positions in our Member Portfolios but babies are being thrown out with the bathwater so acftual earnings are only a small point of reference at this stage of the sell-off (we also added a lot more hedges).

Be careful out there!