By Anna Peel. Originally published at ValueWalk.

Alignable’s New Q2 Rent Report has just been released, showing that the small business rent crisis has reached new heights, as other inflationary trends continue to impair the small business economy. This report is based on a poll of 5,321 randomly selected small business owners, which just concluded yesterday. Here are a few of the many emerging insights:

Q1 2022 hedge fund letters, conferences and more

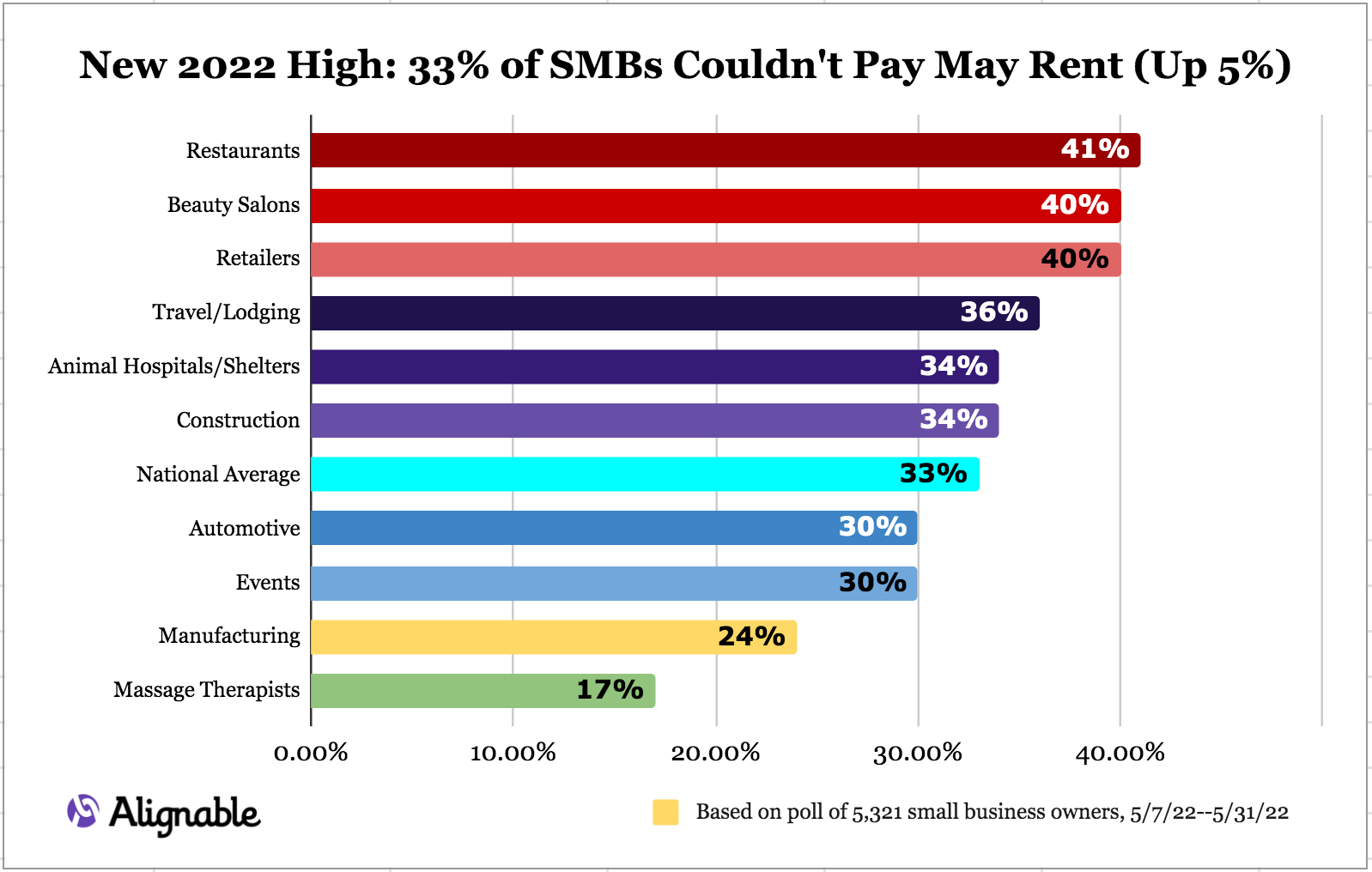

- 33% of all U.S. small businesses (SMBs) could not pay their May rent in full and on time, up 5% from Apr. This is the highest rate of U.S. rent delinquency among SMBs this year.

- Even more alarming, 56% of minority-owned businesses couldn’t afford May rent, up 20% from Apr. This is the highest rent delinquency rate for minority SMB owners since March 2021.

- States with the highest rent delinquency rates include MA (42%), GA (40%), NY (35%), CA (35%), MI (35%), & TX (35%). Rates increased dramatically in MA, GA, NY, TX and FL from Apr. to May.

- Rent issues abound for many sectors, including 41% of Restaurants, 40% of Beauty Salons, & 40% of Retailers. Restaurants, retailers and others reached new levels of 2022 rent delinquency in May.

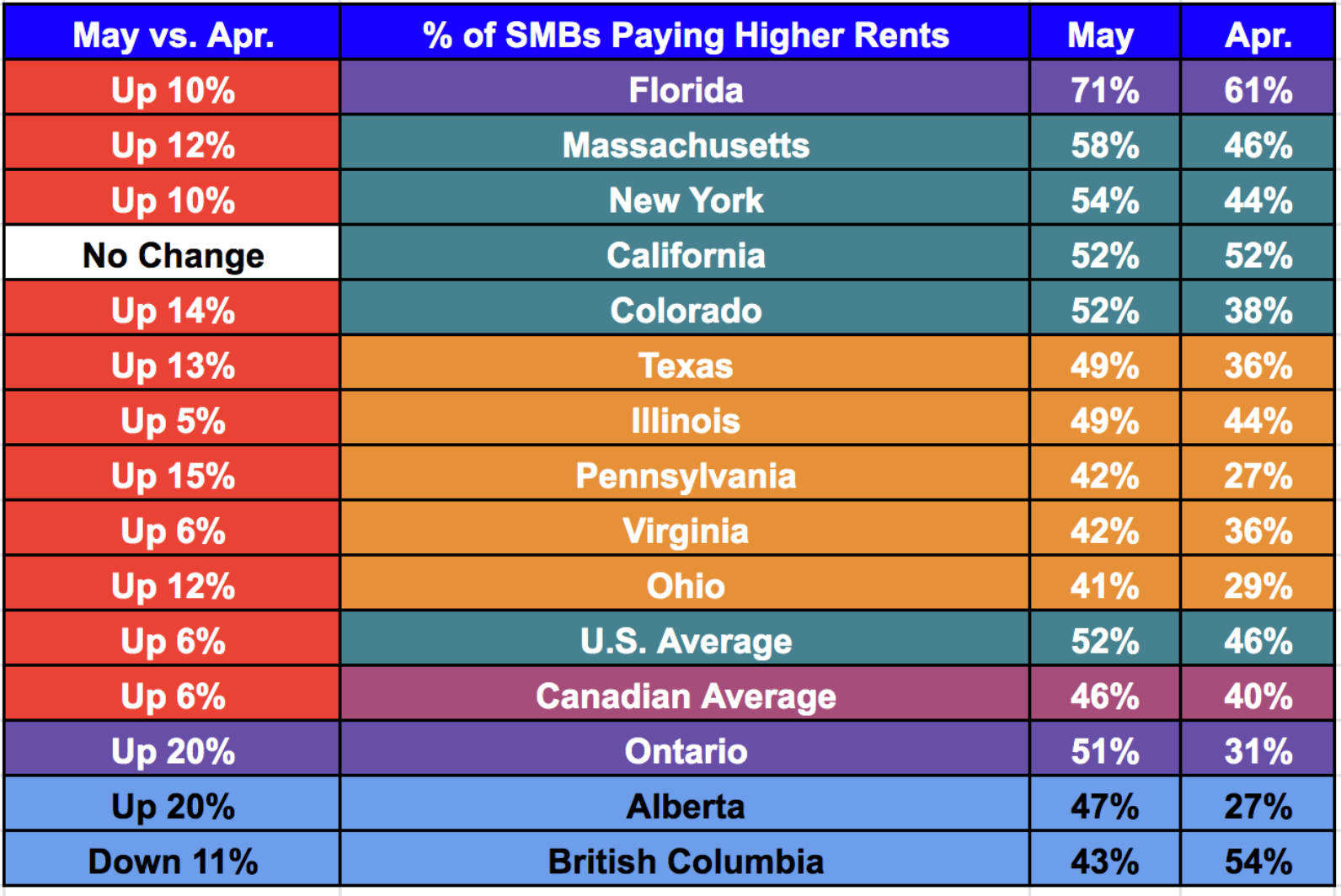

- One reason for increased delinquency rates is that rents are skyrocketing across the U.S. and Canada among the majority of small businesses. In May, 52% of all U.S. SMB owners reported higher rent costs, up 6% from 46% in April, breaking yet another rent crisis record.

- States with the largest percentage of SMBs reporting rent price increases include FL (71%), MA (58%), NY (54%), CA (52%), & CO (52%).

To see the full report, go here.

Updated on

Sign up for ValueWalk’s free newsletter here.