By Fintel. Originally published at ValueWalk.

With the significant volatility and uncertainty in equity markets expected for the remainder of 2022, some investors are seeking alternative short to medium term trading ideas. Identifying companies that have usually been heavily sold off on lower valuations with a spark in recent momentum and a high interest in the options market can sometimes lead to a gamma squeeze rally.

The gamma squeeze happens when the underlying stock’s price begins to rally very quickly within a short period of time due to activity that is occurring in the options market. As more money flows into call options from investors, that forces more buying activity from market makers which can drive stock prices higher.

Q1 2022 hedge fund letters, conferences and more

The Fintel Gamma Squeeze Leaderboard analyses the change of open interest in short-dated put and call options to identify stocks that may be susceptible to a squeeze.

The companies below have the highest score currently on the leaderboard.

3rd Rank, Score 97.17 – HUSA / Houston American Energy Corporation

Houston American Energy Corp (NYSEAMERICAN:HUSA) is a North American natural gas and oil explorer that has interests in the Texas Permian Basin, Louisiana Gulf Coast region and in Colombia.

In April 2022, HUSA and many other microcap energy players’ share prices skyrocketed when the Ukraine/Russia conflict drove oil prices well above $100 a barrel. HUSA shares gained as much as 700% in a matter of days before retreating and giving up over half of the gains.

While the price has retraced back, it has sustained a significant amount of investor interest with shares holding above $3 over the past 3 months. Year to date, shares remain 374% higher.

HUSA has climbed the gamma squeeze leaderboard over the last two weeks as shares began a new rally, more than doubling to over $7. In the options market, net call interest volume is becoming significant as it is worth 10.8% of the total float. The implied volatility IV30 score of 2.02 has fallen 5.9% over the past week.

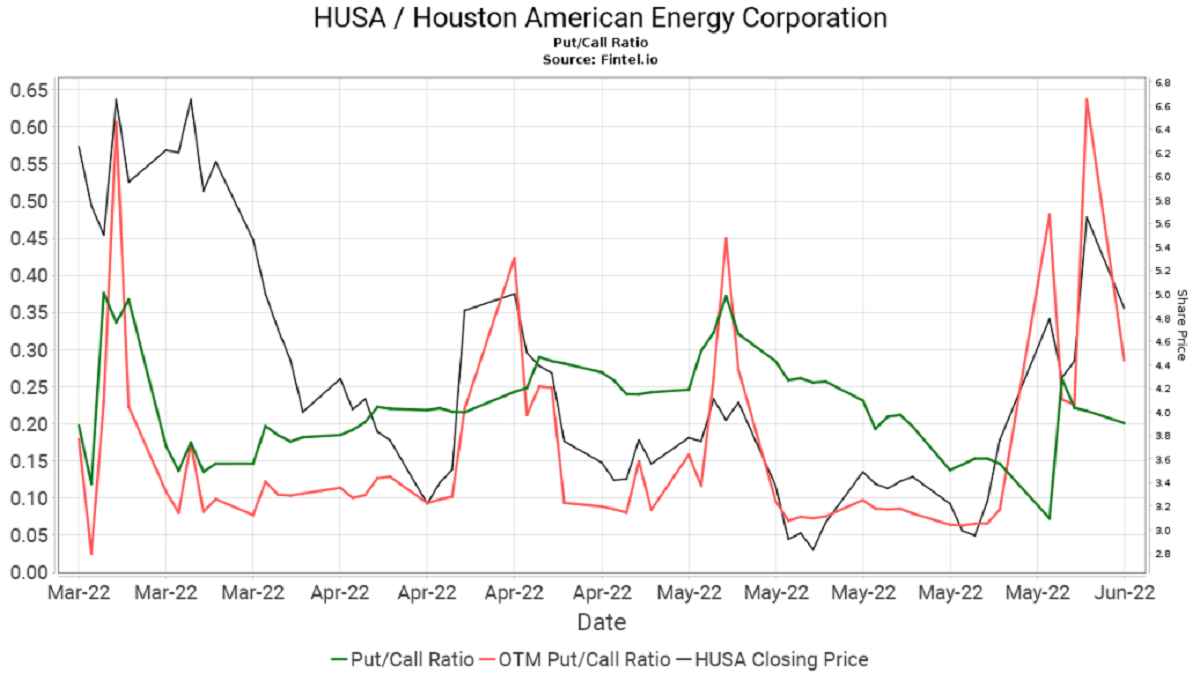

The put/call ratio for HUSA is 0.20 and implies bullish sentiment in the options market with open call interest outweighing put interest. The chart below shows the put/call ratio over the last 3 months against the share price:

2nd Rank, Score 97.96 – SGBX / SG Blocks Inc

SG Blocks (NASDAQ:SGBX) is a company that is an innovator that uses code-engineered cargo shipping containers for safe and sustainable construction. SG offers a product that helps builders and developers in achieving a ‘greener’ construction with faster execution.

SGBX’s share price has been under pressure throughout the last year losing 50% of its value. The share has seen stability over the course of 2022 staying within a $1.50-2.50 trading range where the market cap fluctuates around ~$25 million.

SGBX currently has open interest call volume that equates to 3.2% of the total float. In addition to this, the company has an IV30 (implied volatility) score of 1.71. This score has increased 39% over the last week.

When observing the open options volume for the stock, it is noted that SGBX has a put/call ratio of 1.43, which indicates bearish sentiment in the stock from a higher volume of open put options in the market.

Most recently since the beginning of May, shares have started mounting a rally and have gained 25.5% in total or about 42 cents per share.

1st Rank, Score 98.38 – EBET / Esports Technologies

EBET is a technology company that is developing platforms that focus on esports and competitive gaming. The company operates a licenced digital gambling platform that is focused on esports & traditional sports and focuses on targeting customers in Asia & Latin American markets. EBET was first listed on the Nasdaq in April 2021 with a very hot IPO that was priced at $6 per share and opened at $21 during its debut.

During 2021, EBET’s share price performed well holding above the IPO opening price of $20. Since the beginning of 2022, EBET has come under significant pressure, similarly to peer high growth/valuation stocks that do not produce substantial revenue and are not yet profitable.

EBET’s share price during May looks to have found support with the stock moving 74% higher from the annual low point of $2.60 per share reached last month. The recent share price momentum looks to have been triggered by activity in the underlying options market.

EBET has a market cap of $66 million currently and call option open interest volume that equates to ~7.4% of the total float volume. The IV 30 score (implied volatility) for the stock currently sits at 2.05.

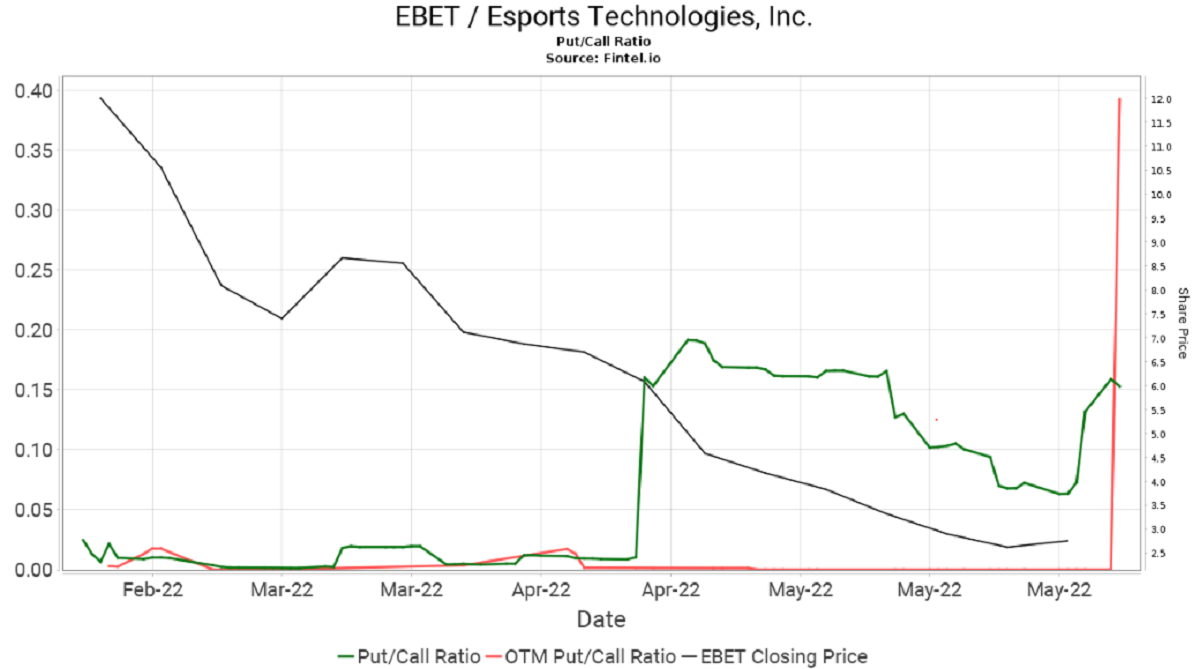

In addition to this significant interest, EBET has a Put/Call ratio of 0.08 which indicates significant bullish sentiment in the options market for the stock. A chart has been included below that shows this ratio and how it has behaved over the last 3 months:

EBET is covered at Needham with a ‘buy’ rating and a $9 target price. Last month, the firm reduced their target from $18 to $9 after revising the target multiple, applying a higher discount rate and after pushing out EBIT assumptions for esports betting share to account for the relaunch of gogawi in a market with increased competition.

Article by Ben Ward, Fintel

Updated on

Sign up for ValueWalk’s free newsletter here.