8.3%.

8.3%.

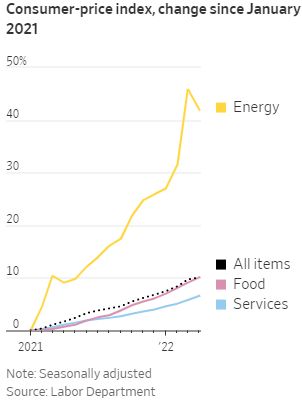

If your income isn't rising that much then you are falling behind on inflation. That's as of the last CPI report and we get another one at 8:30 and, like your eye doctor, the question will be "better or worse" when we see the numbers. We did an analysis last week and decided CPI was not likely to decline much and may even be HIGHER than last month, based on the price of commodities and the productivity report – which showed a sharp rise in Labor Costs. CPI is tricky though because if you pay $1,000 for an IPhone with 256G of memory and they pay $1,000 for an IPhone with 500G of memory – they say you saved 50% – even if you didn't ask for the bump in storage and would have much rather had a $500 phone.

The Goverrnment makes these "Hedonic Adjustments" because it's not in their interest to show a higher CPI as CPI is tied to things like Social Security payments and the Government can't afford the payments their making now – adjusting them up for this kind of inflation will break the bank in short order. Social Security payments are already $1.1Tn a year and Medicare is another $1.3Tn a year (because we never did anything about the costs from back when Obama tried) so an 8.3% rise in those costs will add $200Bn (10%) a year to our deficit.

The Goverrnment makes these "Hedonic Adjustments" because it's not in their interest to show a higher CPI as CPI is tied to things like Social Security payments and the Government can't afford the payments their making now – adjusting them up for this kind of inflation will break the bank in short order. Social Security payments are already $1.1Tn a year and Medicare is another $1.3Tn a year (because we never did anything about the costs from back when Obama tried) so an 8.3% rise in those costs will add $200Bn (10%) a year to our deficit.

Consumers’ grocery bills have risen by an annual rate of more than 10% since earlier this year, a pace last seen in the early 1980s. Food prices are up broadly, unlike early in the pandemic when meat prices drove much of the increase, said Paul Ashworth, chief North America economist at Capital Economics. “For people on lower incomes this is not discretionary spending,” Mr. Ashworth said. “Other than substituting out cheaper food types—cheaper meat cuts, whatever it might be—people need to continue buying food.”

8:30 Update: 8.6%!!! Much worse than expected by our Leading Ecconomorons but exactly what we predicted in Monday's PSW Report. That won't stop the rest of the market from panicking. Fortunately, yesterday afternoon, I sent out an alert to our Members to add more hedges so we'll just be sitting backn and seeing what levels end up holding today. We're nowhere near retesting the lows and our hedges have already been well-tested to those levels and we have much more now than we did last month:

Oil is 20% higher than it was last month and, if this persists, the next CPI Report will suck too. Still, it's not bad enough to force the Fed to do more than they said they would so today's reaction is likely an over-reaction but we won't be getting overly aggressive into the weekend – we'll let things settle down a bit before we pull more money off the sidelines.

Have a great weekend,

– Phil