Better late than never.

Better late than never.

I said on Friday, in a Report that was titled "5% Friday – Down Week Needs 2% Bounce Into the Holiday Weekend":

Usually we're happy with a 1% bounce off a 5% drop but really this is a 10% drop so we need a 2% (of the index) bounce, which would be 80 points (20% of the 400 we lost) on the S&P 500.

That would take us to 3,780 and that would be a massive one-day move in /ES (not that we haven't had them on the way down) so let's not count on it. That means we can't be cute with our hedges and need to stay well-covered into the weekend – even if today does look LIKE a recovery.

We're not "there" yet but I'm sure we'll get back to 3,780 but then what? There's nothing technically pretty about failing below 3,800. 3,840, in fact, is the weak retracement of 4,000 and, if we hang out below 3,840 for too long, all we do is prove that we're in the weak end of the 4,000 channel while we wait for the 50-day moving average to cross below that line and THEN we are in BIG TROUBLE…

3,840 is 277 points below the 50-day moving average so it's going to drop 5 points per day while we're down here, which means we have until about July 20th before things go critical. Fortunately, that's plenty of time for the overold MACD to resolve itself and, HOPEFULLY, that will give us a little bit of bullish tailwind but will it be enough to get us back over the 4,000 line? That's going to be up to bank earnings, which begin on July 14th.

Any bounce is a good bounce at the moment and volume was HUGE on Friday and we didn't go down – so that was a bit encouraging. When I was asked on Friday if I wanted to add more hedges to our Member Portfolios, I responed:

Bearish/Pman, SK – Yes, no changes. I'm tempted to add more hedges actually but the SQQQ 2024 $60 ($29)/80 ($24.50) bull call spread is $4.50 and was at a low of $3 this week so I doubt it would be more than $5 next week and we can add more of those with a 3:1 payoff if we need to – so why do it unless we need to?

Let's not delude ourselves, we have $1.4M in cash BECAUSE we took a chance this will be a bounce so we can't be shy about putting $400,000 back to work to buy another $1.6M worth of protection (net $1.2) if it turns out things are not bouncy. The real chance we're taking is that the markets don't collapse 10% over the weekend and we end up paying $6, not $5 for each $20 of protection. Could end up being a $100,000 or even $200,000 mistake – but it's very unlikely to kill us.

We don't want to overhedge out of fear – that's just flushing money down the drain.

Understanding that we have all these outs is key to playing a calm game while the sands are shifting beneath our feet. The other key component though is BELIEVING that there is, in fact, a bottom to the market. That's something a lot of people struggled with in 2009 but it was very rewarding for those who kept their heads during the sell-off.

That is the key to investing in a bear market – you have to have FAITH and that's where Fundamental Investors have a clear advantage over Technical Investors – because we KNOW when a stock is done falling. Or at least we know when it SHOULD be done falling – you can't stop people from panicking. That's why we scale into our positions (see our Strategy Section) – we may not be right about the bottom in PRICE but we're very good at calling the eventual VALUE.

That is the key to investing in a bear market – you have to have FAITH and that's where Fundamental Investors have a clear advantage over Technical Investors – because we KNOW when a stock is done falling. Or at least we know when it SHOULD be done falling – you can't stop people from panicking. That's why we scale into our positions (see our Strategy Section) – we may not be right about the bottom in PRICE but we're very good at calling the eventual VALUE.

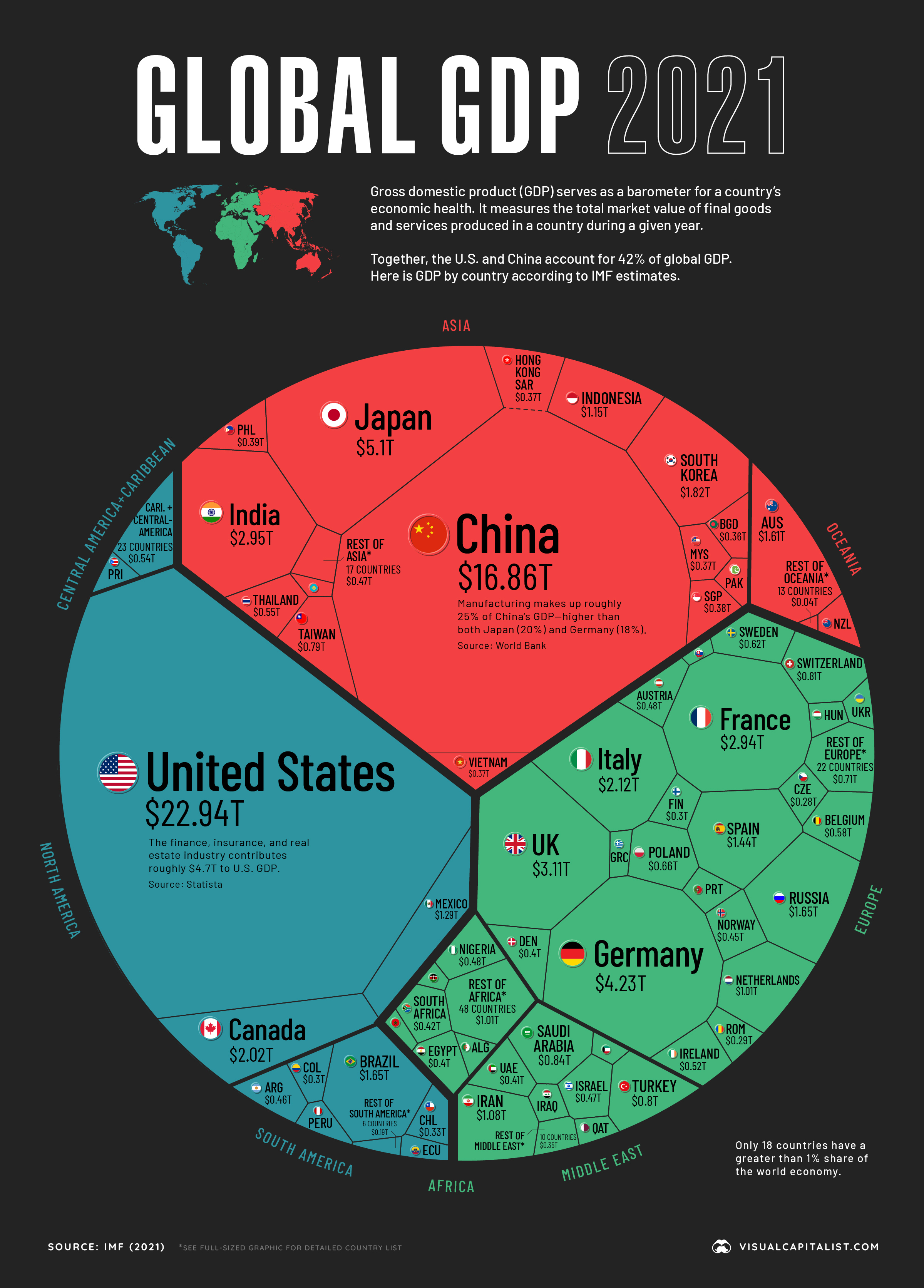

As noted in my article from 12 years ago, as long as our ability to live our lives is not compromised and population is about the same, there is a minimum amount of economic activity that 8Bn humans will generate and, at the moment, Global GDP is about $94Tn and inflation is going to drive that over $100Tn next year and who is it that causes that GDP number to move? COMPANIES – the same companies traders are bailing on now.

Sure we may have a no-growth year or even a recession but you will still go to McDonalds (MCD) and you will still drink Coke (KO) and you will still use a car to get there (F). Just by doing those things you are living well beyond the means of rice farmers in China – and they are generating $6,500 per peron in GDP – surely you can do better than that!?!

Then why are we trading F like they are going broke? Yes, chip shortages, supply chain issues, rising rates, EV restructuring costs, blah, blah, blah. I imagine Henry Ford went through a lot of those issues between 1906 and 1945, while he was running his little motor car company.

In fact, in 1914, due to a labor shortage, Ford began paying his workers $5 per day (double) so they wouldn't quit and said "I think my employees should make enough to afford the cars we produce" ($500 at the time). Ford was also, at the time, investing a great deal of money in new assembly lines, which ramped up production from 95,000 cars in 1912 to over 250,000 cars by 1915 – so he needed every worker he could get.

That's what we're punishing companies for now. Inflation is causing companies to adjust and labor rates are rising but most companies are covering them with price increases that, so far, have not slowed down consumer spending. More raises put more money into consumers hands but, looking at F, another $2.50 per day doesn't let you buy a Model T next week – it takes a while for these things to evolve – but "investors" today have no patience at all.

At $11.23, F has a market cap of $45Bn – even though they made $18Bn last year (not a typo). This year and next year they expect to make a more normal $8Bn but that's still a p/e of 5.5 going forward. F does have $94Bn in debts (net of $41Bn in cash) but that is the nature of their business and we assume it will take 3% more to service the debt going forward, so that will hit F for $3Bn a year and drop eanings down to $5Bn BUT, a lot of F's outstanding debt is for financing – so they may not be hit so hard by increased rates.

Still, if we say they make $5Bn a year until inflation gets them back to their usual 5% Net Profits and we give them 10x in a non-panicked market – that's going to be a $50Bn valuation at about $12.50. That's where we'd draw the line. So, as a new play on F, I would like:

- Sell 20 F 2024 $12 puts for $3 ($6,000)

- Buy 50 F 2024 $10 calls for $3.25 ($16,250)

- Sell 50 F 2024 $15 calls for $1.40 ($7,000)

That would be net $3,250 on the $25,000 spread so the upside potential, at $15 or above, would be $21,750 (669%) and we're starting out $6,000 in the money already. Worst-case scenario is owning 2,000 shares of F at $12 and, if we lose the $3,250, our net cost would be $13.62/shar but then we could sell 2026 puts and calls and knock $4.65 off that price, right?

Meanwhile, F pays a nice 0.40 dividend so we could do the above as a stock play as such:

- Buy 2,000 shares of F at $11.23 ($22,460)

- Sell 20 F 2024 $12 calls for $2.45 ($4,900)

- Sell 20 F 2024 $12 puts for $3 ($6,000)

In this case, we're in 2,000 shares at net $11,560 or just $5.78 per share and that makes the 0.40 annual dividend 6.9% while we wait to get called away at $12 ($24,000) for an additional $12,440 (107%) in profits – and that's at $12 – LOWER than the stock is trading now. The worst-case scenario to the downside is you are forced to buy 2,000 more shares for $12 ($24,000) and then you are in 4,000 shares for $35,560 or $8.89/share – which is 20.8% below the current price. Not even including the dividends.

When your worst-case scenario is something that sounds pretty good – then it's a good trade to make, right?

These are the kind of opportunites we get in a bear market because we are able to remain calm and do simple math while others are in a panic (a TA person would never buy F's chart). There are many stocks we'll be able to take advantage of – our Members already have F in their portfolios but this is a rare opportunity to get in at rock-bottom prices if you don't have it alread.

We'll be looking at more opportunities like this inside PSW's Live Member Chat Room all week.

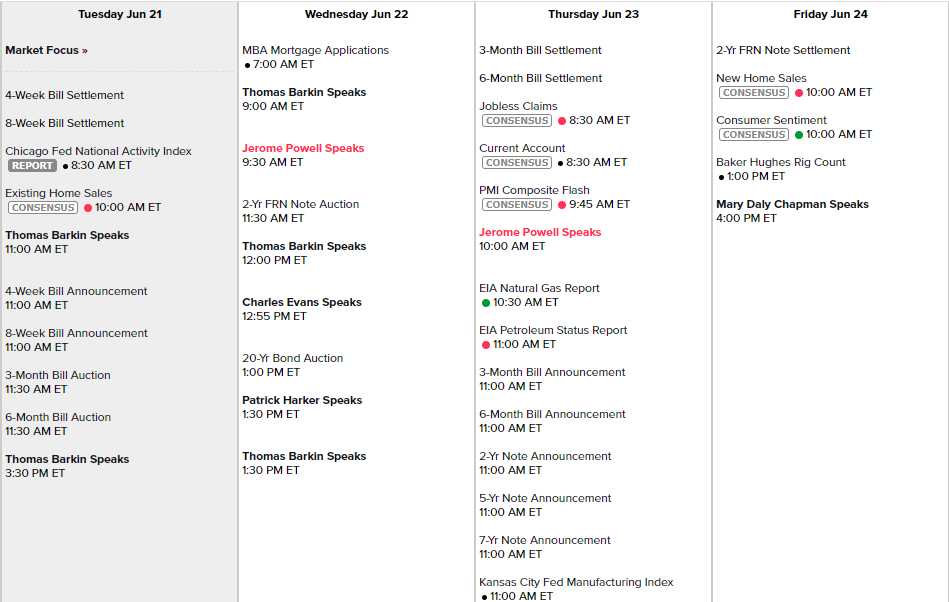

On the Calendar, Powell is speaking to Congress tomorrow and Thursday with other Fed speakers scattered around him. The 20-year note auction is important tomorrow and the Chicago Fed was flat this morning, but that's better than the terrible NY and Philly Fed reports. Home Sales will suck – that's no surprise and then all we have is PMI and Consumer Sentiment – so not much of a data week.

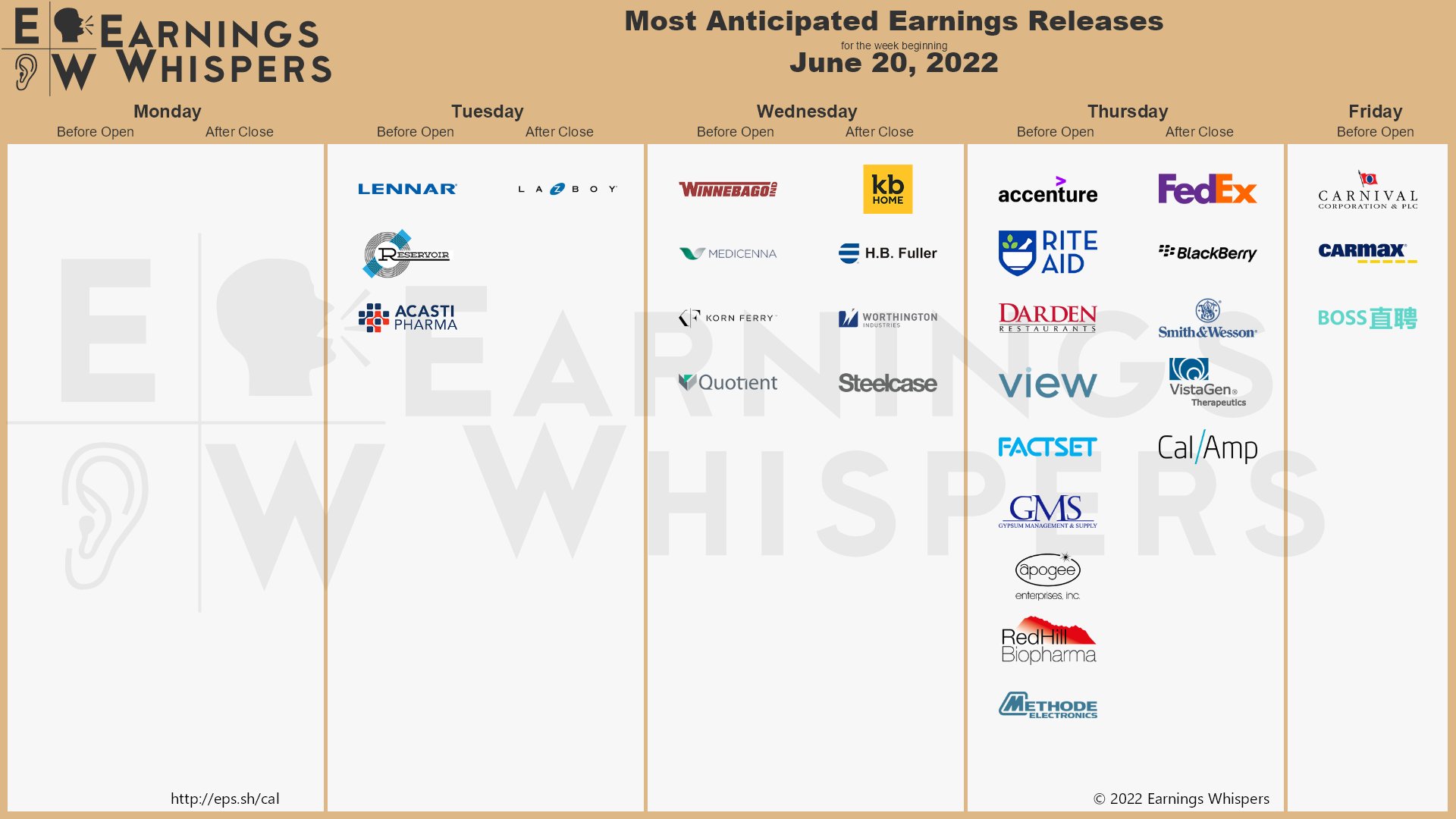

And, surprisingly enough – there are still some interesting Earnings Reports to follow:

It should be a nice, bouncy day but be careful out there and watch those levels.