Putin is not holding Oil hostage (for now).

Putin is not holding Oil hostage (for now).

Russia resumed flows of natural gas to Germany early this morning, easing fears in Europe that a key pipeline would become the latest target in the escalating confrontation between Moscow and the West as the war in Ukraine stretches into its fifth month.

Despite Thursday’s resumption of gas flow, European Union leaders believe that Mr. Putin will continue to exploit bloc members’ dependence on Russian fossil fuels as a way to weaken the countries’ economies and fracture the alliance. “Russia is blackmailing us,” said Ursula von der Leyen, the European Commission president, as she introduced the plan to reduce gas consumption. “Russia is using energy as a weapon.”

In Germany alone, half of all homes are heated with gas, and the fuel is a crucial element to keeping the country’s important chemical, steel making and auto industries running. Even before the July 11 shutdown of Nord Stream 1, the government in Berlin had declared a “gas crisis” and began enacting measures to reduce gas consumption, such as ordering the resumption of coal-fired power plants to replace those running on gas.

In Germany alone, half of all homes are heated with gas, and the fuel is a crucial element to keeping the country’s important chemical, steel making and auto industries running. Even before the July 11 shutdown of Nord Stream 1, the government in Berlin had declared a “gas crisis” and began enacting measures to reduce gas consumption, such as ordering the resumption of coal-fired power plants to replace those running on gas.

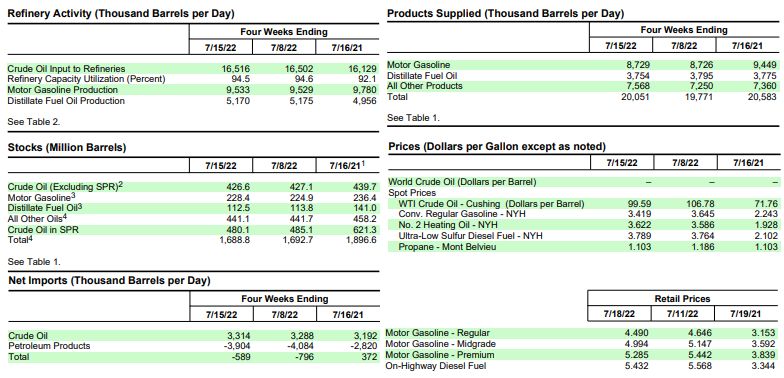

Gazprom is still delivering 40% less Natural Gas (/NG) than they did before the war, driving prices higher and pushing Germany into an Inflationary Recession. Oil fell a very fast 5% from yesterday’s highs on the Russian restart as it’s a very speculative market trading on August delivery in the front month and US demand is not what it seems as we are EXPORTING 28M barrels of refined product per week to other countries and that is 20% of the US’s supposed “consumption” for the week.

Gazprom is still delivering 40% less Natural Gas (/NG) than they did before the war, driving prices higher and pushing Germany into an Inflationary Recession. Oil fell a very fast 5% from yesterday’s highs on the Russian restart as it’s a very speculative market trading on August delivery in the front month and US demand is not what it seems as we are EXPORTING 28M barrels of refined product per week to other countries and that is 20% of the US’s supposed “consumption” for the week.

So there is actually a tremendous amount of Demand Destruction going on – it’s just masked by the 1.1M barrel INCREASE in Petroleum Exports (bottom left) since last year while Production (top right) has actually gone down 500,000 barrels per day (3.5M/week) since last year. Oil Traders know this and Oil Analysts know this – their employers and sponsors just don’t want them to talk about it – so they don’t.

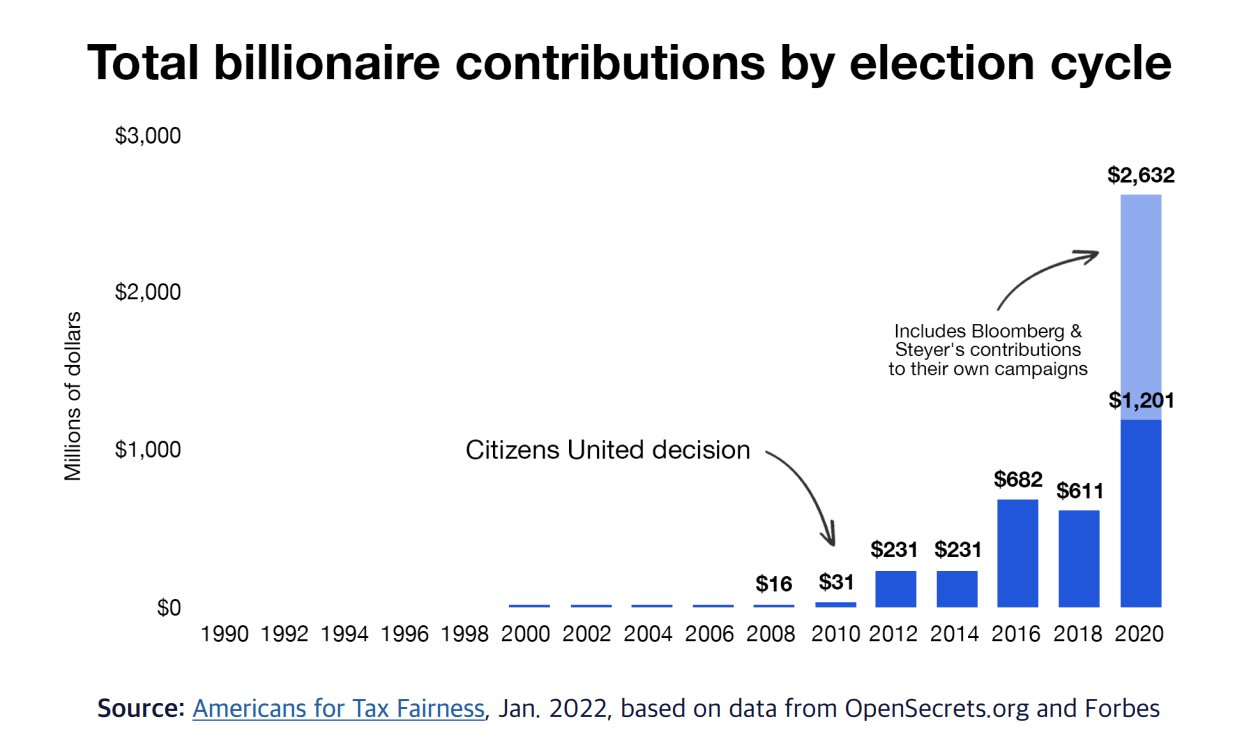

Everything you read and everything you watch is owned by a Billionaire – keep that in mind when you are getting your information. 27 of them own the GOP and are spending $90M (so far) to win the 2022 election for their pet candidates.

“A pair of super PACs tasked with securing Republican majorities in the House and Senate—the Congressional Leadership Fund (CLF) and the Senate Leadership Fund (SLF)—raised a combined $188.3 Million through the first 16 months of the 2022 campaign cycle, according to ATF. Nearly half—$89.4 Million, or 48%—came from just 27 Billionaires. A whopping 86% of the GOP’s Billionaire money came from “Wall Street tycoons” who are arguably the biggest beneficiaries of glaring loopholes in the tax code.“

The Democratic counterparts of those two super PACs—the House Majority PAC and the Senate Majority PAC—raised a combined $154 Million over the same time period. A smaller share—$25.8 Million, or 17%—came from 19 Billionaires.

“Anti-democratic vote-buying,” ATF wrote, “has been facilitated by—and is facilitating—the accelerating wealth growth of the billionaire class and the record profits of the corporations they own.”

The combined net worth of the nation’s roughly 750 billionaires surged by $2 Trillion, or 70%, during the first two years of the Covid-19 Pandemic. The collective wealth of the 27 Billionaires bankrolling the GOP’s super PACs alone soared by an under-taxed $82.4 Billion over that time period, meaning that the $89.4 Million they have donated to CLF and SLF constitutes less than 0.1% of their overall pandemic-era gains – given to them by a very generous Government that handed out $11Tn – 20% of which found it’s way into the pockets of the Ultra-Rich.

The return on that modest investment in Senators and Congressmen could amount to Billions of additional Dollars if Republicans take back Congress in November and preserve their 2017 tax cuts or further slash taxes on super-rich people and the corporations they own. Over a nine-year period, the 400 wealthiest people in the U.S. paid an average effective federal income tax rate of just 8.2% when the increased value of their stock holdings is included in their income.

Our economy is open for business and maybe that’s a good thing. Though Covid cases are alarmingly on the upswing, it’s low on the list of things we worry about now although, over in China, they are getting back into lockdown mode and the Yuan has fallen 7.5% against the Dollar since April.

Our economy is open for business and maybe that’s a good thing. Though Covid cases are alarmingly on the upswing, it’s low on the list of things we worry about now although, over in China, they are getting back into lockdown mode and the Yuan has fallen 7.5% against the Dollar since April.

That’s not helpful as China gets less Dollars for their Goods and Services and that Property Crisis we all forgot about is still raging. Banks have been failing, leaving depositors holding the bag and now homeowners, who are paying mortgages for unfinished projects by failing builders – are beginning to organize and refuse to pay for properties that aren’t being delivered – imagine that! As noted by the Guardian:

“China’s economy is facing a dangerous cocktail of stalling growth, high unemployment, spreading mortgage payment strikes and continued Covid shutdowns that threaten to explode with serious social and political consequences.

“The worsening meltdown in the country’s debt-laden property market is at the heart of the problem as the toxic $300Bn debt pile unleashed by last year’s collapse of the giant developer Evergrande slowly infects the whole economy.”

The initial official response to the bank demonstration was to call in squads of plain-clothed enforcers to use violence to break it up. Authorities have since claimed the bank has been taken over by “criminal gangs” and have promised to start allowing access to money. Beijing’s regulators vowed last Thursday to help local governments finish property projects on time. By Monday, the government was reportedly coming up with measures to allow homeowners to temporarily halt mortgage payments on unfinished property projects without affecting their credit scores.

The property market is 30% of China’s economy and, in the Fall (before the war), we had predicted that China’s meltdown is what would lead to a repricing of the Global Markets – now it is completely overshadowed by War and Inflation – as is Covid.

Still, this is not NEWs, just things that have been contributing to our market slump and hopefully we settle down around 4,000 on the S&P 500 – a little pause at this level is what I’d call healthy consolidation if we are to break back to the “over” side of 4,000 next week.