We’re waiting on the Jobs Report this morning.

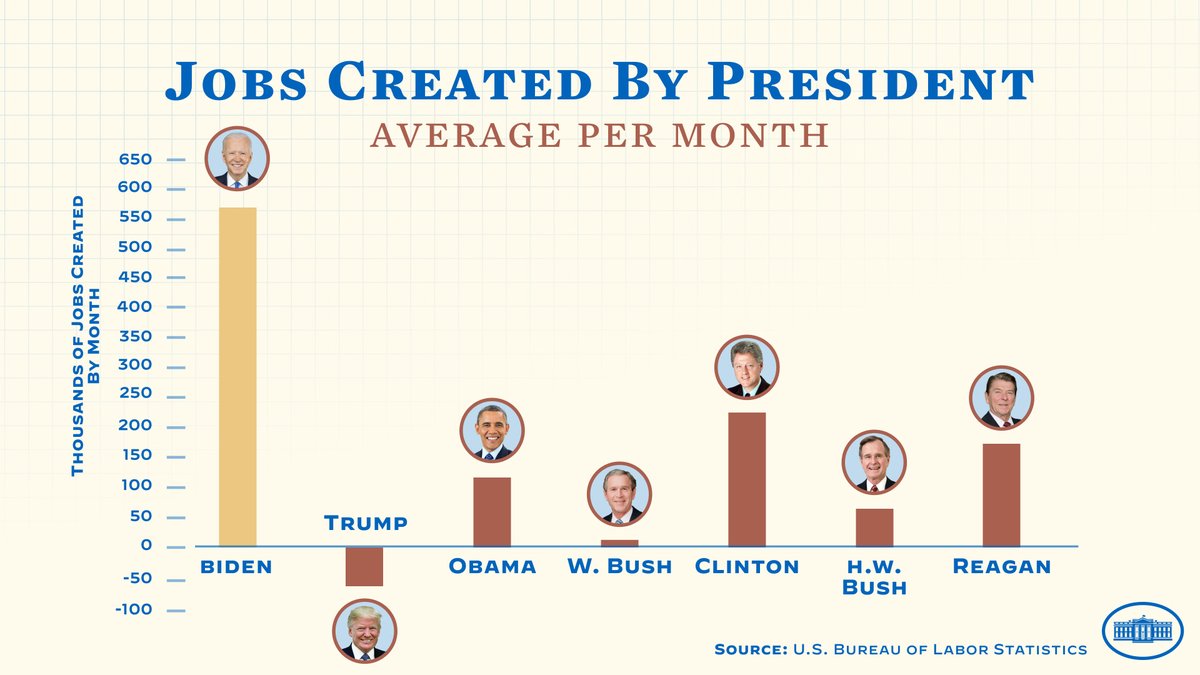

After losing 20M jobs in March of 2020, we’ve gained back about 18.5M, making “Sleepy Joe” Biden the greatest jobs-producing President of all time by a wide margin and poor Donald Trump will have the distinction of being the only President in the history of the United States to have presided over a net destruction of jobs during his administration.

The Republicans should want to give Joe 4 more years just to hopefully bring his average down because, unfortunately for them, this just keeps up the narrative that Democrats create twice as many jobs as Republicans (or 10 times as many in Biden’s case).

From a Market standpoint, however, we may be creating too many jobs as we don’t have enough labor to fill them (again, thanks to Trump cutting off our supply of immigrant labor that has driven the growth of this country since it was founded). That’s why the Fed has completely dropped “maximum employment” from their narrative and is now all about fighting inflation – which very much includes wage inflation.

The Fed does not like to see wages growing this fast although, in fact, they haven’t been keeping up with inflation. So the Fed has been raising rates hoping to slow job and wage growth as they eat into Corporate Profits and happy Corporations are much more important than happy Citizens to our Kleptocratic Government.

8:30 Update: Uh-oh! 528,000 jobs were added in July and that’s DOUBLE the 275,000 expected by our beloved Leading Economorons and much higher than last months 398,000, which has been revised up from 372,000. Hourly Earnings also way higher at 0.5% vs 0.3% expected and last month has been revised up from 0.3% to 0.4% – so a double whammy there too.

This is all DESPITE the Fed’s TWO recent 0.75% rate hikes and that indicates that it’s clearly not enough to cool the economy so any chance of the Fed going easy on us in September is now out the window and the markets don’t like that one bit and the Futures are taking a 1% plunge because, what’s good for the Working Man is not good for our Corporate Masters so – BOO!!! – lots of jobs and higher wages…

We started the week at 4,120 on the S&P 500 and now we’re going to struggle to hold it and, on the whole, we’re rejected at 4,160 in our first attempt to cross is and note what happened in June when we failed to get over the weak bounce line – we’d hate to see that again.

It’s not likely we will as Corporate Earnings have been generally strong – despite having to pay workers a decent wage. The biggest danger we have is we haven’t heard from the bulk of the small caps – which is why our hedging adjustment was made to TZA (the ultra-short Russell ETF) this time around. That’s our most likely point of failure at the moment.

We also have some lovely support at 3,937 from the now-rising 50-day moving average and MACD is still giving us a lift though it’s next week or never for 4,160 – as we’re about to exhaust the momentum fairy and the S&P’s big caps have mostly reported – so where will the catalyst come from?

On the calendar for next week is Productivity Tuesday, which was TERRIBLE in Q1 at -7.3% AND 12.6% higher Labor Costs – not at all what our Corporate Masters like to see. The market bottomed out after the last Productivity Report in early July.

If we survive that, then we’ll have CPI on Wednesday and that was hot, Hot, HOT in July at 1.3%, which is a trend of 15.6% for the year. That’s NOT going to happen again because Gasoline (/RB) was about $4 in June and July’s average was $3.25. Natural Gas is still very high at $8.

The Dollar was 104 in June and over 106 almost all of July – that should cool things down a bit. That’s one of the reason this morning’s dip doesn’t bother me too much – more money for workers means more demand for Dollars and the Dollar is at 106.7 this morning – up about 1% from yesterday’s close and causing much of the damage to the indexes.

That brings us to Thursday and we get PPI, which was up 1.1% in June and also shouldn’t be worse for the same reasons. Friday we have Import and Export Prices, which have been pacing with our 9% inflation and we also get the Consumer Sentiment Report, which should be improving with all these jobs and rising pay and not worse inflation (fingers crossed). Sentiment has been TERRIBLE but last month I said it was probably as low as it would get and we bought a lot of stock since then so hopefully I didn’t blow that prediction:

Either way, the week after that it will be time to adjust our portfolios again. Just yesterday, in our Live Member Chat Room, I declared us well-hedged for the weekend but now the Dow is down 250 points so we’ll see if that’s true, won’t we?

Have a great weekend,

-

- Phil

“And the men who hold high places

Must be the ones who start

To mold a new reality

Closer to the heart” – Rush