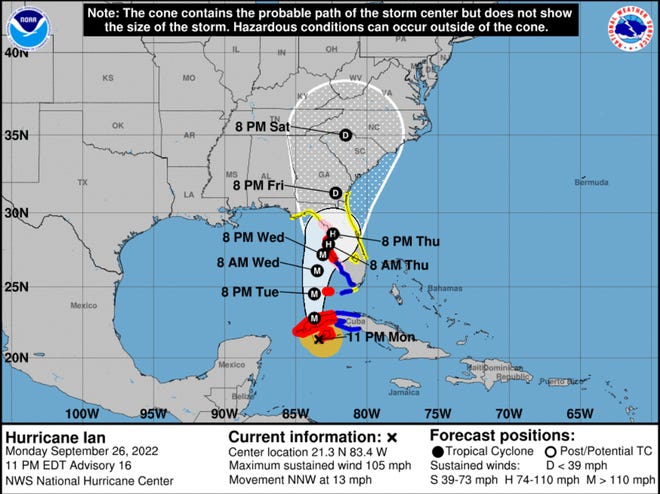

More people haven’t got power in Florida than Puerto Rico.

More people haven’t got power in Florida than Puerto Rico.

Florida Power & Light warned residents that the company expects a major overhaul will be needed to turn the lights back on after Ian. “Hurricane Ian’s catastrophic winds will mean parts of our system will need to be rebuilt – not restored. Be prepared for widespread, extended outages as we are assessing the damage,” the company said. The storm has already caused upwards of $20Bn worth of damage to the state’s $1.2Tn economy (2%).

Evaporation intensifies as temperatures rise, and so does the transfer of heat from the oceans to the air. As the storms travel across warm oceans, they pull in more water vapor and heat. That means stronger wind, heavier rainfall and more flooding when the storms hit land. The average global sea level has already risen by half a foot since 1900 — nearly four of those inches since 1970 — as countries have developed and populations have grown. Higher sea level can push more water inland during hurricane-related storm surges.

Hurricanes are three times more frequent than 100 years ago, and that the proportion of major hurricanes (Category 3 or above) in the Atlantic Ocean has doubled since 1980. The hurricanes are also moving slower because the winds that push the hurricanes are less effective in warmer weather and the slower hurricanes cause a lot more water damage with 2 feet of rain predicted for Central Florida.

This is all part of that Climate Change thing we refuse to fix so now, instead, we are paying for the damage it causes instead. Except that fixing it, while also costing money, would have the benefit of mitigating the damage and saving us money down the road. Of course Americans have never been much for planning and saving, have they?

This is all part of that Climate Change thing we refuse to fix so now, instead, we are paying for the damage it causes instead. Except that fixing it, while also costing money, would have the benefit of mitigating the damage and saving us money down the road. Of course Americans have never been much for planning and saving, have they?

In yesterday’s Webinar, we discussed the hurricane in relation to being cautious about insurance companies who have exposure to such things as the old assumptions about flooding and wind damage are far too mild for the new categories of storms we are brewing up these days.

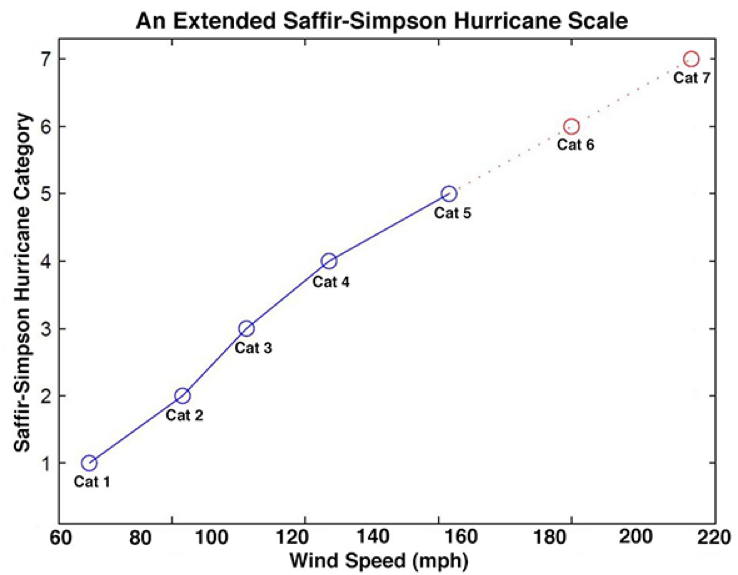

The hurricane scale only goes up to category 5 and those have been only 7% of the 250 hurricanes measured by satellites since 1983 (40 years). Yet Hurricane Dorian in 2019 had winds of 185 mph and gusts up to 220 miles per hour and that would have been a catagory 6 – if we had such a measurement. Category 5 is 157 mph and most homes and buildings in hurricane zones are made to stand gusts of 185 mph but a sustained storm at that level could topple cities – and conditions are now primed for such an event and getting worse and worse every year.

The hurricane scale only goes up to category 5 and those have been only 7% of the 250 hurricanes measured by satellites since 1983 (40 years). Yet Hurricane Dorian in 2019 had winds of 185 mph and gusts up to 220 miles per hour and that would have been a catagory 6 – if we had such a measurement. Category 5 is 157 mph and most homes and buildings in hurricane zones are made to stand gusts of 185 mph but a sustained storm at that level could topple cities – and conditions are now primed for such an event and getting worse and worse every year.

Bahamas alone suffered $7Bn in damage from Dorian – over 50% of their $12Bn total GDP. Had that storm hit Miami – it would have done hundreds of Billions of Dollars in damage and killed many thousands of people. The damage at that level is like a tornado, but on a much wider scale:

How good is your home insurance? This might be a good time to check those policies but what happens to the insurance companies when damage like this in a major US cities drains their reserves? Almost certainly a Democratic Administration and Congress would put the people first and bail them out but what about the GOP? It’s a coin-flip at best.

Ironically, Florida’s ultra-right Governor DeSantis is benefitting from aid from Joe Biden and 35 states who are sending in relief aid. I think it would be funny if they sent all-migrant teams of aid workers who stay in Florida when the work is done…