So far, so good.

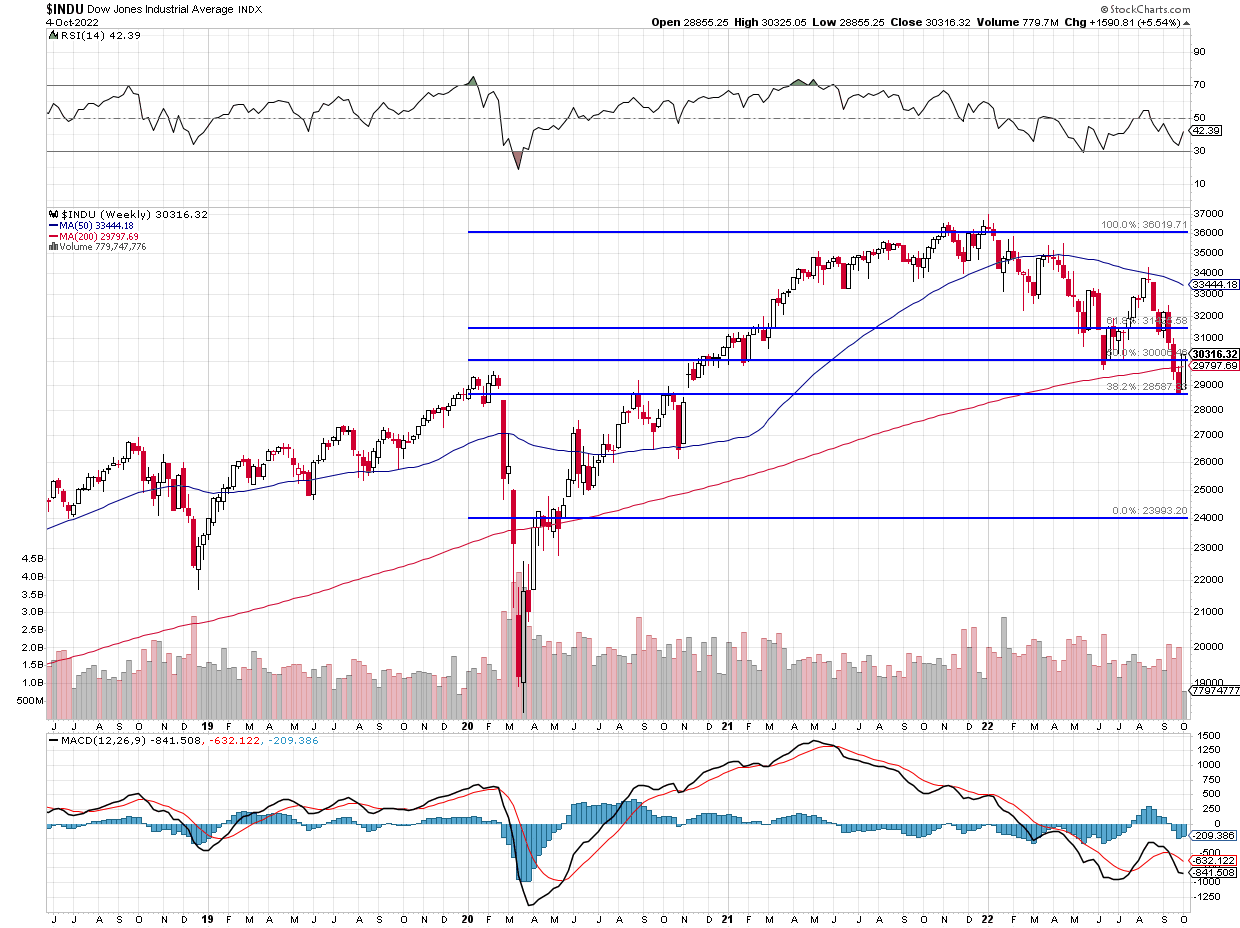

The indexes are pulling back a bit this morning but that’s fine after a massive 2-day rally. The Dow has gone from 28,600 to 30,300 in two sessions, which is 1,700 points or 5.9% or 5% (30,030) with a 20% overshoot – which is as we expect per our own 5% Rule™. The chat above, however, reflects the standard Fibonacci Retracement Series and you can see how well we’re fitting in that range as well.

18,000 (the 2020 low), 24,000 and 36,000 are significant lines for the Dow and we’re ignoring the little dip we had in 2020 and focusing on the run from 24,000 to 36,000, which is 12,000 points from which we expect a 20% pullback of 2,400 points – to 33,600 as a weak retrace and 4,800 points to 31,200 as a strong retrace. That is also the next major Fibonacci Line (more or less) so that’s going to be our technical goal for the week – if all goes well.

Unfortunately, the Dow is a silly price-weighted index and is essentially meaningless but it does follow the S&P, Nasdaq and Russell – more or less and, unfortunately, it’s the index that highlights US market performance around the World. 30 arbitrary stocks to represent the fate of thousands of others – you know it’s wrong…

Unfortunately, the Dow is a silly price-weighted index and is essentially meaningless but it does follow the S&P, Nasdaq and Russell – more or less and, unfortunately, it’s the index that highlights US market performance around the World. 30 arbitrary stocks to represent the fate of thousands of others – you know it’s wrong…

Still, 30,000 is a big line and lots of people will pay attention to it and it’s halfway between 24,000 and 36,000 – so it does have meaning in the bigger picture as well so let’s call it a thumbs up or thumbs down for the current market mood and leave it at that.

Today will be low-volume as it’s Yom Kippur and I shouldn’t be working at all. There are no Fed speeches until Bostic at 4PM but he went twice on Monday and didn’t stop the markets – so I’m not too worried about what he has to say. Evans, Cook and Mester speak tomorrow afternoon and Williams (the most doveish) gets the last word for the week on Friday morning – after Non-Farm Payrolls.

Today will be more driven by the OPEC meeting and boy are they upset that oil is back under $100 and they are looking to cut production by 1Mb/day, which would be about 3% and already that prospect has sent oil up 10% in the past two weeks but it will be hard to convince all the Members to cut production 3% when oil has fallen 20% since July – it will not get them back to where they were and many OPEC nations are in desperate need of revenues.

Today will be more driven by the OPEC meeting and boy are they upset that oil is back under $100 and they are looking to cut production by 1Mb/day, which would be about 3% and already that prospect has sent oil up 10% in the past two weeks but it will be hard to convince all the Members to cut production 3% when oil has fallen 20% since July – it will not get them back to where they were and many OPEC nations are in desperate need of revenues.

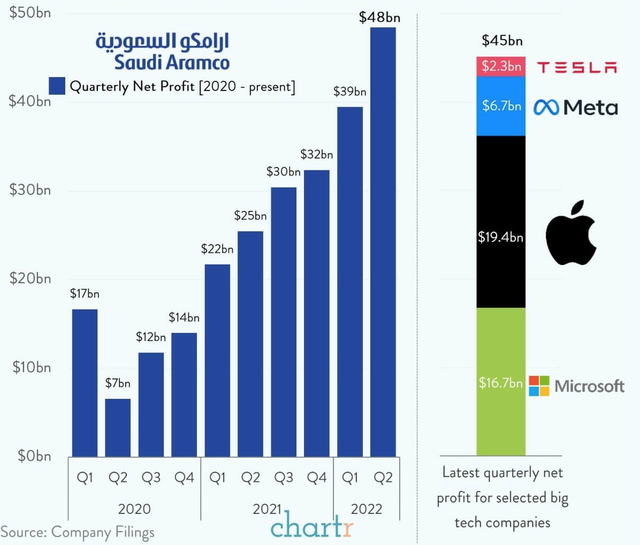

Even after years of cousin-killing, the House of Saud still has 15,000 “Princes” to divide up their $1.4Tn in wealth – that’s just $93M each if it were divided equally but there are “only” 2,000 power princes and the rest are 2nd and 3rd cousins who survived the purge. The princes we see running around the US buying things are in the top 2,000 – they couldn’t survive a year on $93M.

Fortunately, money does keep coming in – from the oil wells – but it’s also needed to feed the people so they don’t storm the palace and come up with a more equitable means for distributing the nation’s commodity profits. 12.4M barrels of oil are sold per day by Saudi Arabia, over 4.5Bn barrels per year so plus or minus $10 per barrel is $45Bn/2,000 Big Princes is $22.5M each to keep those jets running – of course it matters to them – a lot.

Unfortunately, it’s a terrible time for the Saudis to be pushing for higher oil prices as they risk plunging the World into a Recession, which could cause demand and prices to drop for oil and severely impact their cash flow. Also, they are doing this at the same time as dozens of countries are incentivizing their people to make their next cars electric – and those are customers they will lose forever once they switch.

Of course, all of us will switch in the next 20 years and the Saudis only use about 1.7% of their reserves each year so 20 years from now, they’ll still be sitting on 66% of their oil (far more with declining consumption), leaving Trillions of Dollars worth of it in the ground.

THAT is what they should be worried about – not maximizing their short-term profits but OPEC is playing it wrong and pushing the World harder and faster away from oil and towards renewable energy by making the fossil fuel alternatives more expensive AND more erratic in supply.

The biggest story in Florida at the moment is that Babcock Ranch, a community 12 miles from Fort Meyers (who still have no electricity), never lost power during the hurricane last week. Why is that? Because the town is powered by 700,000 solar panels and was built as an eco-community in 2018 and it doubled it’s planned size to 20,000 homes as the residents were loving it long before the storm hit. Now, you couldn’t pay them enough to leave and the rest of Florida is taking notes.

The biggest story in Florida at the moment is that Babcock Ranch, a community 12 miles from Fort Meyers (who still have no electricity), never lost power during the hurricane last week. Why is that? Because the town is powered by 700,000 solar panels and was built as an eco-community in 2018 and it doubled it’s planned size to 20,000 homes as the residents were loving it long before the storm hit. Now, you couldn’t pay them enough to leave and the rest of Florida is taking notes.

That’s what a privately-funded project can do to fossil-fuel demand in just 4 years – what will happen to OPEC when those communities begin to spread (most people in Babcock have electric cars to take advantage of the low-cost energy)?

All these actions have repercussions and the Saudis are playing the short game that may ultimately lead to the undoing of their entire empire in the longer run.