There’s a funding problem brewing in the housing finance market, and it’s sending mortgage rates up at a much faster clip than benchmark Treasuries.

The big picture: Large buyers of mortgage bonds — i.e. the Fed and the big banks — have dropped out of the game. The lower demand has pressured the value (or price) of mortgage bonds, sending yields soaring.

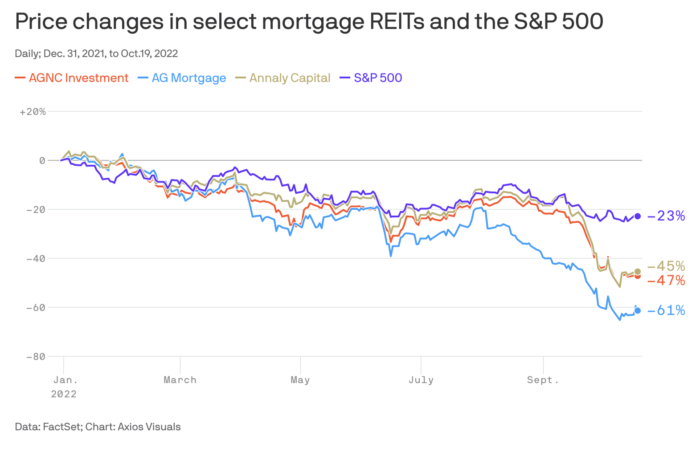

- Caught in the center of this storm are publicly traded mortgage REITs that are facing margin calls, and prospective U.S. homebuyers who are staring down the prospect of mortgage rates near 7%…