Finally, the Fed will decide.

Finally, the Fed will decide.

Actually that’s nonsense as they’ve already decided long ago that this meeting will have a 0.5-0.75% rate hike and odds are leaning very strongly towards 0.75% – for the 4th time in a row. This will bring us to 4% – a level not seen since the beginning of 2008, when the Fed was already dropping rates rapidly to stave off a housing crisis (did not work at all).

Now they are RAISING rates at a ridiculous pace to CAUSE a housing crisis (yes, that’s how they roll), in theory, to reduce Inflation as well. The direct effect of all this tightening is the rising relative value of the US Dollar, which has gained 25% since June of 2021 and, more importantly, 20% since the Fed began raising rates this year.

Since commodities are priced in Dollars (and so are stocks), this has prevented Inflation from hitting Americans a lot harder than it has but it also makes inflation worse in other countries so their Central Banks, in turn, are forced to raises their rates as well and, eventually, we will get back to parity and the Fed will lose their primary weapon. Then what?

Inflation will not go away quickly or quietly and I believe the Fed is employing the wrong tactic to fight it. As we’ve discussed before, 30 out of 50 states still have minimum wages below $10 and 20 states are still at $7.25. $7.25 x 40 hours (most people get paid for 35 due to unpaid lunch hours) is $290 per week to live on for workers in 20 states – including Texas and Pennsylvania.

Clearly this can’t continue and therefore wages will continue to rise. Only Washington State ($14.49), Washington DC ($16.10), Connecticut ($14) and Massachusetts ($14.25) are close to $15 – the rest of the states have miles to go and that means the end of inflation is miles away – unless you think the $7.25 wage set in 2009 is still right for workers in 2023?

Clearly this can’t continue and therefore wages will continue to rise. Only Washington State ($14.49), Washington DC ($16.10), Connecticut ($14) and Massachusetts ($14.25) are close to $15 – the rest of the states have miles to go and that means the end of inflation is miles away – unless you think the $7.25 wage set in 2009 is still right for workers in 2023?

As you can see on the above chart, the Cost of Living had risen 40% in 15 years but this year, it popped another 10% – yet minimum wage has remained the same this whole time. That’s just ridiculous, isn’t it? Social Security benefits have gone up 33% over that same period of time – as they are somewhat indexed to inflation while minimum wages are driven by the whims of Congress, who generally don’t give a rat’s ass about people who are unable to fund their campaigns.

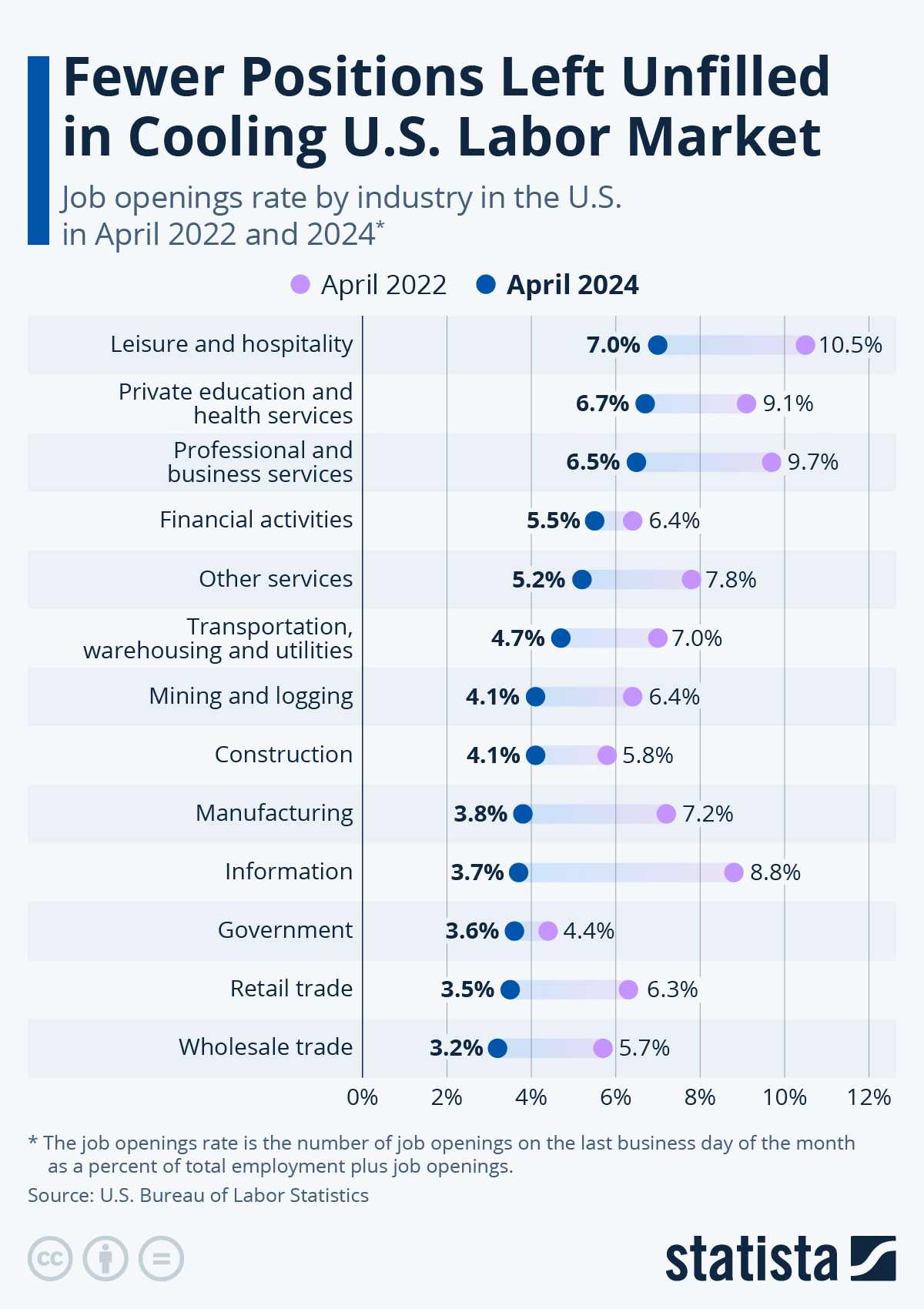

The Fed thinks they can fix this problem by crashing the economy and making workers happy to have $7.25/hr jobs but, despite all their efforts in 2022 – after raising rates from 0.25% to 3.25% (1,200%) so far – there are still 10.7M unfilled jobs in the US – up 500,000 from last month.

And how can there not be? The country has been partially closed for 2 years and now we are re-opening so of course we need more workers in restaurants, movie theaters, shopping malls, sporting events, theme parks, cleaning streets, cleaning offices, staffing hotels, education, mass transportation, etc. So many things we haven’t been doing for 2 years now need doing so OF COURSE we need more workers – the Fed can’t stop that by raising rates.

And how can there not be? The country has been partially closed for 2 years and now we are re-opening so of course we need more workers in restaurants, movie theaters, shopping malls, sporting events, theme parks, cleaning streets, cleaning offices, staffing hotels, education, mass transportation, etc. So many things we haven’t been doing for 2 years now need doing so OF COURSE we need more workers – the Fed can’t stop that by raising rates.

You can’t FIX problems if you don’t UNDERSTAND the problem and, clearly, the Fed does not understand the problem. What is the solution they are working towards? Collapse the economy by 10% to knock down the demand for workers? Clearly that would be insane. A 10% reduction in the economy will not reduce Government Spending but it will reduce collections and the increasing poverty will increase the need for Government Intervention and then we will simply go deeper in debt with a smaller GDP to cover it – that’s a complete disaster!

Last month, as I wrote in “Non-Farm Friday – Is America Working?,” we discussed a better solution than crashing the economy would be enabling 20M qualified women to go back to work by providing affordable child-care to young mothers. Rather than depressing the GDP and costing the Government $2Tn, we could spend $225Bn providing child care and INCREASE the GDP by $2Tn – with more than enough women (or house husbands) to fill all those jobs.

As noted in the NY Times: “Why You Can’t Find Child Care: 100,000 Workers Are Missing,” we haven’t even got enough child-care workers as those tend to be minimum-wage jobs that simply don’t cover the bills for most people. This is another industry that was essentially shut-down during Covid and, for some reason, politicians certainly do not understand how critical it is to the economy.

The Fed might understand this but Child Care is not their department. The only tool they have in their toolbox is rate changes and, as the saying goes: “When all you have is a hammer, every problem looks like a nail.” So the Fed will continue to employ their “Hulk Smash” policy on American consumers – no matter what the solution should be and that, my friends, is why I am leaning towards cashing out until after January earnings at the moment.

Be careful out there.