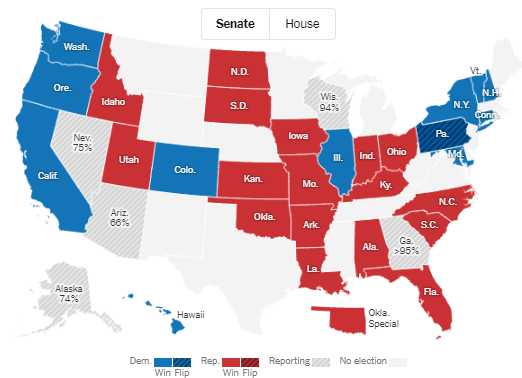

4 Senate races remain undecided.

4 Senate races remain undecided.

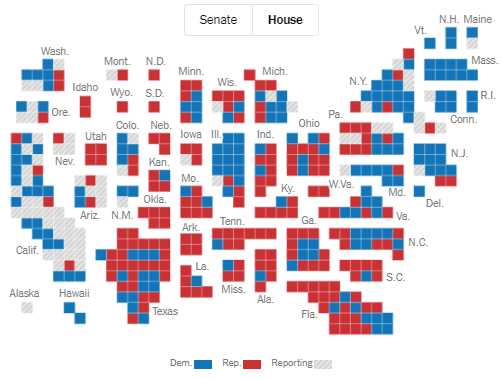

The other 96 seats are split 48/48 among Democrats and Republicans and it does look like Republicans will take the House, at 199/172 so far with 218 seats needed for control. Of course, the Democrats tend to do more mail-in ballots as the GOP has been spending years calling that system fraudulent – and that’s why they think the election is “stolen” as the predominantly mail-in Democratic votes get counted last.

With 98% of the votes counted, Herschel Walker is only losing by 35,300 votes and that is simply horrifying. Kelly (D) should win in Arizona and Wisconsin is too close to call but surprising if it turns blue. Nevada is also too close to call and that’s going to decide the Senate but only 72% has been counted there and the Dems should benefit from later votes.

The Governors generally held their offices and, on the whole, the election was a big disappointment for the Republicans but they do have potential control of Congress and that means Biden will be impeached for “crimes” to be determined and the Government will once more be shut down and good luck passing any sort of bill for the next two years.

So America leaves these midterms much as it entered: a fiercely divided country that remains anchored in a narrow range of the political spectrum, unhappy enough with President Biden to embrace divided government but unwilling to turn fully to the divisive, grievance-driven politics promoted by former President Trump.

Despite the lead the Republicans have in the House at the moment (197/172), it is very possible that the Democrats will pick up 46 of the 66 undecided seats as many of them are in California and simply late to report and, as noted above – mail in ballots – which Republicans don’t trust. Should the Dems keep the house and win the Senate – it will be a crushing defeat for the GOP – who spent the most money ever ($5Bn!) to win these races.

Despite the lead the Republicans have in the House at the moment (197/172), it is very possible that the Democrats will pick up 46 of the 66 undecided seats as many of them are in California and simply late to report and, as noted above – mail in ballots – which Republicans don’t trust. Should the Dems keep the house and win the Senate – it will be a crushing defeat for the GOP – who spent the most money ever ($5Bn!) to win these races.

I know I’m the only analyst saying this but I’m also the only analyst who knows how to do math and the Dems had a 220/212 advantage in the House with 3 open seats coming into the election and, so far, with 371 races declared, they have lost 3 seats. That’s 1% and there are only 64 races left to call so, if they only lose 0.64 seats out of those – they win! The GOP has to flip 3 more seats of the last 64 to gain control – a 500% better pace than they are on so far.

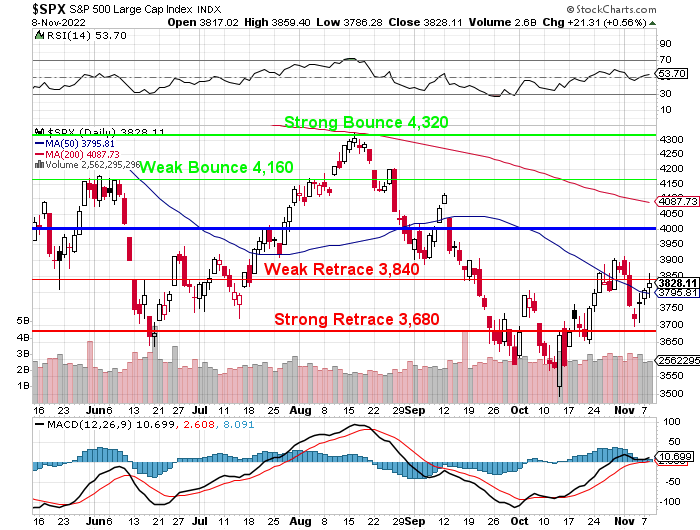

The market is undecided this morning and, sadly, back below 3,840 on the S&P 500 but still holding 11,000 on the Nasdaq – so there’s still hope. We really do need to be over 3,840 at Friday’s close or we should probably be adding some hedges into the weekend. The SQQQ 2025 $60 ($27)/90 ($23) bull call spread at $4 is the best deal at the moment, offering $3,000 worth of protection for each $400 spent.

We will see which way the winds blow today but the energy sector is already taking a dive as mean old Biden may be around to call them out for raping the taxpayers for a little while longer.

Even as we speak, the GOP just lost 2 of their 199 house calls (now back to undecided, but they are trending the wrong way for them) as those late ballots roll in.